As Intel (NASDAQ: INTC) has suffered a string of troubles in recent weeks due to defects in its products and corporate operational issues, competitors like Qualcomm (NASDAQ: QCOM) are eyeing bigger PC processor market share and artificial intelligence (AI) models are bullish on their stock prices.

Indeed, Qualcomm might end up being one of the benefactors of Intel’s recent misfortunes, the current conditions representing an ideal opportunity for the company to make inroads into the AI PC market, particularly against the backdrop of its Microsoft (NASDAQ: MSFT) partnership.

Meta AI’s Qualcomm stock price prediction

In this context, the Llama 3.1 chatbot by Meta Platforms (NASDAQ: META) has predicted that a potential price range for QCOM shares at the end of 2024 could be between $200 and $250, “assuming a moderate increase based on the average price targets.” At the same time:

Picks for you

“However, if the company exceeds expectations and achieves higher earnings, the stock price could potentially reach the higher end of the estimated range, around $300.”

ChatGPT’s QCOM stock prediction

Interestingly, ChatGPT-4o, the AI model by OpenAI, also envisions a price range from $200 to $250 for QCOM stock at the end of 2024, considering experts’ predictions, sector growth, and technical analysis, as well as “Qualcomm’s strategic positioning in AI and semiconductors.”

That said, the popular AI chatbot has pointed out that Qualcomm shares could even approach the upper target of around $270, taking into account that “with strong market performance and technological advancements, there is potential for the stock to push higher.”

Google Gemini’s QCOM stock prediction

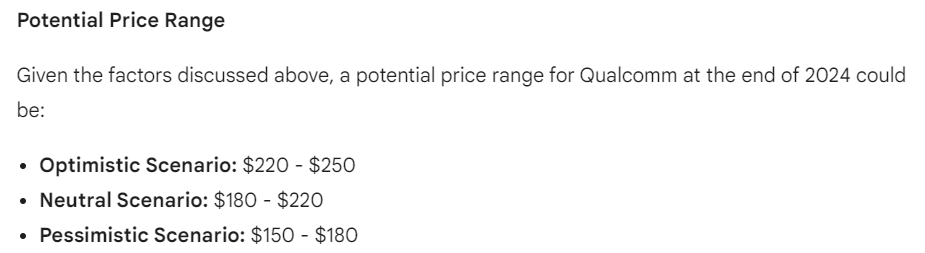

Finally, Google Gemini, the AI innovation by Alphabet (NASDAQ: GOOGL), has offered three potential scenarios and QCOM stock price ranges based on Qualcomm’s leadership in 5G technology, expansion into automotive, AI integration, global economy, competition, and technical analysis (TA):

Stock market experts’ Qualcomm stock prediction

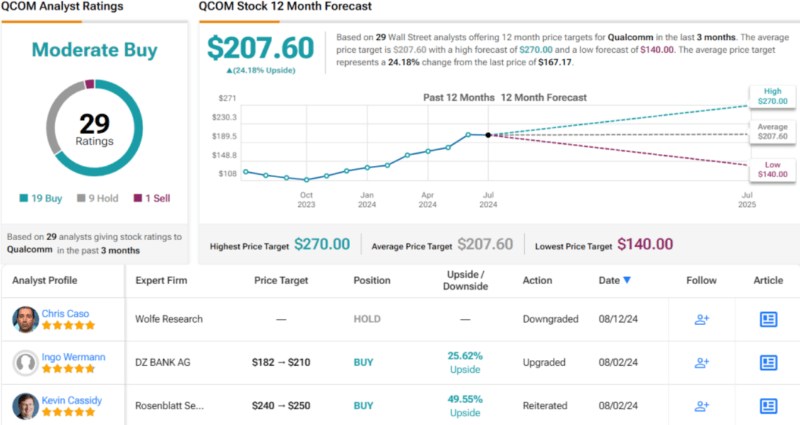

It is also important to note that 29 Wall Street analysts offering their QCOM stock price targets over the course of the past three months have rated Qualcomm shares as a ‘moderate buy,’ with an average price target of $207.60 for the next 12 months, as per TipRanks data on August 16.

Among them is Wolfe Research’s Chris Caso, who has recently downgraded his QCOM rating from ‘outperform’ to ‘peer perform’ while also removing his previous $200 price target due to its relationship with Apple (NASDAQ: AAPL), which he says has been eager to develop its own modern technology.

“Recent checks suggest the AAPL modem is indeed coming. We now expect a limited impact from AAPL’s modem in iPhone SE in the spring, more impact from iPhone 17, and for AAPL to likely supply modems for all phones outside the US by iPhone 18.”

However, he also anticipates QCOM will outline its next phase of “incremental growth” to offset the loss of the iPhone, focusing on AI handsets and Internet of Things (IoT), at the November analyst day, but that it might be a “tougher sell” considering the market’s competitiveness.

Qualcomm stock price analysis

For the time being, the price of QCOM stock stands at $173.34, which represents a 3.70% increase on its daily chart, adding up to the 5.65% gain across the past week, and reducing its monthly losses to 17.32% as it records an accumulated advance of 23.61% year-to-date (YTD).

All things considered, Qualcomm shares might reach the price set out by the AI models, even if some experts are not that bullish. That said, they are still only AI chatbots, so doing one’s own due diligence is critical when investing significant amounts of money into any asset.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.