Apple (NASDAQ: AAPL) has been struggling lately, with its stock price dropping nearly 10% since late November 2023, even as the broader technology sector has been surging.

Adding to Apple’s woes, the stock receives a dismal technical rating of 0 out of 10. It performs poorly compared to the overall market, and both the medium and short-term technical indicators are negative.

This begs the question: is Apple on the edge of disaster, or is this a buying opportunity for long-term investors?

AAPL stock price analysis

Apple’s stock price is currently experiencing a downward trend. As of press time, it sits at $168.45, representing a minor loss by -0.05% for the day.

However, over the past five days, the stock has fallen by 0.38%, and the past month has seen a more considerable decrease of 2.58%.

The most concerning trend for investors is the significant decline over the last six months. During this period, the stock price has dropped by a total of 6.86%.

This substantial decrease has pushed the price to its lowest level since November 2023, highlighting the ongoing challenges impacting Apple.

Apple’s challenges on multiple fronts

Apple is facing several issues that are dampening investor sentiment. The company recently abandoned its Apple’s car “Project Titan” after significant investment in research and development. This raised concerns about Apple’s ability to innovate and enter new markets.

However, shortly after the project’s failure, the company’s future direction has become a point of curiosity. Reports indicate that Apple is currently developing robots designed to follow people around in their homes, in hopes that this will be the “next big thing.”

Wedbush analyst Dan Ives expressed significant doubts about Apple’s recent venture into personal robotics during an interview with CNBC on April 4th.

“It would be a horror show if they actually spent money on robots,” Ives said. “They need to focus on AI.”

Additionally, the company is entangled in a web of legal battles in the US and Europe, facing accusations of being a monopoly. While competition from Android phones exists, the legal battles create uncertainty for investors.

Perhaps the most concerning issue is Apple’s slowing sales growth. Revenue has declined year-over-year, falling from $394 billion in 2022 to $383 billion in 2023. This slowdown is largely driven by declining iPhone sales.

Buying opportunity or looming decline?

The current downward trend in Apple’s stock price presents a potential buying opportunity for some investors, but caution is warranted.

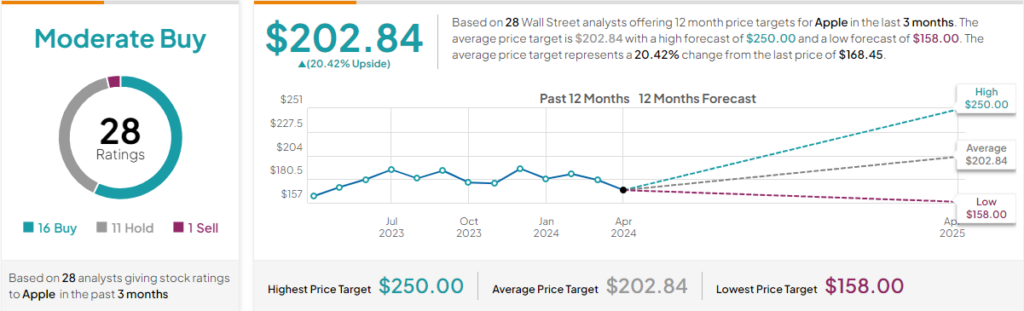

Insights from 28 Wall Street analysts who have provided 12-month price targets for Apple over the last 3 months reveal varying perspectives. Out of these analysts, 16 recommend buying the stock, 11 suggest holding it, and 1 advises selling.

Their price targets range from a high of $250 to a low of $158, with an average of $202.84, offering a collective outlook on Apple’s expected performance in the coming year, according to TipRanks data from April 9.

However, the technical analysis presents a contrasting view. The “death cross” pattern and the stock’s proximity to the crucial support level of $168.45 suggest a potential for further decline if this level breaks.

Therefore, before investing in AAPL, it might be wise to wait for a potential further price drop or a more positive overall outlook.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.