Meme coins, initially created as lighthearted jokes, have taken the cryptocurrency world by storm, ballooning in value, gaining multibillion-dollar market caps, and attracting celebrity endorsements.

Despite their rapid rise, most meme coins lack fundamental value or unique use cases. Their primary appeal lies in community participation and entertainment value, leading industry experts to often dismiss them for their perceived lack of utility.

However, Galaxy Digital CEO Mike Novogratz believes these tokens are becoming an essential part of the cryptocurrency landscape, capturing investor interest beyond just humor. In a recent post on X (formerly Twitter), he stated:

Picks for you

“Memecoins – whether you’re a fan or not – have become a cornerstone of the crypto economy… In today’s market, they’re one of the most powerful narratives out there. At @galaxyh. we estimate that memecoins on permissionless blockchains have an aggregate market cap of more than $60bn !!”

In a subsequent video posted on June 13, Novogratz highlighted two ways to achieve financial success with meme coins: selecting humorous memes that resonate with the audience and creating new meme coins.

He emphasized the importance of a good sense of humor for predicting successful memes and saw creating meme coins as a way to engage the crypto community’s creativity and entrepreneurial spirit, potentially leading to significant financial gains.

Industry pushback and criticisms

Despite Novogratz’s enthusiasm, his stance has faced criticism from other industry leaders. Charlie Silver, CEO of Permission.io, dismissed meme coins as “silly casino chips,” arguing they are used primarily for speculative gambling rather than serious investment or technological advancement.

Silver suggested that more substantive and transformative technologies will eventually define the industry’s foundation, not the fleeting popularity of meme coins.

Adding to the criticism, a pseudonymous crypto commentator, McGavin, also criticized meme coins, describing them as “inefficient market activities.”

He argued that meme coins do not contribute meaningfully to the overall efficiency or growth of the crypto market and can mislead investors about the true potential of blockchain technology.

Cultural and economic impact

Despite these critiques, Novogratz and his followers believe in the cultural and economic impacts of meme coins.

A report from Galaxy Digital released on June 3 supports this stance by asserting that meme coins are not merely a passing trend but a persistent part of wealth-creation strategies rooted deeply in human culture and behavior.

The report states that memes and the desire to make quick money are not new phenomena and have long been part of human behavior and culture.

Although often ridiculed for their lack of substantive value, meme coins have surprised the world with their performance A staggering 12,000% increase in the value of Dogecoin (DOGE) in the first five months of 2021 supports this.

More recently, Dogwifhat (WIF) and Pepe (PEPE) have produced similar results – the former helped liquid fund Stratos post a 137% return in Q1.

Risks of meme coins

The meme coin market has seen significant growth this year, with March witnessing $13 billion in spot trading volumes.

These tokens have even outperformed major cryptocurrencies like Ethereum (ETH) and Solana (SOL). However, the heavy concentration of assets among a few holders poses risks of market manipulation and liquidity challenges.

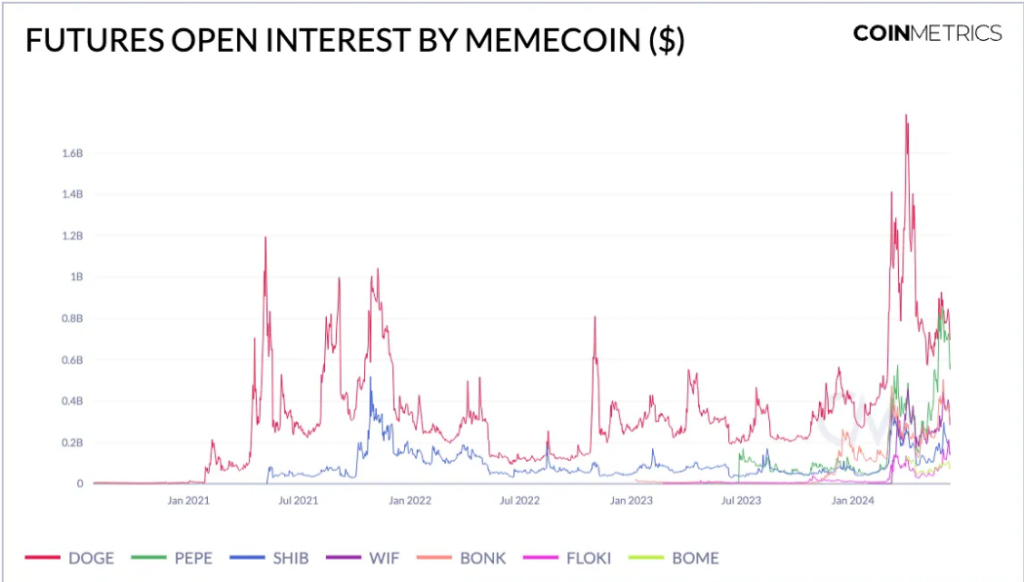

A recent CoinMetrics report underlines the strong market presence of meme coins, highlighted by high futures open interest, which points to substantial speculative trading activity.

Additionally, a high Gini coefficient of approximately 0.8 for meme coins signals significant centralization of token holdings, suggesting that a small number of participants hold a large proportion of the tokens

Conclusion

Meme coins remain a contentious topic within the crypto community. While figures like Novogratz champion their potential for wealth creation and cultural significance, others warn of their speculative nature and associated risks.

As the debate continues, the future of meme coins will likely depend on their ability to maintain investor interest and navigate the challenges of market manipulation and liquidity.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.