Amid Nike (NYSE: NKE) posting a more significant sales decline than expected for the fiscal year of 2025, NKE shares have started to tumble, and certain Wall Street analysts have updated their NKE stock price expectations following the earnings report or in the days leading up to it.

Indeed, some finance experts had expected impressive results from Nike, which is why they upgraded their price targets ahead of the earnings call in combination with other factors, whereas others downgraded NKE stocks in response to the tepid report, and the shares retaliated.

Nike stock forecast

Among the more optimistic experts were those from Oppenheimer, who late last week upgraded shares of the athletic clothing maker to ‘outperform’ from ‘perform,’ reinstated the stock as a top mega-cap pick, and lifted the price target for the next 12 months from $110 to $120. As analyst Brian Nagel explained:

“Challenges persist for NKE. (…) That said, we are increasingly of the view that multiples at which shares trade and nearer-term financial expectations for NKE are now largely ‘derisked’ and poised to rebound gradually as efforts on the part of senior leadership to refocus on product innovation and brand-building take hold.”

Around the same time, Barclays cut its price target for Nike shares to $109 from the previous $114, although retaining the ‘overweight’ rating on the stock, while citing the difficulties that Nike’s North America direct-to-consumer (DTC) operations could experience due to unfavorable factors.

More recently, TD Cowen adjusted its price target on Nike stock to $89 from $91, reiterating the ‘hold’ score, while Goldman Sachs (NYSE: GS) maintained its ‘buy’ recommendation, having redacted the target price from $118 to $105, and RBC’s Piral Dadhania maintained his ‘neutral’ outlook, with a $100 target.

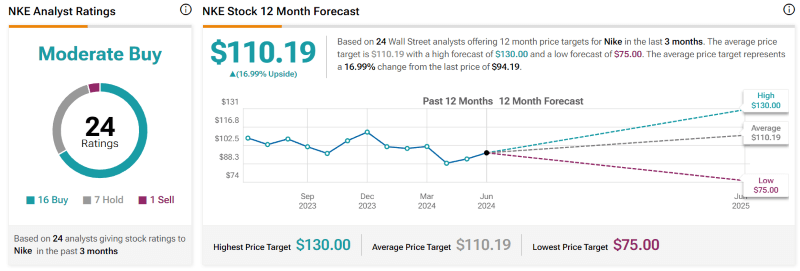

With the most recent Nike stock price target updates, the analyst consensus on NKE shares now stands at ‘moderate buy,’ with an average price target for the next 12 months at $110.19, which suggests an increase of over 24% from its current price, with the lowest target at $75 and the highest at $130.

Nike stock price analysis

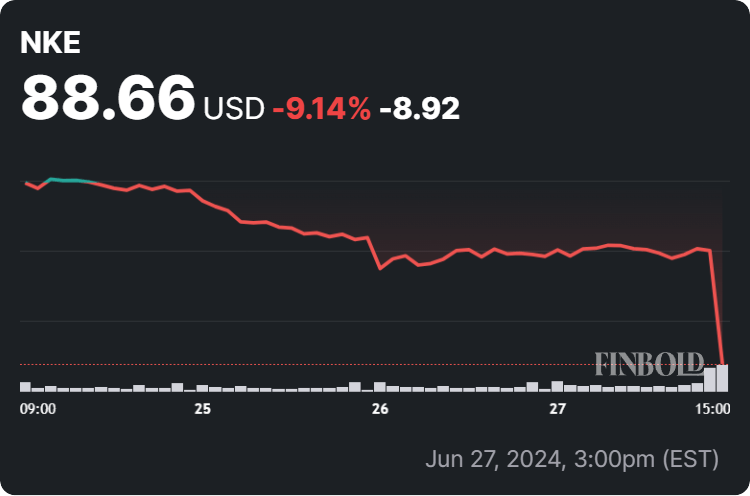

For now, the price of Nike shares amounts to $88.66, which represents a slight increase of 0.70% on the day, a 9.14% dip across the week, and a 2.75% gain accumulated in the last month, as the stock records a decline of 11.60% since the year’s turn, according to the data on June 28.

All things considered, analysts retain careful optimism when it comes to Nike stock, believing it may yet grow in the next 12 months and still recommending investors to buy it. However, things in the stock market can often turn around, so doing one’s own research when investing is critical.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.