Meta Platforms (NASDAQ: META) is one of the stocks in the S&P 500 and “Magnificient Seven” that posted an impressive recovery from its lows in 2022 when it was trading below the $100 mark.

META stock has added over 430% since then, of which 53% came in this year alone.

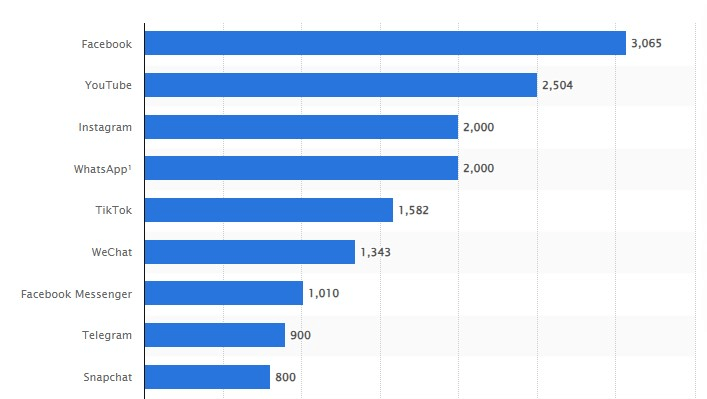

Analysts and investors seem to love the rebranding that this social media giant and its CEO, Mark Zuckerberg, have done in the previous years, especially with an early involvement in artificial intelligence (AI) and further expansion in social media, as it is reported that over 3 billion people use some of the Meta products daily.

Analysts are still bullish on META stock

Growing revenue cost-cutting measures are strategies analysts on Wall Street hold in high regard, especially if they prove effective shortly afterward.

A July 8 report from Wells Fargo noted the company’s position within its capital expenditure (Capex) cycle, which is contributing to potential gains. Meta has maintained strong momentum, leading to an “overweight” rating and a raised price target of $625 per share.

Loop Capital has reiterated a “buy” rating for Meta stock with a $550 price target on July 3. Rob Sanderson noted that Google will face significant challenges defending its dominant search position against competitors like Microsoft’s (NASDAQ: MSFT) Bing and generative AI-powered services like ChatGPT.

In contrast, Meta’s strategy to advance AI tools for creators and businesses appears promising.

On the same date, Bernstein analyst Mark Shmulik said spending could help fulfill Zuckerberg’s vision of Meta becoming its platform rather than an application on systems designed by other tech firms.

Shmulik noted that investors’ perspectives will vary based on how they value this approach. Bernstein maintains a positive “outperform” rating for Meta stock and has reiterated a price target of $575.

An average analyst on Wall Street doesn’t see much growth for META stock

Despite the analysts from giant financial institutions being bullish, the average expert on Wall Street thinks that META stock doesn’t have much room for growth, at least not in the upcoming 12 months.

This is reflected through an average price target of $530.37, representing a potential upside of just 0.07% from the current price levels.

It remains to be seen whether this is just a lack of current ratings that reflect the ongoing growth or whether analysts think that META stock has run out of gas.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.