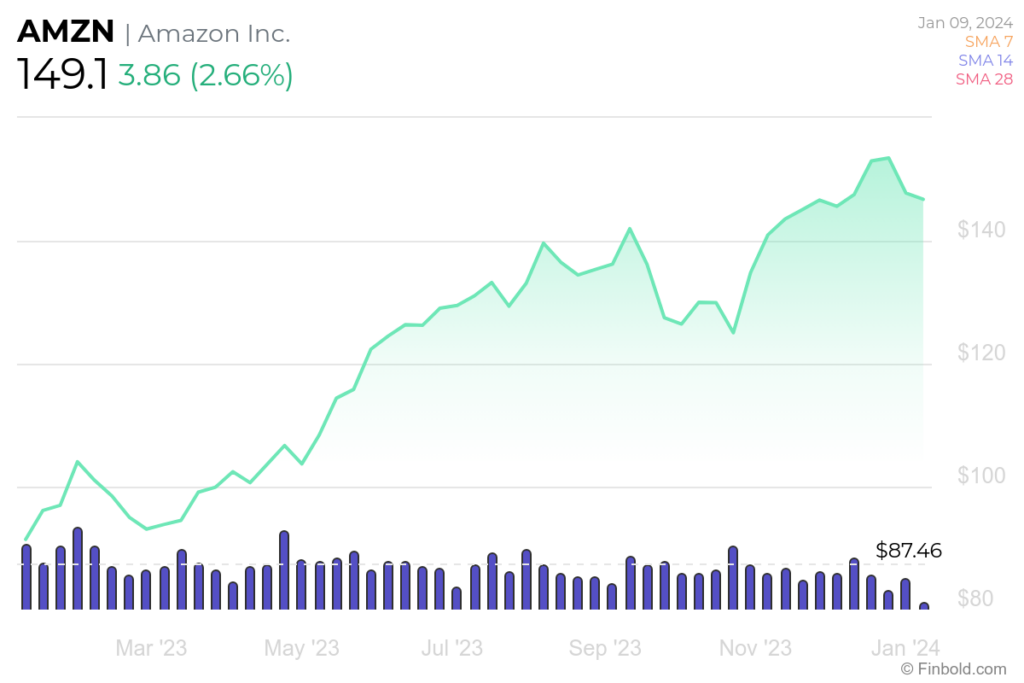

Having faced a decline amid economic challenges in 2020, Amazon’s (NASDAQ: AMZN) stock has grown strongly. An improving economic environment and the ongoing recovery in the technology sector drive this revival. In 2023, shares of the online retail pioneer surged by over 70%.

Nonetheless, the notable performance of the stock in the previous year raises a fundamental investing inquiry: Given the substantial gains, is it now too late to invest in Amazon stock, hold if you have it, or sell?

On January 9, we explore what the upcoming 12 months could hold for AMZN, scrutinizing the possibilities for additional advancements.

Why are analysts so bullish on AMZN stock?

In the preceding week, five brokerage firms—specifically, Piper Sandler, Bank of America, D.A. Davidson, Wolfe, and Wells Fargo—unanimously designated Amazon as their top pick for 2024, all on the same day.

Beyond these brokerages, numerous others consider the stock a prime pick for 2024, including JPMorgan, Evercore ISI, Citi, TD Cowen, and Bernstein.

There are various reasons, and on many, there is a consensus. For instance, the expansion in advertising revenues is expected to contribute 370 basis points to Amazon’s North America margins.

It’s worth mentioning that Amazon is set to introduce an ad-supported Prime plan this year, aligning itself with streaming services like Netflix (NASDAQ: NTFLX) and Disney (NYSE: DIS) that have already rolled out ad-supported tiers.

Amazon branches as catalysts for growth

Amazon emphasizes its enterprise-oriented Amazon Web Services and asserts that while Microsoft’s (NASDAQ: MSFT) Azure may experience a higher percentage growth, AWS is expected to achieve “comparable gains” in absolute dollar terms.

The growth of Amazon’s advertising business is swift, with an annualized run rate surpassing $50 billion and continuing to climb. Another noteworthy potential growth driver is Amazon’s business-to-business (B2B) platform, Amazon Business, which, as disclosed during the Q2 2023 earnings call, boasts annualized gross revenues reaching $35 billion.

Also, Amazon announced its intention to initiate drone deliveries in Britain, Italy, and a third location in the United States in late 2024. This move aligns with the e-commerce giant’s ongoing efforts to broaden its aerial delivery program and bolster its e-commerce performance worldwide.

AMZN stock price analysis

At the time of press, AMZN stock was trading at $149.10, signifying an increase of 2.66% from its previous close on January 8. However, in the last 5 trading sessions, this stock has lost -1.61% of its value.

However, in the last 5 trading sessions, this stock has lost -1.61% of its value.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.