Over the past week, the stock market recorded highs following the Federal Reserve’s indication that it will maintain its projection for three interest rate reductions this year, despite stubborn inflation readings.

As we enter the new week, investors will be closely monitoring the market to gauge whether the recent gains will be sustainable. The market is likely to be influenced by various fundamentals such as the initial jobless claims report and revisions to the United States gross domestic product (GDP).

Besides these factors, several equities stand out. Finbold has identified the following three stocks to watch.

Apple

The share price of Apple (NASDAQ: AAPL) has experienced turbulence in 2024, influenced by various challenges impacting the company. Formerly the world’s most valuable firm, Apple has underperformed both the Nasdaq 100 and the S&P 500 this year.

Key concerns revolve around declining iPhone sales in China. Adding to this, the Justice Department’s lawsuit against Apple accuses the company of monopolistic behavior in its iPhone business operations.

Notably, Apple is taking measures to address declining sales in China, highlighted by CEO Tim Cook’s high-profile visit to the country and the opening of a new store in Shanghai, its second-largest worldwide. At the same time, Apple is expanding its presence in the artificial intelligence (AI) sector, reportedly engaging in talks with China’s Baidu regarding AI integration into its devices.

Moreover, as reported by Finbold, Apple is encountering security concerns related to the technology behind some of its products. Specifically, a recent study highlighted a substantial security vulnerability within Apple’s M-series chips. This flaw, potentially unpatchable, could jeopardize encryption keys, thereby heightening concerns regarding user data security on the affected Macs.

As the new week unfolds, investors will closely monitor Apple’s stock performance in response to these developments. Despite the legal challenges, Apple ended Friday on a positive note, with analysts suggesting that the DOJ lawsuit poses more of a headline risk than a financial risk.

Following the antitrust lawsuit on March 21, Apple’s stock initially dropped by 4.1% within 24 hours, resulting in a market value loss of about $113 billion. However, the company managed to recover slightly, gaining 0.5% by the close of markets on Friday, March 22 to trade at $172.28.

Tesla

Tesla (NASDAQ: TSLA) has incurred losses exceeding 30% in 2024 as the general electric vehicle (EV) market encounters challenges amidst declining demand. The company is implementing a new strategy to secure market share while sacrificing profits and evaluating the impact of decreasing EV demand globally.

Tesla’s predicament has escalated with reports indicating plans to reduce production at its Shanghai factory due to slowing EV demand. Production at the China plant will be reduced to five days a week from 6.5 days.

Monitoring the stock’s performance becomes crucial as this reduction in Shanghai production would confirm weakening demand not only in China but also in Europe and other significant markets.

Additionally, attention will be drawn to Tesla’s stock reaction following new regulatory concerns surrounding the company. This is after Senator Elizabeth Warren called for an investigation by the U.S. Securities and Exchange Commission (SEC) into Tesla, CEO Elon Musk, and the company’s board of directors over governance issues.

The investigation pertains to possible misappropriation of Tesla resources and conflicts of interest arising from Musk’s dual role at Tesla and X (formerly Twitter).

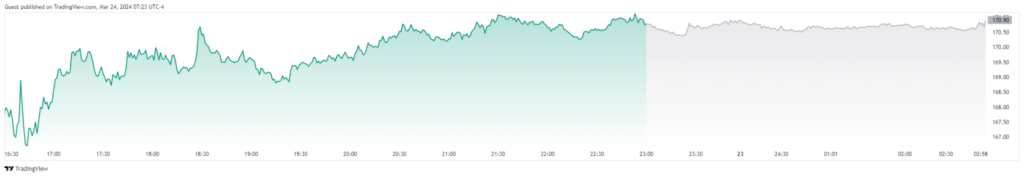

As of press time, Tesla was trading at $170.83 having concluded last week with a 1.15% drop on Friday, March 22.

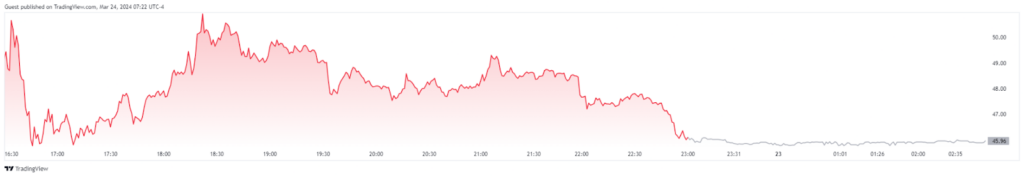

Reddit (NYSE: RDDT) made a strong debut on Wall Street, surging as high as $57 from its initial public offering price (IPO) of $34 per share. While the stock was mainly influenced by the positive momentum in the equity market following the interest rate decision, other key elements make RDD worth watching in the coming week.

Firstly, Reddit’s stock has been under speculation regarding the possibility of following the trajectory of meme stocks. Some participants on the r/WallStreetBets platform have already expressed interest in shorting Reddit’s stock.

Shorting occurs when an investor borrows a share, sells it to a third party, and later buys it back at a lower price, profiting from the price difference.

It’s worth noting that the Reddit community was allowed to buy into the IPO, potentially opening the door for stock manipulation. Therefore, it will be important to monitor Reddit closely in the new week to see if investors move towards shorting.

By the close of markets on March 22, RDD was down almost 9%, trading at $46.

Overall, it’s worth noting that despite the significant underlying fundamentals of the mentioned stock, investors should bear in mind that it remains susceptible to overall market swings.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.