After its CEO Jensen Huang laid out plans for new artificial intelligence (AI) accelerator chips, the stock of technology giant Nvidia (NASDAQ: NVDA) has climbed to its new all-time high (ATH), and Wall Street analysts have started to adjust their NVDA stock price targets accordingly.

As it happens, NVDA stock price has soared in response to the bullish news announced at Taiwan’s showcase event, Computex 2024, during which Huang announced that Nvidia would roll out Blackwell Ultra chips in 2025 and a new Rubin chip architecture in 2026.

Nvidia price target

In this context, analysts at Bank of America (NYSE: BAC) have raised their price for Nvidia stock to a whopping $1,500 from the previous NVDA price target of $1,320, with the firm maintaining its ‘buy’ score on the renowned chipmaker, according to a report by StreetInsider published on June 3.

As BofA’s analysts stated, they also expected Nvidia’s potential earnings per share (EPS) power to increase to over $50 in the next two years, emphasizing Nvidia’s new GB200 NVL2 platform and the MGX modular reference design platform and explaining that:

“Key product announcements continue to bolster NVDA’s AI leadership position. (…) Importantly, NVDA is now eyeing millions of GPU-sized clusters for large hyperscalers as early as 2026, paving the way for greatly increased unit opportunities.”

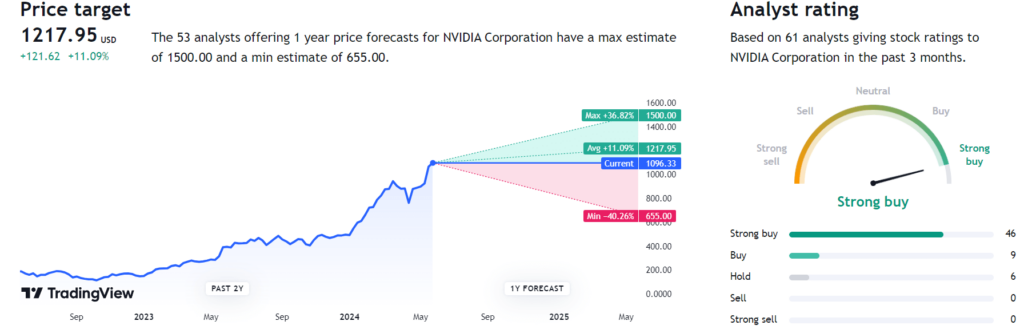

Notably, the recent Nvidia stock price revisions have contributed to the average NVDA share price target reaching $1,217.95, according to the collective price targets offered by 53 Wall Street analysts and stock scoring provided by 61 experts in the last three months, who have rated Nvidia as a ‘strong buy.’

Should it come true, this average price target would represent an increase of 6.83% to the current price of Nvidia stock, taking into account BofA’s price target of $1,500, which is also the highest offered target and a gain of 31.57%, whereas the lowest target at $655 would see it decline 42.55%.

On top of that, market experts at Goldman Sachs (NYSE: GS) have pointed out that Nvidia’s latest AI chips would likely leverage the technology of Taiwan Semiconductor Manufacturing Company (NYSE: TSM), arguing that the Rubin platform would employ TMSC’s powerful 3-nanometer nodes and that:

“We sense that the overall sentiment among investors towards AI is still positive, with more future new applications to emerge beyond just AI chatbot[s] [like] ChatGPT. “

As a reminder, the fiscal Q1 2025 earnings call on May 22, Huang stated that his company would design new chips every year, as opposed to its previous practice that saw it produce new platforms every two years – Ampere in 2020, Hopper in 2022, and Blackwell in 2024.

Nvidia stock price analysis

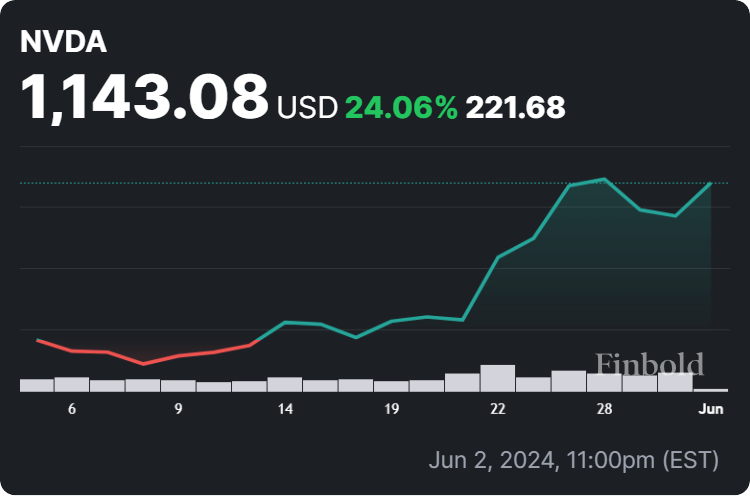

Meanwhile, Nvidia stock climbed 4.15% in premarket trading, as its shares rose by 2.01% to the current $1,140.08 across the last week, adding up to the 23.61% advance on its monthly chart, as per the most recent chart data retrieved by Finbold on June 3.

All things considered, Nvidia seems to be looking at a bullish future in the next year or further, assuming continuous growth and positive indicators. However, things in the stock market can sometimes do a 180 unexpectedly, so doing one’s own research is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.