Bank of America has raised its expectations for U.S. equities, signaling further upside for the S&P 500 over the next year based on its closely followed Sell Side Indicator.

The bank’s framework suggests the benchmark index could deliver a price gain of about 12% over the coming 12 months, reinforcing a constructive outlook for stocks despite already strong sentiment.

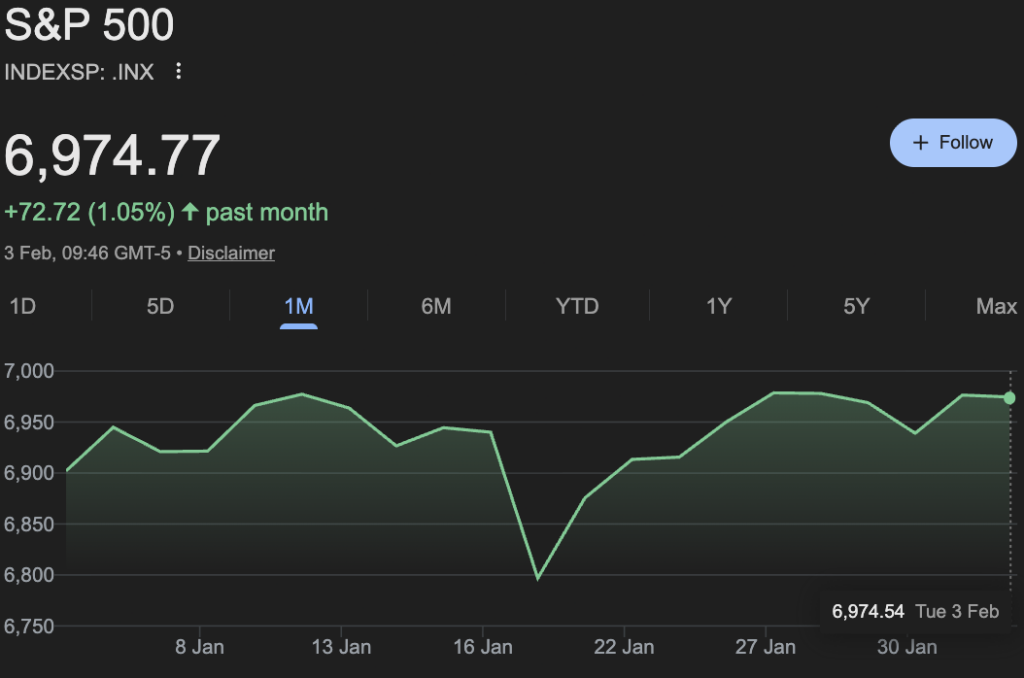

A 12% rise for the benchmark index would imply a rally to roughly 7,815 from the S&P 500’s current value of 6,974.

The Sell Side Indicator, which measures the average equity allocation recommended by Wall Street strategists, edged slightly higher in January and now sits at its most optimistic level since March 2025.

Stock market bullish signals

While allocations remain just below last year’s peak, the indicator continues to flash a bullish signal under Bank of America’s contrarian approach, which tends to be most positive when strategists are relatively cautious and most negative when optimism becomes extreme.

Importantly, Bank of America analyst Victoria Roloff said she does not see conditions that typically precede a market top.

Although strategist positioning has moved closer to levels that would warrant caution, it remains below the threshold historically associated with major market peaks.

January’s market performance reflected that resilience, with the S&P 500 finishing the month higher despite a mid-month pullback tied to geopolitical concerns.

Roloff also pointed to supportive fundamentals underpinning sentiment, with strategists’ steady equity exposure suggesting confidence in corporate earnings. Early results from the current reporting season show no downward revisions to 2026 profit expectations.

Overall, consensus forecasts continue to call for double-digit earnings growth next year, while corporate commentary indicates robust confidence, with signs of weakening demand becoming less frequent.

Featured image via Shutterstock