Although concerns are rising that Bitcoin (BTC) might continue to decline in the following weeks, perhaps even dropping below the $40,000 territory, one cryptocurrency analyst believes the opposite will happen, arguing that bears are in the wrong here and “about to get murdered.”

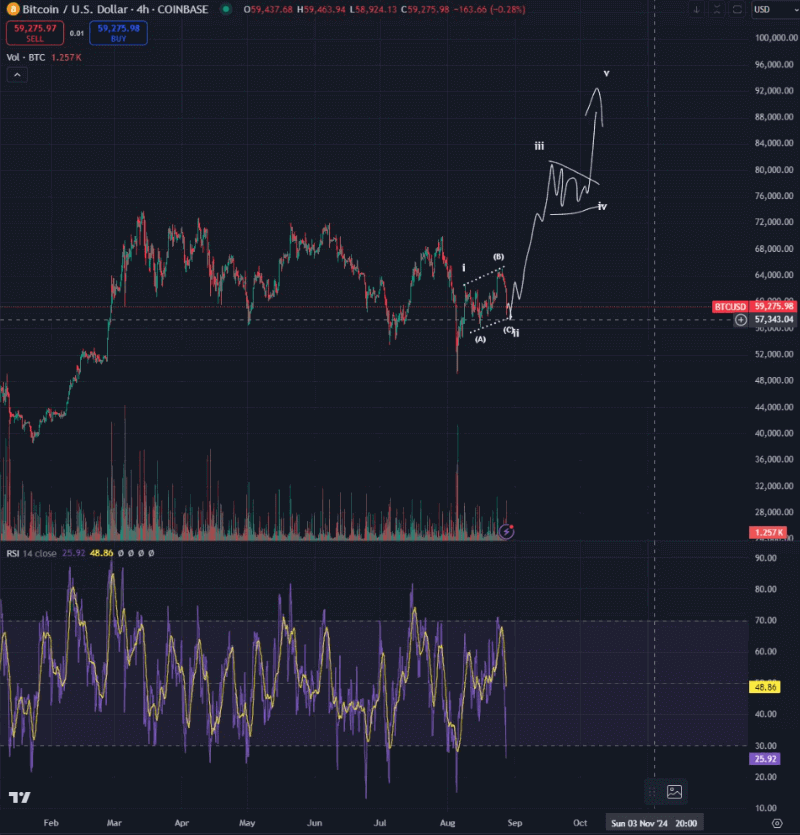

Specifically, a popular pseudonymous crypto trading analyst known as Bluntz has earlier shared his core thesis and “base case for BTC,” according to which Bitcoin was making the second wave of its last leg into a new all-time high (ATH), and about to enter the third one, reiterating it in an X post on September 3.

Indeed, as the expert’s analysis demonstrates, the maiden crypto asset could end up in the $80,000 zone before consolidating in the fourth wave. After that, the fifth wave could take it upwards and toward $95,000 sometime in October this year.

Other crypto analysts’ Bitcoin price prediction

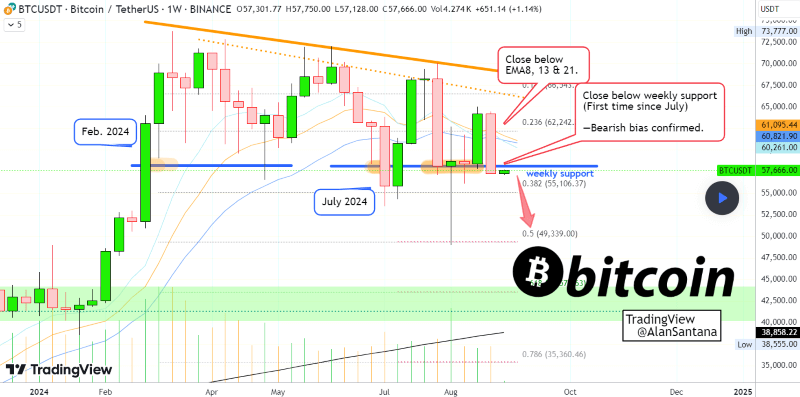

On the other hand, trading analyst Alan Santana suggested the possibility of Bitcoin crashing toward $38,000 within the next few weeks, considering its moving average (MA) shows an “ultra-bearish signal and confirms the bearish bias and potential” as it “moved below EMA8/13/21 weekly in July.”

