Four years ago, the world was shocked by the news of COVID-19, which crashed all financial markets worldwide, including Bitcoin (BTC).

Since then, Bitcoin has gone through a full market cycle. First, it went up to $69,000 in 2021 and then to $15,400 in 2022, consolidating in 2023. Now, a new bull market is supposedly in its first stages, with BTC breaking from its previous highs.

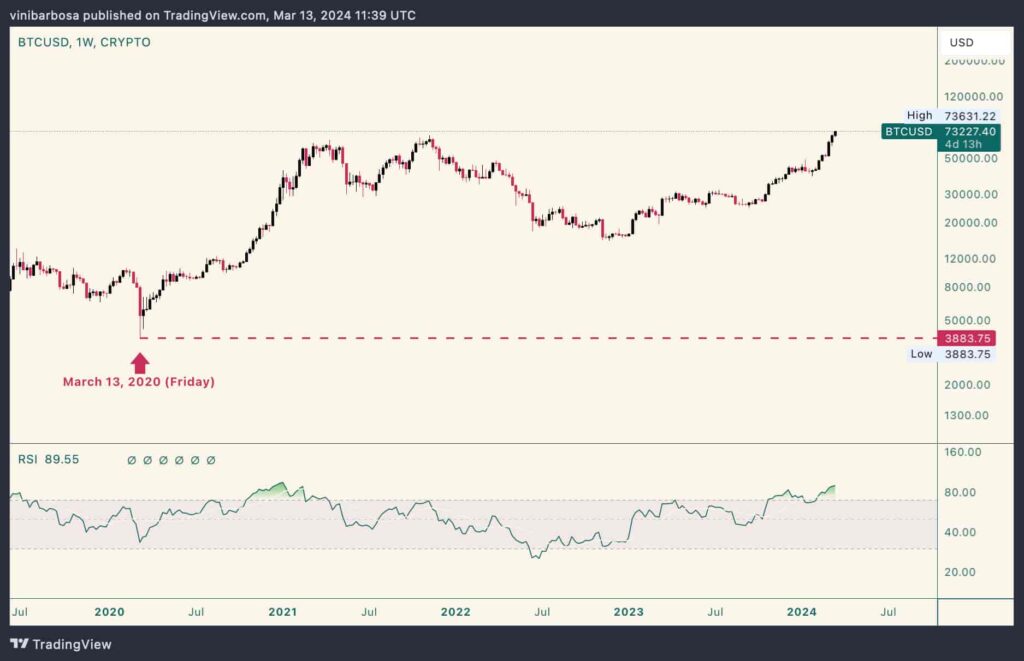

Notably, the leading cryptocurrency traded as low as $3,883 on March 13, 2020, during what was later known as “the COVID crash.” Exactly four years later, on March 13, 2024, Bitcoin is trading at $73,227. Nearly $70,000 higher than what it did at the crash, for nearly 1,750% gains.

Bitcoin price analysis in the 4-year cycle

Looking at Bitcoin’s 4-year, also known as the halving cycle, provides valuable insights about past and future performance.

In particular, the 2020 crash happened two months before the year’s block subsidy halving, on May 11. Bitcoin miners expect the halving for April 21 this time, meaning we are only one month before the event.

Therefore, if we take the halving as our milestone, Bitcoin was already recovering from March’s crash at this point in the past.

However, the cryptocurrency landscape, the macroeconomics, and even BTC price action are all fairly different from four years ago.

From 2020 to 2024: What changed in four years?

Currently, there is more competition among solid cryptocurrencies, and the world’s economy is balancing high interest rates and inflation issues inherited from the COVID-19 crash.

Moreover, technical indicators on Bitcoin’s price chart show how different this halving cycle is from the previous ones. The weekly Relative Strength Index (RSI) has been above the overbought line since last year, which did not happen in 2020.

Previously, during the intermediate bull market stage, the RSI only crossed the overbought zone in late 2020, months after the halving. Similarly, Bitcoin only broke its predecessor’s all-time high in late 2020.

In summary, the maiden cryptocurrency has performed remarkably in the past four years. Such an accomplishment makes BTC one of the best-performing assets in the world and a strong store of value.

Nevertheless, insights from the previous cycle suggest that things may be different this time, and the market should avoid using past performance as guidance for what is to come. The crypto market is highly unpredictable, requiring cryptocurrency investors to constantly revisit their strategies and theses.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.