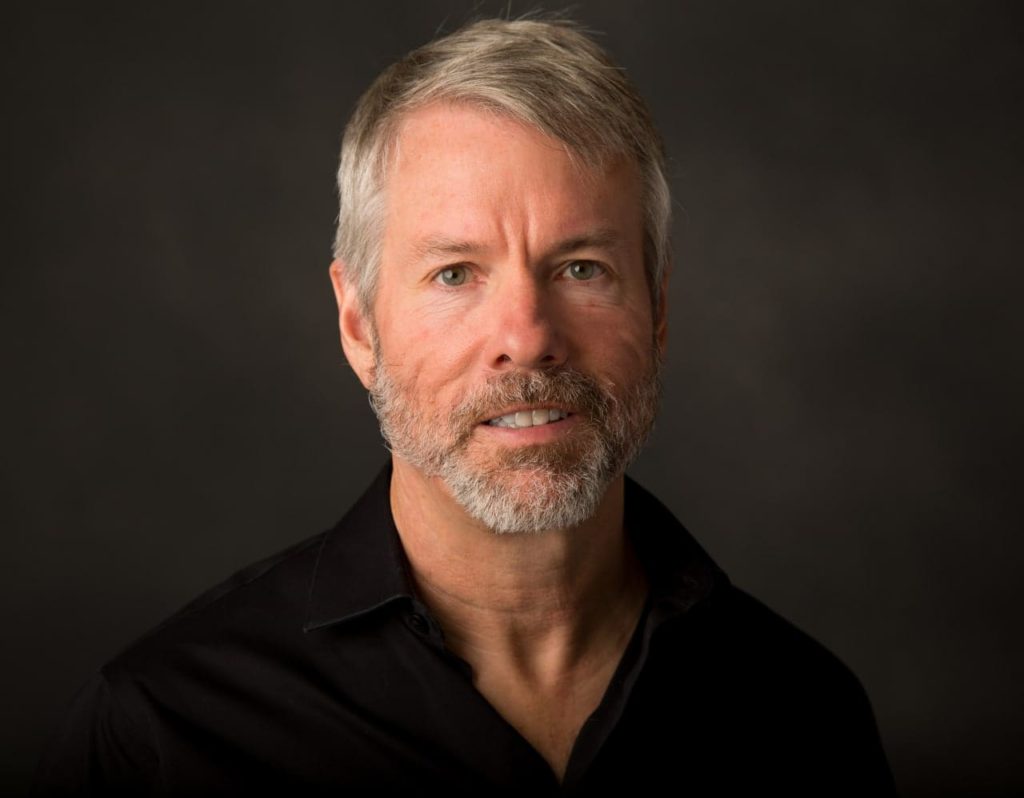

Bitcoin maximalist Michael Saylor, the executive chairman of MicroStrategy and who was recently sued for evading taxes, claims that the output of the Bitcoin network is 100 times greater in cost than its input.

According to some estimates, Bitcoin’s yearly energy usage is comparable to that of a very small nation. However, supporters of the first cryptocurrency and its energy-intensive Proof-of-Work (PoW) consensus method contend that the majority of the energy being used originates from environmentally friendly sources like wind and solar.

Saylor explained in a letter on September 14 that mining is “the most efficient, cleanest industrial use of electricity.” In the letter addressed to ‘journalists, investors, regulators, & anyone else interested in Bitcoin & the environment,’ Saylor pointed out seven facts about Bitcoins use of energy in order to ‘share a few high-level thoughts on Bitcoin mining & the environment.’

Firstly he stressed that Bitcoin runs on stranded, extra energy created at the grid’s periphery is used during times and areas with little or no demand for power. Secondly, compared to other industries, he stated:

“Bitcoin mining is the most efficient, cleanest industrial use of electricity, and is improving its energy efficiency at the fastest rate across any major industry. Our metrics show ~59.5% of energy for Bitcoin mining comes from sustainable sources and energy efficiency improved 46% YoY.”

BTC consumes less energy than Google, Netflix, or Facebook

According to Saylor, around $4-5 billion in energy is utilized to power and safeguard the network worth $420 billion today, which settles $12 billion every day ($4 trillion per year). The outcome is worth 100 times the cost of the energy intake.

”This makes Bitcoin far less energy intensive than Google, Netflix, or Facebook, and 1-2 orders of magnitude less energy intensive than traditional 20th century industries like airlines, logistics, retail, hospitality, & agriculture.”

In the PoW concept, miners compete against one another to add new blocks to the chain as quickly as possible. However, some major blockchains are moving away from Proof-of-Work. The recent update of Proof-of-Stake as a consensus mechanism on Ethereum (ETH), known as Merge, is expected to alleviate these environmental concerns, with co-founder Vitalik Buterin explaining on September 15 the “Merge will reduce worldwide electricity consumption by 0.2%.”

However, the executive chairman of MicroStrategy says PoW (Bitcoin mining) is the only established method for generating a digital commodity. PoS Crypto Securities may be useful for certain purposes, he stated, but not as global, open, fair money or a worldwide open settlement network, “therefore, it makes no sense to compare Proof of Stake networks to Bitcoin.”

Bitcoin and Carbon emissions

Concerning Bitcoin and carbon emissions, the Bitcoin maximalist said that 99.92% of global carbon emissions are caused by industrial uses of energy other than Bitcoin mining. He suggests Bitcoin mining is neither the cause nor the solution for the issue of decreasing carbon emissions.

While regarding Bitcoin and its beneficial effects on the environment, he notes there is a growing understanding that Bitcoin is fairly good for the environment since it can be used to deploy monetization strategies for stranded natural gas or methane gas energy sources.

“No other industrial energy consumer is so well suited to monetize excess power as well as curtail flexibly during periods of energy shortfall & production volatility.”

Saylor concludes that Bitcoin mining is an egalitarian technology industry because anyone with the energy and engineering capability to operate a mining center can participate in the industry, regardless of location or power availability.

As a founding member of the Bitcoin Mining Council, Saylor has previously committed to defending Bitcoin against detractors who are concerned about its energy consumption.