“The Big Short,” a 2015 film adaptation of Michael Lewis’s best-selling book, paints a vivid picture of the tumultuous period leading up to the Great Recession, honing in on a select group of financial professionals, including Michael Burry, who, not only anticipated the impending economic crisis but also managed to reap colossal profits from their foresight.

In this guide, we will investigate what exactly was the big short, unravel the sequence of events that precipitated it, its extensive impact on the global economy, and its aftermath. We’ll also delve deep into the life of Michael Burry, a central figure in this financial saga, exploring how his acute predictions translated into millions for him and his investors, even as the rest of the financial world grappled with unprecedented turmoil.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Related reads:

- Who is Bernie Madoff? History’s Largest Ponzi Scheme Explained

- Who is Jordan Belfort? True Story of “The Wolf of Wall Street”

- Who is Robert Kiyosaki? The Story of “Rich Dad Poor Dad”

- Who Started Bitcoin? The True Story of Satoshi Nakamoto

- Who is Warren Buffett? The Story of the Oracle of Omaha

Summary

– He is best known for predicting and profiting from the 2007–2008 U.S. housing market crash;

– “The Big Short” explains how Burry analyzed mortgage-backed securities and spotted the financial bubble early;

– He made huge profits by betting against (shorting) the U.S. housing market using credit default swaps (CDS).

Who is Michael Burry?

Michael J. Burry grew up in San Jose, California. He studied economics and pre-med at UCLA and earned his medical degree at Vanderbilt University School of Medicine in Tennessee. After moving back to California to do his residency at Stanford, Burry would dabble in financial investing on nights off duty. Soon, without finishing, he left school to start his hedge fund, which he called Scion Capital.

Michael Burry was always awkward and anti-social, leading him to later self-diagnose himself with Asperger’s syndrome. And though he was exceptionally brilliant, Burry had few friends and was not yet established in investment circles when he embarked on his career.

Recommended video: Michael Burry explains how he shorted the housing bubble

Michael Burry and the dot-com bubble

Burry has stated that his investment style is built upon Benjamin Graham’s and David Dodd’s 1934 book “Security Analysis,” the core text for value investing, saying: “All my stock picking is 100% based on the concept of a margin of safety.”

Accordingly, he was among the first to call the dot-com bubble by analyzing overvalued companies with little revenue or profitability. He began shorting those stocks immediately, quickly earning extraordinary profits for his investors.

Burry returned 55% in the first year (2001) even though the S&P 500 fell almost 12%. The market continued to decline dramatically over the next two years, yet Burry’s fund returned 16% (compared to the 22% fall of S&P 500) and 50% (S&P rose 28%), making him one of the most successful investors in the industry at the time.

Burry was so successful that he attracted the interest of companies such as Vanguard, White Mountains Insurance Group, and well-known investors such as Joel Greenblatt. As a result, by the end of 2004, he was managing $600 million and turning investors away.

Micahel Burry and the big short

In 2005 Burry’s focus turned to the subprime market. Through his analysis of mortgage lending practices and bank balance sheets in 2003 and 2004, he began to notice significant irregularities in this market, correctly predicting that the housing bubble would collapse as early as 2007.

He saw the riskiness of the subprime market as millions of borrowers with low income and no assets bought homes with enormous leverage, in many cases, making no down payments for mortgages that they couldn’t afford when interest rates would eventually rise.

Yet, the banking system was valued as if these mortgages were all solid. Burry realized this would be unsustainable long term and that the credit products based on these subprime mortgages would plummet in value as soon as higher rates replaced the original rates.

Recommended clip from the famous movie “The Big Short”: Michael Burry realizes MBSs are full of subprime loans and decides to short the housing market.

This conclusion led him to short the housing market by convincing Goldman Sachs and other investment banking companies to sell him credit default swaps (CDS) against subprime deals he saw as vulnerable. In short, sell positions on the assumption that housing prices will drop.

However, as prices continued surging, Burry’s clients grew nervous and frustrated as he continued his short plays using derivatives. Unfortunately or, instead, fortunately in retrospect, when they demanded to withdraw their capital, Burry simply refused the investors’ pleas (by placing a moratorium on withdrawals from the fund), angering his clients even more.

