After Apple (NASDAQ: AAPL) recently unveiled its new products, including the iPhone 16, Wall Street analysts’ ratings have been pouring in, with most of them retaining their original ratings and targets but some revising their Apple stock price targets for the next 12 months.

As it happens, Apple has triggered a wave of optimism after debuting its recent product line, which it believes might kickstart a new major sales cycle after several years of lagging iPhone sales amid hardware upgrades nearing their peak and less need for further advancements.

Analyst upgrades Apple stock price target

In this context, Wedbush Securities analyst Dan Ives has increased his Apple stock price target from $285 to $300, maintaining the ‘buy’ recommendation and arguing that the iPhone 16 launch would drive Apple to a $4 trillion valuation by 2025 through its artificial intelligence (AI) innovations.

Furthermore, in a recent X post and interview with CNBC’s Squawk on the Street, Ives shared his company’s belief that “iPhone 16 will be a renaissance of iPhone growth for Apple with China growth now on the horizon again.” Specifically, after the iPhone 16 reveal, Ives wrote that:

“The new era of personalization and how consumers interact with their iPhones has now begun. We believe this will cause a renaissance of iPhone growth (high-single-digit growth upside) for Apple over the next 12 to 18 months and drive shares higher with a $4 trillion market cap in 2025.”

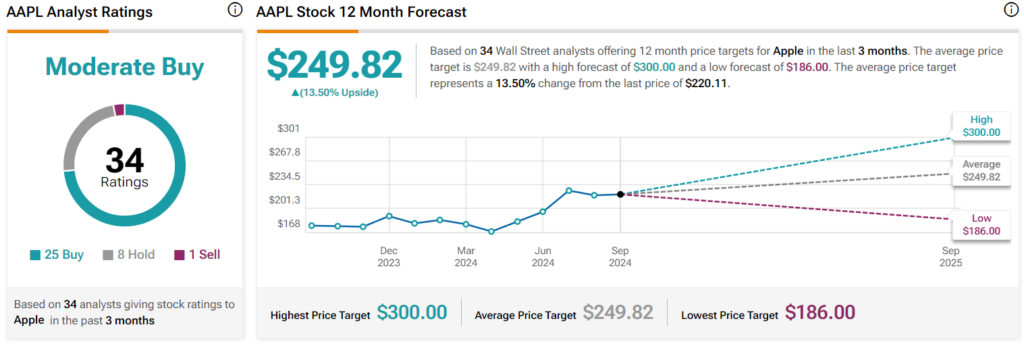

Meanwhile, most other analysts share Ives’s optimism, with the average Wall Street Apple stock price target standing at $249.82, reflecting a potential increase of 13.50% from its current price, the lowest target at $186 (-15.50%), and the highest amounting to $300 (+36.30%).

Apple stock price analysis

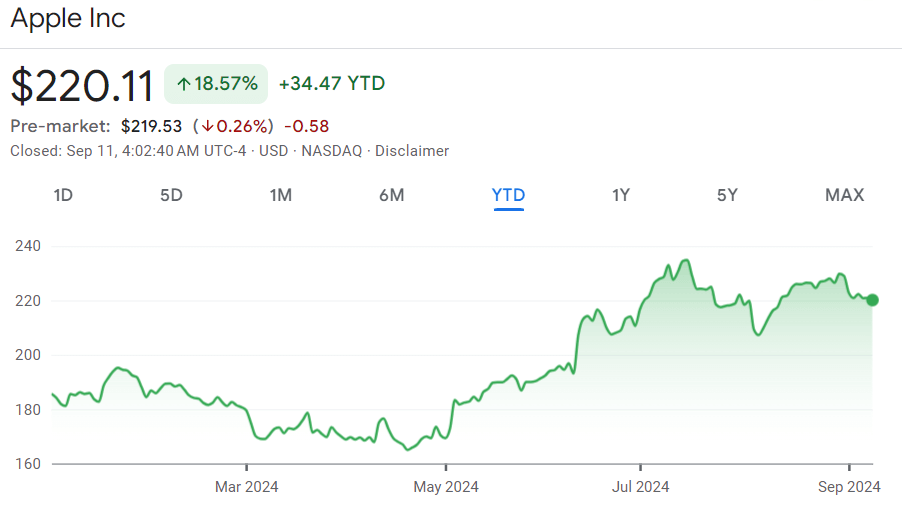

For the time being, the price of Apple stock stands at $220.11, reflecting a decline of 0.36% on the day as well as losing 0.72% in the past week, reducing its one-month increase to 1.19% and gaining 18.57% since the year’s turn, according to the data retrieved by Finbold on September 11.

So why is Apple stock down? Notably, Apple stocks fell after the European Court of Justice upheld an order for Ireland to recoup up to €13 billion (~$14.35 billion), plus interest in taxes from Apple, as the European Commission argued that Ireland had granted Apple benefits against EU state-aid rules, allowing it to pay much less in taxes than it owed.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.