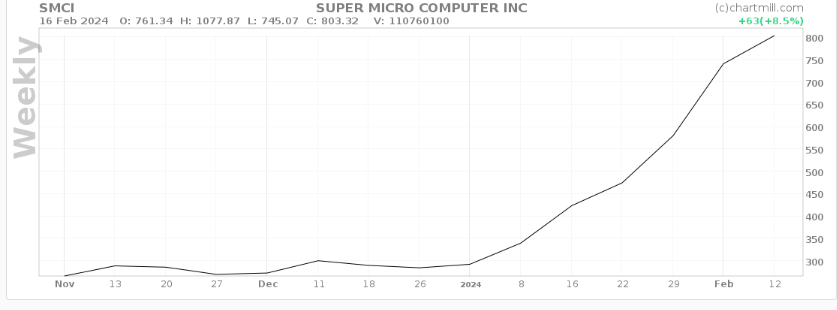

The share price of Super Micro Computer (NASDAQ: SMCI) has experienced a recent surge, reaching new heights due to the company’s strategic focus on the growing artificial intelligence (AI) trend. Notably, investor confidence in the stock propelled SMCI to an all-time high of $1,077 during early Friday, February 16 trading.

However, the stock failed to maintain momentum above the $1,000 level, concluding Friday’s trading session with a nearly 20% decline, settling at $803. This marked the end of a nine-day winning streak for SMCI and represented the largest one-day percentage drop since August.

Interestingly, this decline coincided with an overall market sentiment shift that saw most indices ending a five-week winning streak. Despite this short-term setback, SMCI has recorded impressive gains of approximately 181% year-to-date.

AI predicts SMCI stock for end of 2024

As SMCI predominantly continues to trade in positive territory in 2024, investor interest is keen on whether the equity can sustain its momentum. Notably, the stock has displayed volatility, with a Finbold report suggesting similarities to the circumstances observed during the 2021 GameStop (NYSE: GME) frenzy period.

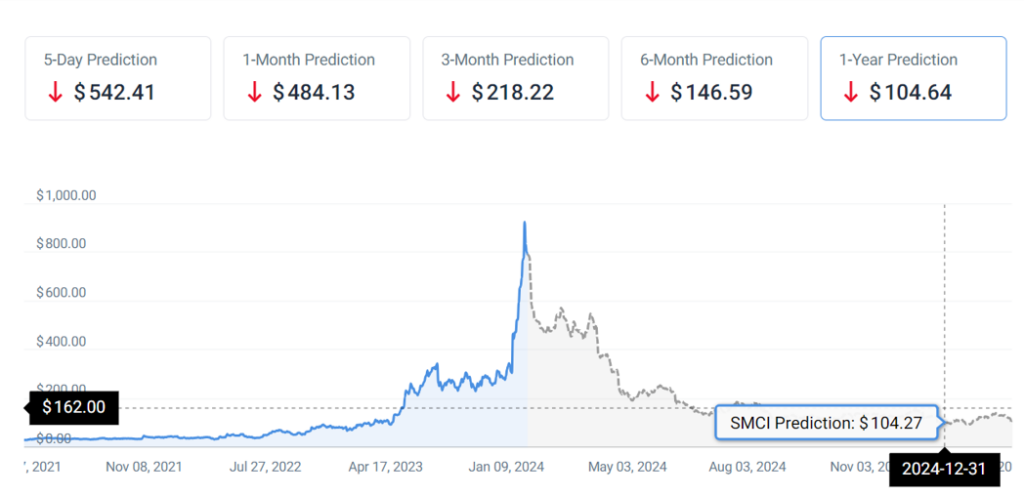

To gain insights into how SMCI is likely to trade by the end of 2024, Finbold consulted an Al-powered machine-learning algorithm. Interestingly, the AI-based prediction tool anticipates a significant downside for SMCI, projecting the equity to trade at $104.27 by December 31, 2024. This forecast represents an 87% drop from the current valuation.

On the other hand, Wall Street analysts at TipRanks also foresee a potential downside for SMCI. The consensus among analysts indicates an average 12-month price target of $734.50 for Super Micro Computer.

The most optimistic projection sets the price target at $1,040, while the most conservative forecast places it at $160. Notably, the average price target of $734.50 signifies a -8.57% change from the last recorded stock price of $803.32.

SMCI’s ability to maintain gains

Despite a brief dip, SMCI stock holds significant relevance among investors because it is one of the largest high-performance, high-efficiency server producers. Positioned as a key player in data centers, cloud computing, and AI, Super Micro has garnered attention for its strategic position and partnerships with major AI chip manufacturers like Nvidia (NASDAQ: NVDA) and Intel (NASDAQ: INTC).

The recent sustained bullish sentiment is also attributed to the company’s rapid improvement, with December quarter revenues expected to be 30% higher than initially forecasted. Q2 fiscal year results, released on January 29, further boosted confidence as the company raised its guidance substantially for the remainder of 2024.

However, potential threats to SMCI’s momentum include growing competition, lack of patent control on its products, and perceived portfolio diversification issues. Despite these concerns, the company remains optimistic about its ability to sell AI servers without challenges, maintaining a positive outlook.

In conclusion, Super Micro Computer’s momentum stock has the potential to stay high if demand consistently outpaces supply, supported by strong purchasing intent.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.