Bitcoin’s (BTC) remarkable rally hit a brief pause after November 22, as investors grew impatient waiting for the cryptocurrency to breach the highly anticipated $100,000 mark.

Now teetering just below this critical psychological level, Bitcoin appears primed for a breakout that could propel it to new highs.

Despite losing some market dominance amid an ongoing altcoin surge, Bitcoin remains the cornerstone of the cryptocurrency sector, supported by strong technical patterns and robust fundamental drivers.

Technical outlook: Key levels and bullish signals

Notably, prominent analyst RLinda highlights Bitcoin’s consolidation phase as a precursor to significant growth.

According to the analyst, the cryptocurrency has formed an ascending triangle pattern, a classic bullish indicator that reflects sustained buyer interest and mounting pressure to breach resistance.

Currently, key support levels are established at $94,700, $91,250, and $89,200, while resistance lies at $99,000 and $100,000.

The $99,000 mark is identified as a critical trigger point. Breaking this level could open the door for Bitcoin to test the $105,000 milestone and potentially move even higher.

RLinda also notes that recent pullbacks have likely served as liquidity traps, designed to attract large institutional buyers ahead of the next leg up.

Bitcoin’s ability to hold above the ascending price channel reflects strong market confidence and growing institutional interest, further solidifying the bullish outlook.

Fundamentals driving Bitcoin’s rally

Bitcoin’s rally is underpinned by strong fundamentals, driven by large-scale accumulation by whales and institutional investors, reflecting long-term confidence in its growth potential.

During the recent market correction, whales strategically accumulated 16,000 BTC, valued at approximately $1.5 billion, as highlighted by CryptoQuant analyst Cauê Oliveira.

This buying followed the sale of nearly $4 billion in BTC at a loss by short-term holders, showcasing the ability of larger market participants to capitalize on market dips.

This whale activity is consistent with broader institutional movements. MicroStrategy, for instance, has significantly expanded its holdings, adding Bitcoin worth $5.4 billion to its reserves.

Additionally, Bitcoin ETFs from major issuers like BlackRock Inc. (NYSE: BLK) and Fidelity Investments have attracted $6.2 billion in inflows throughout November, surpassing February’s previous peak of $6 billion.

Favorable policy discussions and renewed market interest in cryptocurrencies have further fueled the rally. Figures like Donald Trump continue to play a pivotal role in driving sentiment toward digital assets.

Despite Bitcoin’s market dominance slightly declining due to an active altcoin season, its strong fundamentals, combined with historical performance, suggest significant upside potential.

Historical data provides further optimism for Bitcoin’s trajectory. According to analyst Ali Martinez, Bitcoin has historically surged by 30% and 46% in December following the U.S. presidential elections, achieving significant gains in the last two cycles.

Martinez suggests that this trend could repeat, potentially propelling Bitcoin’s price to trade between $125,000 and $140,000 by the end of December.

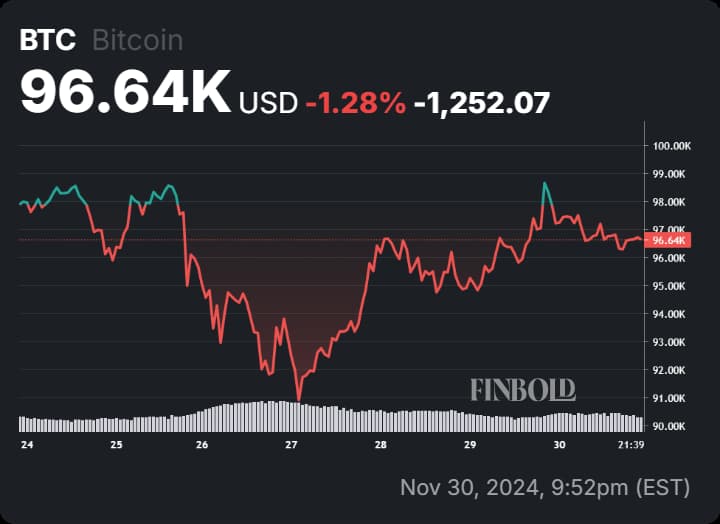

BTC price analysis: Momentum builds for the next move

As of press time, Bitcoin is trading at $96,682, reflecting a 1.6% decline over the past 24 hours. However, on the monthly chart, BTC remains resilient, showing an impressive 36% gain, signaling robust upward momentum.

As Bitcoin hovers near the pivotal $100,000 milestone, both technical and fundamental indicators continue to align in favor of a bullish trajectory.

The combination of strong institutional demand, accumulation by whales, and favorable market sentiment strengthens Bitcoin’s potential for further gains.

With momentum steadily building, Bitcoin is on track to not only break this psychological barrier but to set new milestones, reaffirming its position as the flagship leader of the cryptocurrency market.

Featured image via Shutterstock