Recommended clip from the famous movie “The Big Short”: Michael Burry and the rest of the teams are confronted with surging MBS and CDO values (the very bonds they are trying to short).

Eventually, Burry’s analysis proved correct: in 2007, the market started to turn in his predicted direction as more insiders understood the system’s risks. Then the dominoes began to drop, with Bear Stearns, Lehman Brothers, AIG, and the rest of the financial system behind them.

Burry’s bet paid off handsomely, earning him a hefty personal profit of $100 million and more than $700 million for his remaining investors. Ultimately, Scion Capital documented returns of 489.34% between its November 1, 2000, founding, and June 2008. In contrast, the S&P 500 returned under 3%, including dividends over the same period.

Michael Burry predictions for 2025

Michael Burry is known for his active yet enigmatic presence on X (formerly Twitter), where he frequently posts his predictions under the moniker “Cassandra B.C.” Burry’s Twitter name comes from when Warren Buffett called Dr. Burry “Cassandra,” a Trojan priestess from Greek mythology who delivered true prophecies but, just like Burry and his warnings about the housing bubble, was never believed.

Despite his active tweeting, Burry often deletes his posts, which adds a layer of mystery and intrigue to his social media activity. This practice has led to the creation of archival accounts, such as the Michael Burry Archive, dedicated to preserving his deleted messages for public reference.

“The Big Short” synopsis

“The Big Short” is a character-driven film focusing on the events leading up to the subprime meltdown and the cynical yet shrewd men who foresaw and profited from the crisis.

One of those men is Michael Burry: an eccentric ex-physician turned hedge fund manager at Scion Capital. It is 2005, and Burry begins to suspect the booming U.S. housing market is virtually an asset bubble inflated by high-risk loans. Consequently, he proceeds to bet against the housing market with derivative financial instruments.

Meanwhile, Deutsche Bank executive Jared Vennett inadvertently gets wind of what Burry is doing and, too, tries to capitalize on Burry’s beliefs. Bennett’s accidental phone call to FrontPoint Partners gets this information into the hands of Mark Baum, a hedge fund manager under Morgan Stanley (NYSE: MS), whose distrust of the financial system leads him to join forces with Vennett.

A third plot strand follows two young investors, Charlie Geller and Jamie Shipley, with a $30 million start-up garage company called Brownfield, who get a hold of Venett’s paper on the matter. Wanting in on the action but lacking official credibility to play, they seek the investment advice of retired banker Ben Rickert.

In short, all these men have concluded that the housing bubble is out of proportion to the industry’s fundamentals and will ultimately pop and may, in fact, lead to the downturn of the entire U.S. economy. And so, they invest accordingly: by shorting the American housing market.

All three groups work on the premise that the banks are blinded by their greed and don’t know what’s coming to them. However, for them to profit, the economy has to collapse, representing the suffering of millions of average citizens who have put their trust and savings into these financial institutions. Best summarized by Ben Rickert, Brad Pitt’s character as he lambasts Geller and Shipley for celebrating their good fortune:

“If we’re right, people lose homes. People lose jobs. People lose retirement savings; people lose pensions.”

Most leading characters in the film take short positions in mortgage-backed securities (MBS), convinced that prices will fall when the housing market collapses.

“The Big Short’s” premise

“The Big Short” recounts how the housing bubble, driven by the growth of the subprime mortgage market and the investment vehicles derived from it, led to the 2008 financial crisis.

Illustrated by clips from the film, let’s briefly go over the state of the economy and the housing market at the time.

Subprime meltdown explained

Confronted with the dot-com bubble’s collapse and 9/11, the Federal Reserve lowered the interest rate from 6.5% in May 2000 to 1% in June 2003. This resulted in vast economic growth across the U.S., increasing the demand for homes and mortgages.

On the other hand, the real estate bubble that ensued also led to record levels of homeownership in the U.S., leading banks to struggle to find new homebuyers.

So, to still capitalize on the home-buying frenzy, some lenders started to extend mortgages to those who couldn’t otherwise qualify by offering subprime loans made to borrowers with poor or no credit histories and thus higher interest rates than other mortgages.

Recommended video: Margot Robbie in a bubble bath explains subprime loans in mortgage bonds.

