As financial markets brace for the release of the U.S. Consumer Price Index (CPI) data on August 14, silver prices are coming under increasing pressure.

This reflects a blend of economic uncertainties and wavering industrial demand, leaving silver hovering around the $27.45 mark, just below the critical resistance level of $27.50.

Market participants are closely monitoring inflation metrics, particularly the CPI and the upcoming Producer Price Index (PPI), to gauge the Federal Reserve’s next steps.

A higher-than-expected CPI reading could signal entrenched inflationary pressures, potentially prompting the Fed to delay interest rate cuts. Such a scenario would likely weigh on silver, as higher interest rates diminish the appeal of non-yielding assets like silver.

Conversely, if the CPI data shows that inflation is slowing down, it might increase the chances of the Federal Reserve cutting interest rates soon. This would likely provide a tailwind for silver, making it more attractive to investors seeking refuge amid economic uncertainty.

Additionally, lower interest rates would likely lead to a decline in the U.S. Treasury bond yields, further enhancing silver’s appeal as an alternative investment.

Industrial demand and geopolitical tensions

Beyond the CPI data, silver’s price dynamics are heavily influenced by industrial demand, particularly from major economies like the U.S. and China.

Recent data suggests a cooling in industrial activity in both countries, which could limit silver’s upside potential. According to sources, the U.S. has seen a slowdown in manufacturing activity, while China’s economic recovery remains fragile, with its manufacturing sector showing signs of weakening.

This dual pressure from reduced industrial demand and potential shifts in monetary policy creates a challenging environment for silver.

Investors should be cautious, as any further deterioration in industrial demand could cap silver’s gains, even if the CPI data supports a more dovish Federal Reserve.

Additionally, if U.S. Treasury yields rise due to stronger economic data, silver may face additional headwinds, as investors might shift towards safer, interest-bearing assets.

Geopolitical tensions are also adding to the complexity. Escalating conflicts in the Middle East – particularly intensified Israeli attacks on Gaza and concerns about China’s economic stability – are driving investors toward safe-haven assets, including silver.

The interplay between these global factors and upcoming U.S. economic data will be crucial in determining silver’s trajectory in the coming weeks.

ChatGPT sets silver price target

In light of these developments, Finbold consulted OpenAI’s latest and most advanced artificial intelligence (AI) tool, ChatGPT-4, to gather insights on how silver prices may evolve following CPI data release.

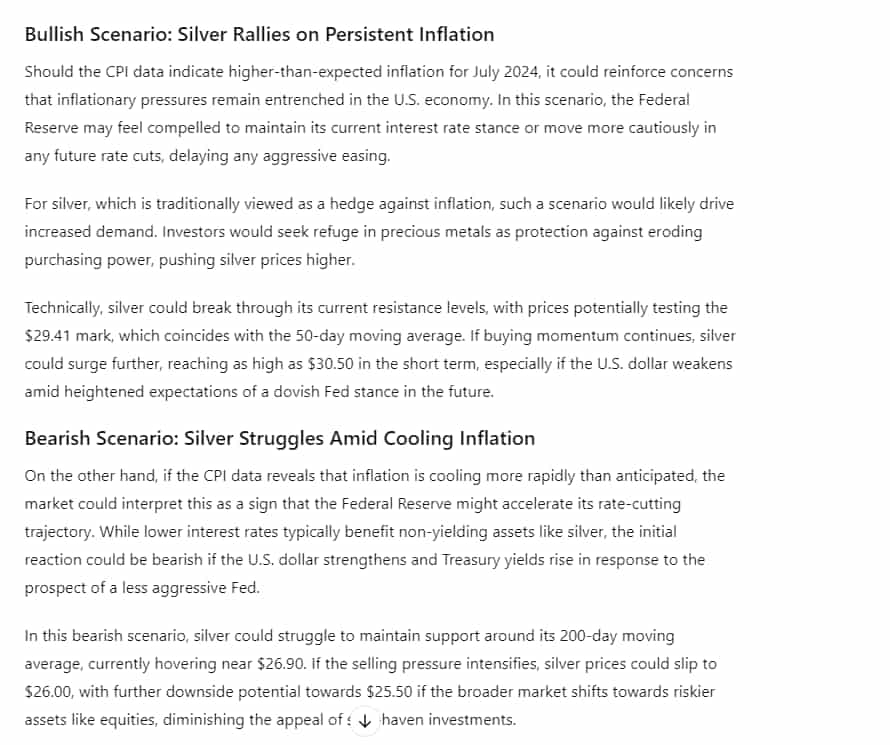

ChatGPT outlined two potential scenarios: a bullish and a bearish scenario. In the bullish view, if the July 2024 CPI data shows higher-than-expected inflation, silver could rally as investors seek it as a hedge against inflation.

Prices could break resistance levels, potentially reaching $29.41 to $30.50, especially if the Fed adopts a cautious approach to rate cuts.

In the bearish scenario, if the CPI data indicates cooling inflation, silver might face downward pressure as the Fed could accelerate rate cuts.

This could strengthen the U.S. dollar and raise Treasury yields, potentially pushing silver prices down to $26 or even $25, as investors shift towards riskier assets.

Ultimately, the July 2024 CPI data will set the tone for silver’s short-term trajectory, with the market’s reaction hinging on whether inflation is seen as a persistent threat or a diminishing concern.

Investors should closely monitor the data release and subsequent market developments to gauge the most favorable entry or exit points for silver trades.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.