Gold has found its spot in many headlines in recent weeks thanks to its near-continuous surging to record highs – including rising to finish April at its highest-ever end-of-month price at about $2,300 per ounce.

Indeed, with the stock market and economic outlook feeling uncertain and geopolitical fears mounting, the king of safe-haven commodities has indeed been climbing rapidly, with many experts – including Bloomberg’s Senior Commodity Strategist Mike McGlone – predicting the precious metal is likely to hit $3,000.

Many, again including McGlone, have also concluded that, with the recent disheartening inflation data and a widespread belief that a recession has been postponed rather than avoided, gold has a substantial advantage over stocks and cryptocurrencies and that it will outperform many other assets in the long run.

Short-term predictions, on the other hand, are in a shorter supply and with gold trading with significant volatility in the last few days, Finbold decided to consult artificial intelligence (AI) of OpenAI’s flagship platform – ChatGPT – on where gold might find itself at the end of May.

AI forecasts gold price at the end of May

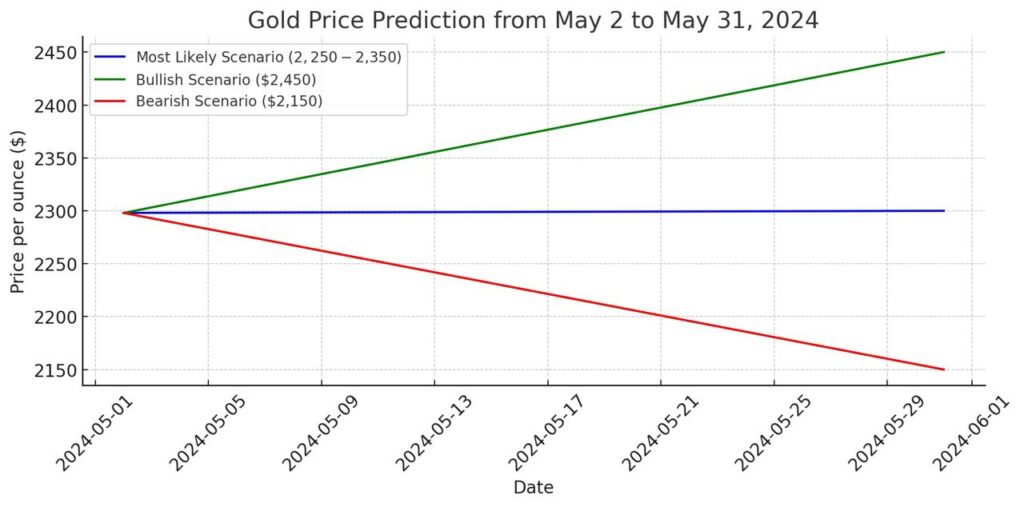

As analysts and experts are themselves highly bullish about gold’s likely performance by the end of 2024, the AI is also positive about the precious metal’s prospects.

Still, its most likely scenario would see gold remain in its press time range, either slightly below or slightly above its press-time price of $2,292. ChatGPT also offered a substantially more bullish forecast that would – at $2,450 – send gold well on its way toward the year-end forecasted value of $3,000.

Finally, the AI also sees a slight possibility that gold’s current slump could deepen and could, in one month’s time, find itself at $2,150.

While a rally toward $2,450 in one month’s time might appear ambitious, a substantial increase should not be entirely ruled out.

Indeed, gold has been both rising and trading with some volatility recently and though there have been few news as concerning as the possibility of a full-blown war between Israel and Iran that ran high in mid-April, the situation in the Middle East remains tense, and the situation in Europe is growing tenser with President Macron’s increasingly hawkish rhetoric.

After a gold slump in the second half of April, Nicky Shiels, Head of Metals Strategy at MKS PAMP, opined that ‘no new bad news is bad news for Gold (& Silver) bulls,’ and with the potential dangers looming ahead, the precious metal may indeed see a massive surge in the coming weeks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.