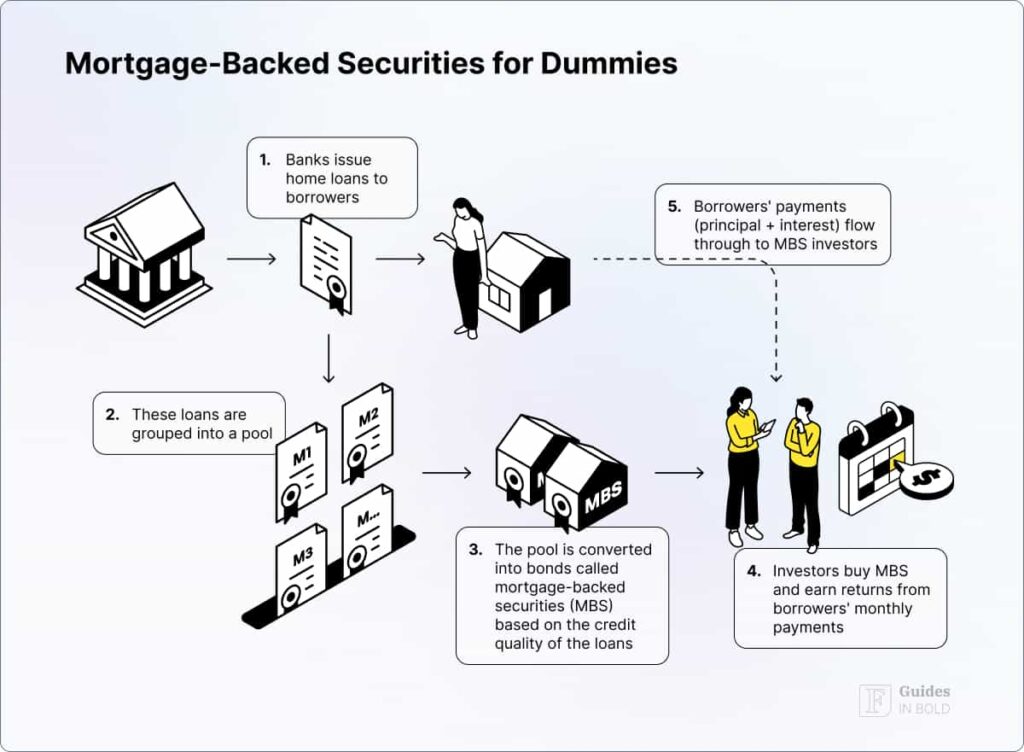

The banks then bundled up these loans and sold them to investment banks, which repackaged them into what were advertised as low-risk financial instruments such as mortgage-backed securities and collateralized debt obligations (CDOs) which were, in turn, marketed to investors on Wall Street. But unfortunately, these credit products were only as sound as the mortgages that backed them up, a fact that would become painfully obvious in the years to come.

Recommended video: Anthony Bourdain explains how subprime mortgages were tossed into CDOs to hide their risky nature from unsuspecting investors.

Many subprime mortgages were adjustable-rate mortgages (ARM), also known as variable-rate mortgages. In short, these loans generally come with a fixed interest rate in the early life of the loan (teaser rate) and are then reset over time, depending on changes in a corresponding financial benchmark (e.g., Prime Rate or the Fed funds rate) associated with the loan. Ultimately, the borrower’s payment will increase or decrease according to the index’s fluctuations.

Eventually, interest rates rose, and homeownership reached a saturation point (by 2004, U.S. homeownership had peaked at 69.2%). The Fed began raising rates in June 2004, and two years later, the Federal funds rate had reached 5.25%, remaining as such until August 2007.

And so, as expected, during early 2006, home prices started to fall, which for many Americans meant their homes were now worth less than what they paid for them, making it more difficult to refinance their loans.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Moreover, if they had ARMs, their costs went up as their homes’ values plummeted, leaving the most vulnerable subprime borrowers stuck with mortgages they couldn’t afford in the first place. Additionally, the eventual recession saw substantial job losses throughout the economy, further increasing the number of loan defaults.

The problem with collateralized debt obligations

Weak CDOs, particularly mortgage-backed securities, were the leading culprits of the subprime mortgage crisis that led to the Great Recession.

