The share price of social media giant Meta Platforms (NASDAQ: META) is in the spotlight after the company reported robust Q2 2024 results, surpassing most analysts’ estimates.

The stock, trading at $474 by the close of markets on July 31, registered gains of 8% at some point within 24 hours following the positive results. Currently, META shares are targeting the $500 mark and have maintained positive momentum throughout 2024, gaining over 37% year-to-date.

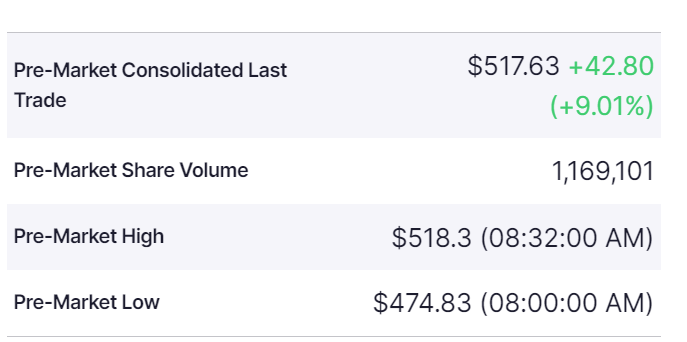

Meanwhile, the equity also showed strong gains in pre-market trading ahead of the August 1 opening, with a value of $517, reflecting an increase of about 9%.

Meta’s stock’s performance comes after the company reported Q2 2024 earnings per share (EPS) of $5.16, beating expectations of $5.72 on revenue of $39.1 billion, above the anticipated $38.3 billion. A majority, 98%, of the revenue came from advertising, primarily on Facebook and Instagram.

Additionally, the firm recorded 3.27 billion daily active users, exceeding expectations. This figure translates to over 40% of the world’s population active daily on Meta’s platforms.

Overall, these returns will likely alleviate concerns regarding Meta’s massive spending on artificial intelligence (AI).

Analysts revise META share price

In the backdrop of this positive performance, several prominent financial analysts have revised their price targets for Meta, reflecting heightened optimism about its future performance.

For instance, Oppenheimer analyst Jason Helfstein has increased the price target from $525 to $615 while maintaining an ‘outperform’ rating on the shares. This adjustment comes in response to Meta’s strong revenue and promising third-quarter guidance. Helfstein highlighted CEO Mark Zuckerberg’s focus on AI spending as a key factor expected to enhance future advertising capabilities and user engagement.

Additionally, banking giant Goldman Sachs (NYSE: GS) has updated its outlook on Meta, raising the price target to $555 from the previous $522 and maintaining a ‘buy’ rating. The firm emphasized Meta’s extensive audience reach across its various applications, which it believes positions the company well to adapt to evolving user behaviors. The analysts also cited Meta’s potential in short-form video, messaging, commerce, augmented reality, and social connections as significant growth drivers.

Elsewhere, Piper Sandler raised its price target to $575 from $545, maintaining an ‘overweight’ rating, Rosenblatt increased its projection to $643 from $562, keeping a ‘buy’ rating, and Jefferies adjusted its target to $600 from $565, continuing to rate the stock as a ‘buy.’

Wall Street META stock price prediction

On the other hand, 28 Wall Street analysts at TipRanks forecast the same rating above $500, with a majority maintaining the ‘buy’ rating. The analysts project that Meta will trade at an average price of $549 in the next 12 months. The highest projection is $630, while the lowest target is $360.

Notably, the rating should increase investor interest in Meta, considering that the company has been battling several challenges. Most importantly, the company has faced stiff competition in the social media space, which has added more pressure on its revenue growth.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.