Amid the announcements by Microsoft (NASDAQ: MSFT) of increased investments in artificial intelligence (AI), triggering a wave of optimism in the industry and on the stock market, Wall Street analysts have revised their price prediction targets for MSFT shares.

Indeed, Microsoft CEO Satya Nadella and finance chief Amy Hood have recently revealed plans to invest heavily in AI, including the infrastructure based on Nvidia (NASDAQ: NVDA) products, in addition to spending nearly 80% more in the last quarter compared to a year ago – “nearly all” in cloud and AI.

Microsoft stock price prediction 2025

That said, several Wall Street analysts have adjusted their Nvidia stock targets to reflect what seems to be pessimism regarding NVDA share price, like Keith Weiss from Morgan Stanley (NYSE: MS), who reduced his projection from $520 to $506, albeit maintaining an ‘overweight’ rating and advising investors to “take the opportunity to build positions in this long-term winner on the dip.”

“Our conviction in Microsoft’s ability to effectively monetize against this investment (and not overspend) also rises, given management commentary on the call. (…) With ~23% upside to our $506 price target after-hours, we remain firmly Overweight the clearest AI winner in software.”

At the same time, Karl Keirstead, the head of the software equity research team at the investment bank and financial services behemoth UBS Group (NYSE: UBS), lowered his Nvidia forecast from $520 to $510, holding onto the ‘buy’ rating, arguing that investors might be willing to stay patient on the AI narrative, on July 31.

With the most recent Microsoft stock price predictions, the analyst consensus regarding its future performance sees it as reaching an average price of $493.97, with a ‘buy’ recommendation based on the ratings of 34 analysts in recent months, as per Benzinga data on August 1.

Microsoft stock price analysis

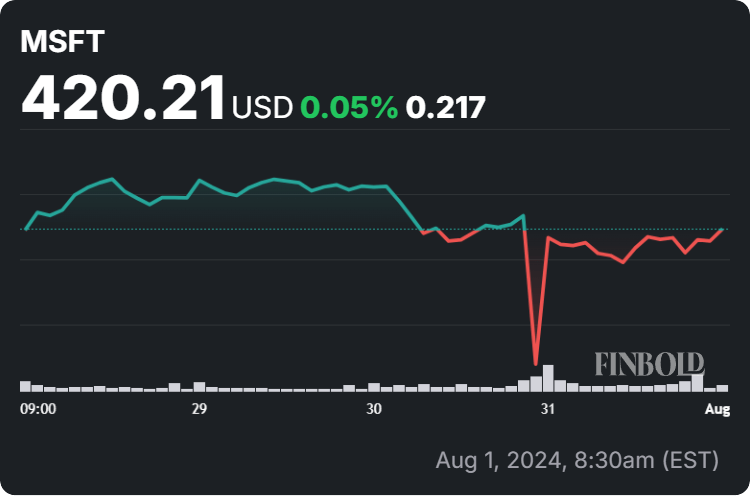

Meanwhile, MSFT stock was at press time changing hands at the price of $420.21, which reflects a 0.30% increase on the day, a very modest recovery of 0.05% across the past week from the accumulated loss of 8.51% over the last month, while holding onto the 13.31% gain since the year’s turn.

It is also worth noting that the price of Microsoft shares has dipped recently due to another outage on July 30, caused by a Distributed Denial-of-Service (DDoS) attack and an error in the implementation of defenses, which left the technology giant’s Azure cloud computing platform inaccessible for almost 10 hours.

Elsewhere, Microsoft’s positive announcements have triggered a bullish price action for Nvidia stock, considering that MSFT is Nvidia’s top customers, but also volatility, as it clashed with investor anxiety on the future of AI, as well as the CEO’s insider selling activity, as Finbold reported earlier.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.