With the recent rate cuts by the United States Federal Reserve (‘Fed’) providing a bullish trigger for the price of Bitcoin (BTC), the maiden cryptocurrency has managed to cross the critical level at $60,000 and continue upwards, and artificial intelligence (AI) algorithms have turned bullish.

As it happens, for the first time in over four years, the U.S. central bank has cut the interest rates, and by no less than a half point, in an aggressive beginning of its easing campaign, helping Bitcoin to recover from its losses amid uncertainty prior to the Federal Open Market Committee (FOMC) vote.

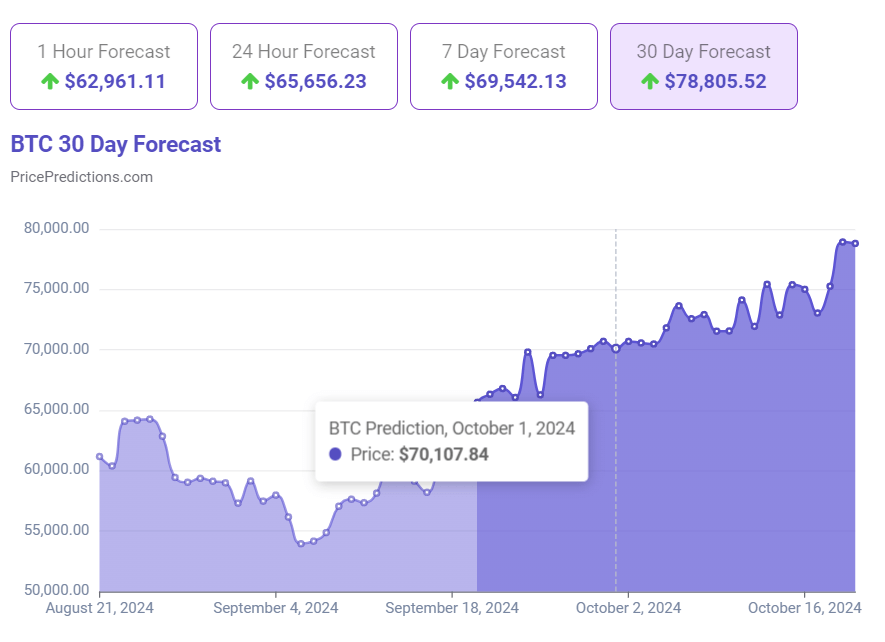

AI’s Bitcoin price prediction

In this context, Finbold has consulted the advanced AI algorithm deployed by the crypto market analytics and forecasting platform PricePredictions, which has set Bitcoin’s price in an uptrend for the rest of the month, predicting it to hit $70,107.84 by October 1, 2024.

Specifically, if the AI model, which relies on technical analysis (TA) indicators like moving average convergence divergence (MACD), Bollinger Bands (BB), relative strength index (RSI), and others, is correct, it would mean an increase of 10.80% from Bitcoin’s price at press time.

Experts’ Bitcoin price prediction

Meanwhile, renowned crypto trading expert Ali Martinez observed that Bitcoin’s rise above $61,500 and then surpassing $62,000 suggests the return to the bull market and increases the chance of Bitcoin reaching $70,000 in ‘Uptober,’ a traditionally strong period for crypto assets and Bitcoin in particular.

