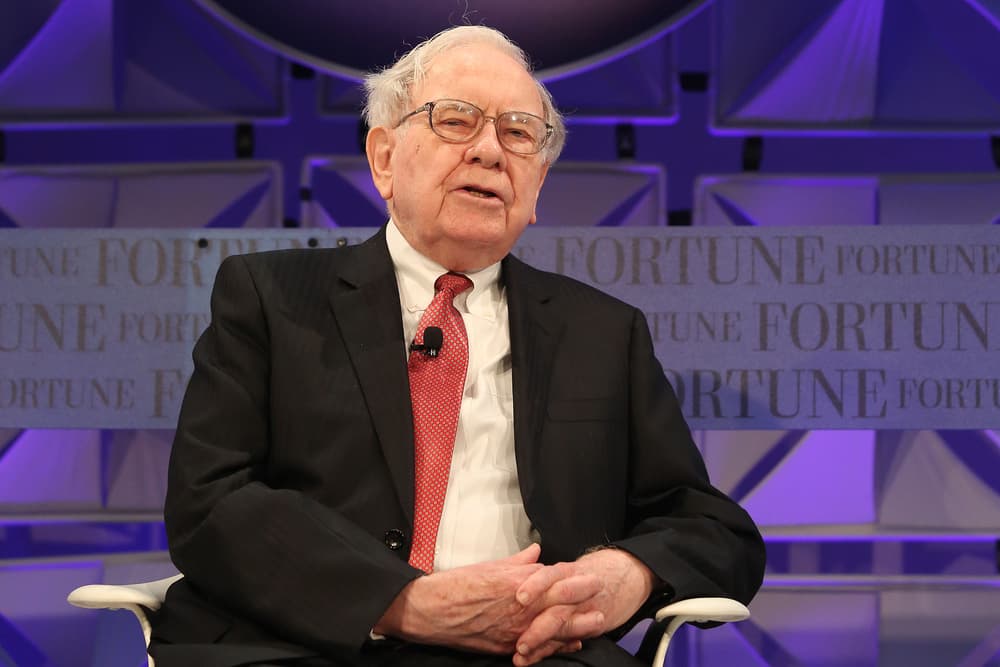

Warren Buffett’s Berkshire Hathaway has sold almost $4 billion of Apple stock (NASDAQ: AAPL) during the third quarter, according to market reports. Apple is the largest holding of the insurance and investment conglomerate portfolio.

Warren Buffett’s Berkshire Hathaway has spent almost $35 billion between 2016 and 2018 to build a stake in technology titan. Berkshire’s second-quarter earnings results indicated that it has held $111.7 billion of Apple stock as of June 30. This means that Berkshire has tripled its money in the past few years.

Apple is still Berkshire’s favorite stock

Apple accounted for almost 40% of the overall portfolio at the end of the second quarter while $4 billion of Apple’s stock sale in the September quarter would only make a small percentage change in the overall stake.

Bank of America is its second-largest stock holding with a fair value of $24.9 billion. Bank of America accounts for 10% of Warren Buffett Berkshire Hathaway’s portfolio.

Although Berkshire Hathaway sold a small percentage of Apple stake, the “Oracle of Omaha” is bullish over the future fundamentals of the tech giant. “It’s probably the best business I know in the world,” Buffett said in a CNBC interview in February. “I don’t think of Apple as a stock. I think of it as our third business.”

Apple stock price rallied almost 62% since the beginning of this year. Apple stock performance has helped Berkshire Hathaway to offset the negative performance of insurance, banking, and energy businesses in the past two quarters.

Berkshire Hathaway’s profits soared

Berkshire Hathaway has generated 87.7% year over year growth in the third-quarter earnings, thanks to gains from its derivative contracts and an investment portfolio that jumped 189.1% from the past year period.

The firm has also bought $9 billion of its stock in the third quarter, marking the largest quarterly buybacks in history.