Bank of America strategist Michael Hartnett anticipates a downturn in stocks following the Federal Reserve’s expected interest rate cuts in September.

Hartnett suggests that this move will likely coincide with signs of a hard landing for the U.S. economy rather than the more favorable soft landing scenario.

The strategist points out that historically, when the Fed begins easing in response to economic downturns, it often leads to negative outcomes for stocks and positive outcomes for bonds.

“One very important difference in 2024 is the extreme degree to which risk assets have front-run Fed cuts,” Hartnett said.

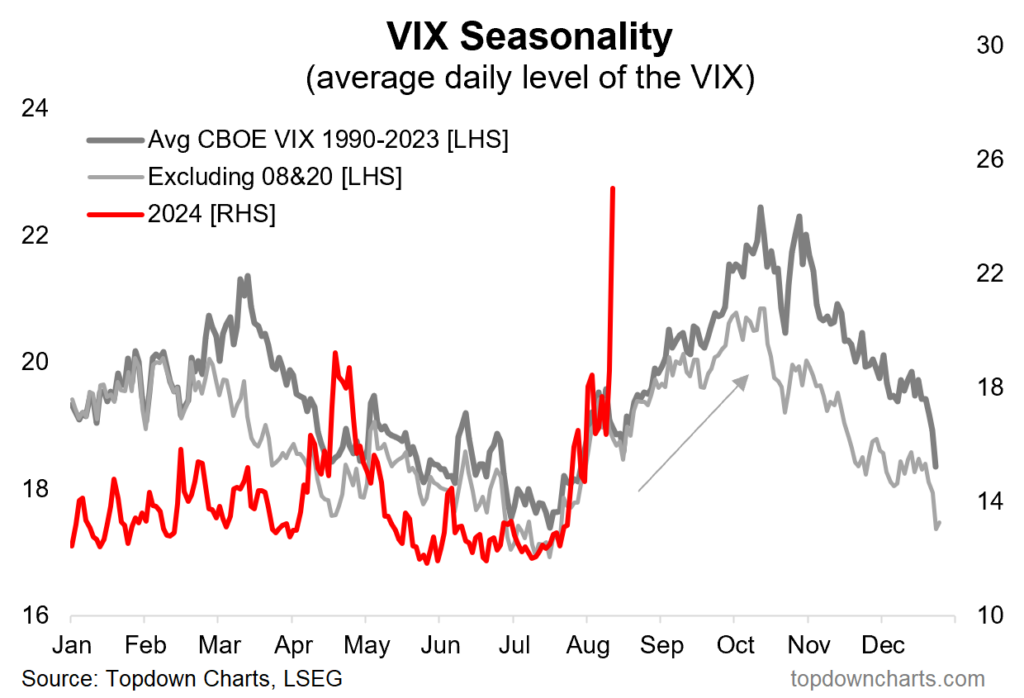

Rising volatility indicates stock market weakness

The equity market is already vulnerable as investors increasingly expect the Fed to ease monetary policy more aggressively in the latter half of the year.

This expectation has led to heightened volatility, with the CBOE Volatility Index rising above the key 20 level for only the second time this year.

On August 1, Wall Street saw stocks decline while two-year Treasury notes, sensitive to policy changes, rallied. This shift followed reports of unemployment claims reaching their highest levels in nearly a year and a contraction in manufacturing.

This is a marked change from the past year when weak economic data was often seen as a positive signal for easing without triggering inflation.

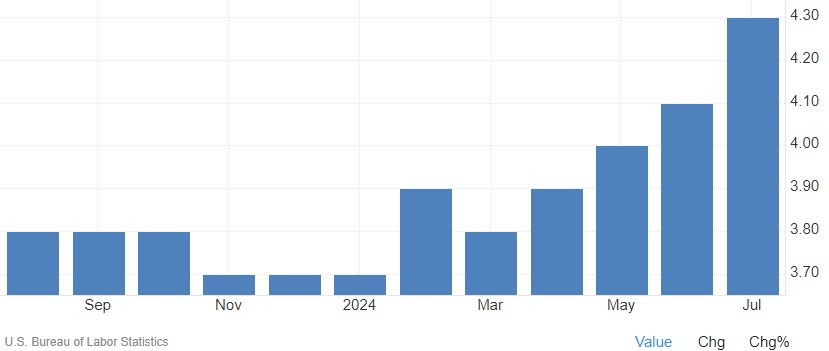

The unemployment report left a big impact on the stock market

As U.S. stock futures continued to fall on August 5 and bonds gained, traders focused on the most recent July employment report. The unemployment rate has risen to 4.3%, the highest since November 2021, marking the fourth consecutive monthly increase.

The rising unemployment rate is drawing closer to a recession indicator developed by former Fed economist Claudia Sahm, known for its accuracy over the past sixty years.

Finally, Bank of America’s chief strategist is closely watching for the rate to reach 4.3%, which would trigger this recession signal in the second half of the year and further exacerbate concerns about the economic outlook.