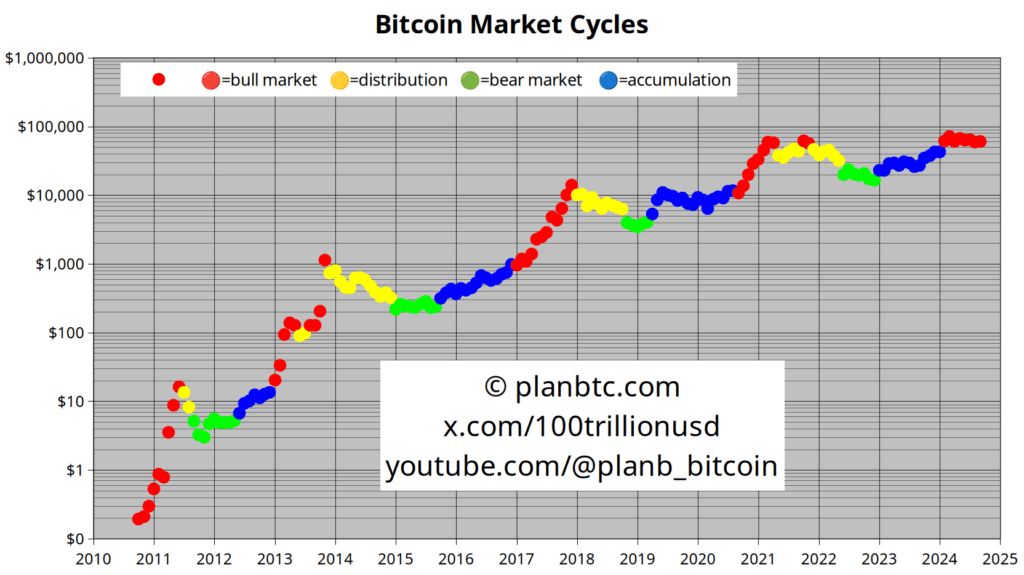

Furthermore, the recent rate cuts might be the necessary trigger for the price of Bitcoin, as earlier suggested by pseudonymous crypto analyst PlanB, who opined that the largest asset in the crypto sector by market capitalization was only waiting for a catalyst to “explode upwards.”

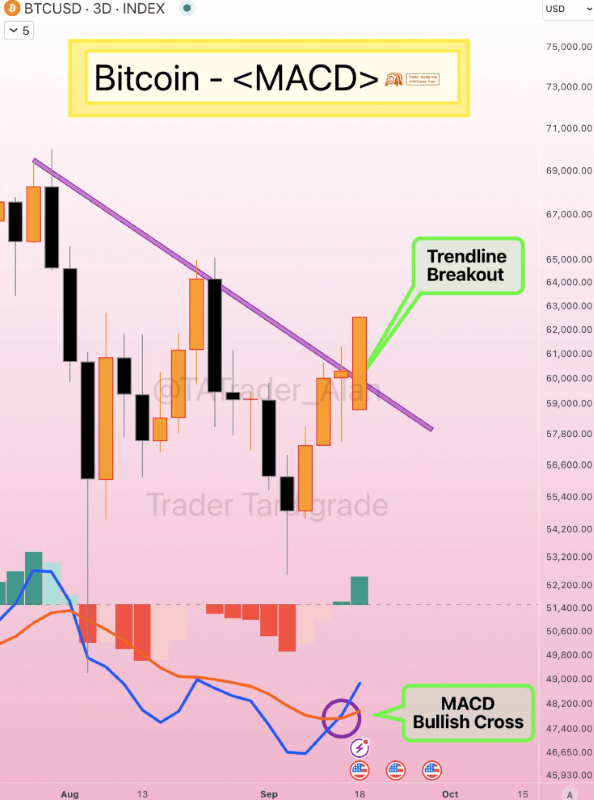

Finally, another crypto expert, who goes by Trader Tardigrade on X, highlighted a bullish MACD crossover pattern for Bitcoin and a three-day candle “breaking out a descending trendline to support the huge buying power coming in” in an X post on September 19.

Indeed, the expert’s chart indicates that BTC has successfully broken above the descending trendline, which represents the previous resistance that the digital asset was struggling to overcome and, in addition to the MACD bullish cross – traditionally a buy signal – means it is ready for an upward continuation.

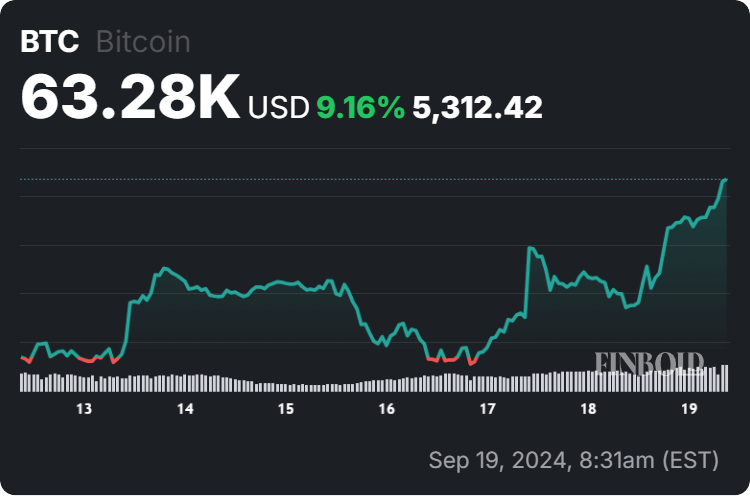

Bitcoin price analysis

For now, Bitcoin is changing hands at the price of $63,280, reflecting a 5.87% increase in the last 24 hours, a gain of 9.16% across the previous seven days, and an accumulated advance of 3.77% over the past month, according to the most recent chart information on September 19.

All things considered, while it is difficult to offer a specific Bitcoin prediction, AI models and crypto experts all seem to agree on one thing – the original cryptocurrency will continue to grow its price in the next few weeks. However, trends can easily change, so doing one’s own research is critical when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.