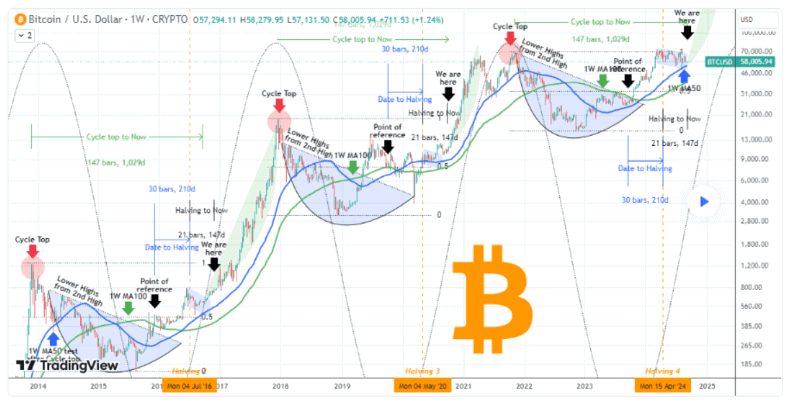

However, other experts share Bluntz’s optimism, including another pseudonymous analyst called TradingShot, who recently noted that the original crypto asset could reach new highs based on technical analysis (TA) and exterior catalysts, as Finbold reported on September 2.

Finally, VanEck’s digital asset research team, Matthew Sigel and Patrick Bush laid out a path for Bitcoin’s price by 2050, including a base projection of $2,910,345, a bearish forecast of $130,314, and a scenario of $52,386,207 under bullish conditions.

Bitcoin price analysis

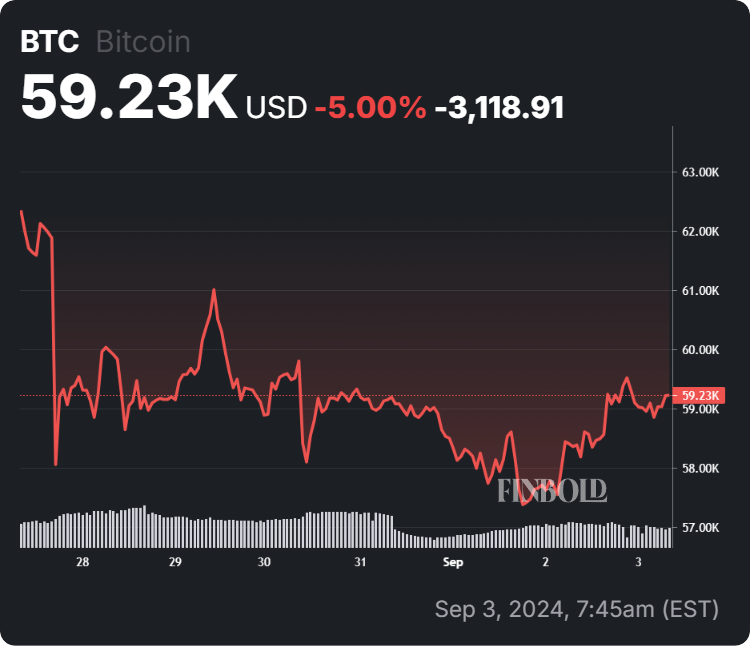

At press time, the flagship decentralized finance (DeFi) asset was trading at $59,230, which suggests an increase of 1.43% in the last 24 hours, a decline of 5% across the previous seven days, and an accumulated loss of 2.92% over the month, according to the most recent chart data obtained on September 3.

All things considered, Bitcoin might, indeed, follow the path laid out by the above crypto trading expert or take an even more bullish road as that outlined in the famous Cathie Wood Bitcoin prediction of $2.3 million, and the total crypto market capitalization of $25 trillion by 2030.

That said, doing one’s own due diligence, including carefully researching market trends, keeping up with any relevant Bitcoin news, as well as experts’ analyses is critical when investing significant amounts of money in it, as trends in the crypto market can easily change.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.