The goal of creating CDOs is to use the debt repayments as collateral for the investment. In other words, the promised repayments of the loans give the CDOs their value. That’s why banks slice CDOs into various risk levels or tranches.

The least risky tranches (senior/AAA) have more certain cash flows and a lower degree of exposure to default risk. In contrast, riskier (equity) tranches have more uncertain cash flows and greater exposure to default risk but offer higher interest rates to attract investors.

Recommended clip from “The Big Short” movie: The famous “Jenga” episode visually explains the mortgage bonds and the whole market crash.

Unfortunately, the underlying loans of CDOs were often rated incorrectly, inflating the CDO’s value and misleading investors. To complicate matters even more, CDOs could be made up of a pool of prime loans, near-prime loans (called Alt.-A loans), risky subprime loans, or a combination of the above.

Recommended video: Mark Baum gets to the bottom of why the value of mortgage bonds is rising if the underlying loans that back them are weak and how the system is rigged to the bank’s favor.

On top of asset composition, additional factors caused CDOs to be more complicated. For example, some structures used leverage and credit derivatives that could render even the senior tranche risky, creating synthetic CDOs backed merely by derivatives and credit default swaps made between lenders and derivative markets.

Wall Street crashes

As the housing market collapsed and borrowers could not pay their mortgages, banks were suddenly overwhelmed with loan losses on their balance sheets. And as unemployment soared across the nation, many borrowers defaulted or foreclosed on their mortgages.

Unfortunately, because of the recession, banks struggled to resell the foreclosed properties for the same amount they were mortgaged. As a result, banks endured massive losses, leading to tighter lending and less credit access, ultimately culminating in lower economic growth.

The losses were so significant for some banks that they were declared insolvent or purchased by other banks to preserve them. Additionally, several large institutions had to take a bailout from the federal government in the Troubled Asset Relief Program (TARP).

However, the bailout was too late for Lehman Brothers, the fourth-largest investment bank in the United States, which– succumbed to its overexposure to the subprime mortgage market– announced the largest bankruptcy filing in U.S. history at that time.

The fact that Lehman Brothers was allowed to fail by the federal government led to massive repercussions and sell-offs across the markets. Moreover, as more investors pulled capital out of banks and investment firms, those establishments also began to suffer.

So, although the subprime meltdown started with the housing market, its shockwaves ultimately devasted the entire financial landscape leading to the Great Recession and massive sell-offs in the markets.

In conclusion

Much like “The Big Short” depicted, what was brewing underneath the housing bubble went largely unnoticed. The truth about what banks and their enablers were doing was only evident to a handful of people– the motley crew of investors we meet in the movie. Of whom Michael Burry is the most notable, the hedge fund manager who broke the seal on the big bet on financial catastrophe.

The film manages to excel at illustrating and defining high finance’s dry, complex abstractions by employing creative and vivid methods such as celebrity cameos, metaphoric descriptions, and visual aids like a Jenga tower.

Boiling it all down, “The Big Short” serves up a delicious, yet somewhat tragic, financial cocktail, reminding us that Wall Street, in its gluttonous revelry, threw quite the party at the expense of the global economy.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about Michael Burry and “The Big Short”

What are some of the best movies about the 2008 financial crisis?

- Adam McKay’s “The Big Short” (2015);

- Charles Ferguson’s documentary “Inside Job” (2010);

- J .C. Chandor’s “Margin Call” (2011);

- Ramin Bahrani’s “99 Homes” (2015).

How did the financial crisis look in numbers?

- GDP declined by 4.3% from 2007-09

- 8.8 million jobs lost

- Unemployment at 10% by October 2009

- 8 million home foreclosures

- $19.2 trillion in household wealth evaporated

- An average 40% decline in home prices

- 38.5% decline in the S&P 500 in 2008

- $7.4 trillion lost in stock wealth from 2008-09, or $66,200 per household on average

- Employer-sponsored retirement account balances declined 25% (.8 trillion) or more in 2008

- Failure rates for adjustable-rate mortgages (ARMs) climbed to nearly 30% by 2010

What caused the housing crisis?

