Amazon (NASDAQ: AMZN), the world’s largest e-commerce company, announced its plan to eliminate plastic pillows from its packages by the end of this year, aiming to replace 95% of them with paper fillers.

This initiative is expected to avoid nearly 15 billion plastic air pillows annually. While this announcement highlights the environmental benefits, it also opens significant business opportunities.

One such opportunity lies with Ranpak Holdings (NYSE: PACK), a lesser-known company that stands to benefit from Amazon’s shift.

Ranpak Holdings is one of the largest packaging producers

Ranpak specializes in machines and consumable paper products for packaging. As of the first quarter 2024, it had 141,000 machines across various businesses.

These machines require regular replenishment of paper products, creating a steady revenue stream for Ranpak. According to some investor presentations, Amazon is already a Ranpak customer, and Craig-Hallum analyst Greg Palm even identifies Amazon as Ranpak’s largest direct customer and sets a $10 price target for PACK stock.

While this isn’t explicitly confirmed in Ranpak’s filings, it’s noteworthy that 30% of Ranpak’s revenue in 2023 came from e-commerce companies, indicating a substantial potential impact from Amazon’s decision.

PACK stock is a low-risk investment

Ranpak’s business model benefits from recurring revenue, as customers continually purchase machine paper supplies. Despite moderate growth and profit margins, the company’s high-margin consumables and consistent revenue make it a low-risk investment.

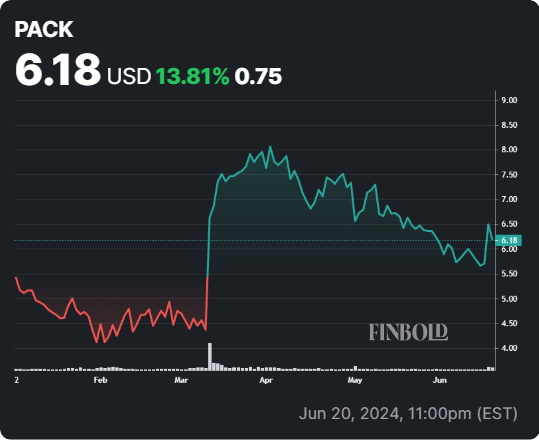

Ranpak went public via a SPAC deal in 2019, and although its stock performance has lagged behind its revenue and EPS growth, the potential boost from Amazon’s packaging change could be significant.

Additionally, if other e-commerce companies follow Amazon’s lead, Ranpak could see even greater benefits, further bolstering its 13% YTD growth.

Currently, the stock is reasonably priced with a price-to-sales ratio of about 1.5, and the market may not yet be accounting for the potential upside from Amazon’s move, making Ranpak an interesting under-the-radar investment opportunity.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.