The housing boom led banks to issue an increasing number of mortgages, often to unqualified borrowers. These risky mortgages were then bought by Wall Street investment banks and transformed into complex financial products like Mortgage-Backed Securities MBSs and CDOs. Easy access to capital allowed hedge funds and other investors to heavily invest in these derivatives, further inflating their value. However, the scenario turned dire when interest rates rose in the mid-2000s, leading to a peak in homeownership and a subsequent fall in real estate prices. This trend triggered widespread defaults on loans, devaluing the credit products and precipitating the burst of the housing bubble, which had severe repercussions for Wall Street and the broader economy.

How did Michael Burry make his money?

In 2005, Michael Burry realized the United States housing market was backed by subprime loans given to unverified borrowers likely to default in a rate hike. So he bet against it by shorting mortgage-backed securities built on these loans. Unsuspecting banks let him construct and buy credit default swaps (CDS), an insurance policy that pays out if the underlying security sustains a default or a credit downgrade. And as predicted, the bubble eventually burst, resulting in a 100 million dollar payday for Burry.

How much did Michael Burry make?

Michael Burry from “The Big Short” took a big bet when he shorted the American housing market. After the housing bubble crashed in 2008, he made $100 million for himself, with investors in his fund making a further $700 million.

How did Michael Burry short the housing market?

Michael Burry shorted the housing market by using credit default swaps to bet against subprime mortgage bonds. This approach allowed him to profit from the housing market collapse when the subprime mortgage crisis hit in 2008.

What is dr. Michael Burry's net worth?

According to Celebrity Net Worth, Michael Burry’s net worth is around $300 million as of December 2024.

Who is Michael Burry's wife?

Burry is married with children. However, his wife’s name and other details about her are not prominently discussed in the public domain.

What is Scion Asset Management?

Scion Asset Management is an investment firm founded by Michael Burry, best known for its role in predicting the subprime mortgage crisis of the late 2000s. After dissolving his original hedge fund, Scion Capital LLC, post-crisis, Burry reopened it under Scion Asset Management in 2013. Like its predecessor, the fund focuses on value investing, although the specifics of its strategies and holdings can vary based on Burry’s analysis and market conditions. As with most private funds, detailed operational and strategy specifics are not always publicly disclosed. However, periodic regulatory filings provide some insights into the firm’s holdings and activities.

How did Michael Burry predict the 2008 housing bubble?

Michael Burry predicted the 2008 housing bubble by analyzing mortgage lending practices and noticing the increasing risk in subprime mortgages. He recognized that the housing market was overly speculative and heavily reliant on high-risk loans, which were likely to fail as adjustable mortgage rates increased.

What's going on with Michael Burry's tweets?

Michael Burry has a unique style of tweeting that combines cryptic messages with historical parallels. Burry’s tweets often carry a cautionary tone about potential market over-optimism, drawing comparisons between current market scenarios and significant past economic events, such as the downturns post-1929, 1968, 2000, and 2008.

How much money did Michael Burry make in 2008?

In 2008, Michael Burry made approximately $100 million for himself and an additional $700 million for his investors after the housing market crashed, as he had predicted.

Why does Michael Burry delete his tweets?

Michael Burry has a habit of deleting his tweets after posting them as well as deleting his account outright. This tendency has spurred the emergence of various Michael Burry tweet archive accounts that meticulously track and document his social media activity. One notable example is @BurryArchive, a dedicated account that captures and shares Burry’s fleeting tweets, preserving them for a broader audience.

Why is Michael Burry referred to as 'Cassandra' and what does this nickname signify?

It was Warren Buffett who referred to Michael Burry as “Cassandra.” This nickname was given in recognition of Burry’s foresight and warnings about the 2008 housing market collapse, which were initially ignored or not believed by the majority, much like the prophecies of the mythological figure Cassandra. Burry embraced this nickname and even used it as part of his Twitter handle, “Cassandra B.C.”.

What are Michael Burry's views on crypto?

Michael Burry has expressed a critical view of the cryptocurrency market. In 2022, he warned investors that the crypto market was in what he described as the “greatest speculative bubble of all time in all things,” predicting a significant crash for cryptocurrency investors. He highlighted that a major problem with cryptocurrency is its leverage, suggesting that understanding the amount of leverage in crypto is crucial to truly understanding the market. Despite these critical views, Burry clarified that he has never shorted any cryptocurrency, indicating that while he foresees problems in the crypto market, he has not bet against it in the manner he did with the real estate market before the 2008 crash.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.