Bitcoin (BTC) highly capitalized investors known as “whales” are showing growing optimism at current prices, buying and accumulating the cryptocurrency. These whales accumulated nearly $240 million worth of Bitcoin this week, signaling a bullish bias to BTC price moving forward.

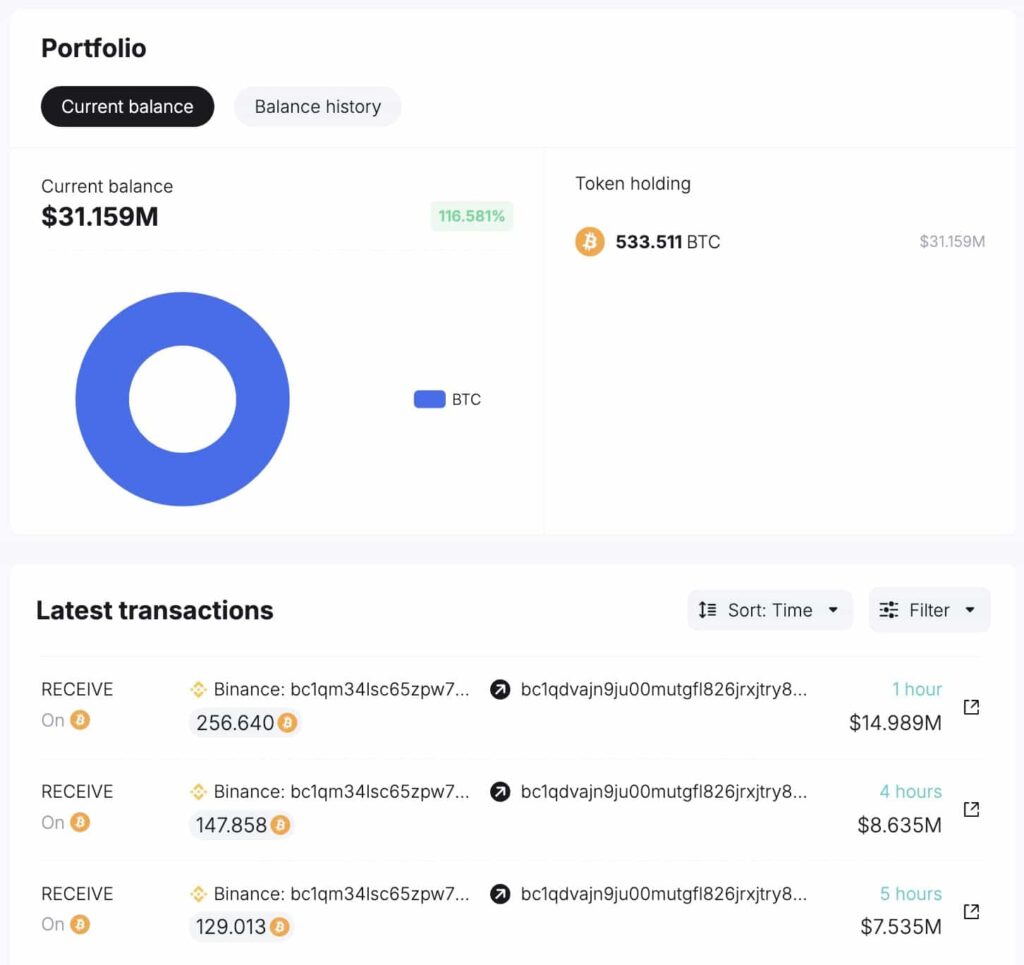

Most recently, a new Bitcoin wallet address withdrew 533.5 BTC from Binance, worth $31 million, according to SpotOnChain‘s post. This investor moved the likely purchased assets at an average price of $58,188 per BTC after a notable crash.

In this context, SpotOnChain reported that other “fresh whales” have shown a similar accumulation behavior this week. “Fresh whales” are recently created addresses, previously with zero balance, who suddenly received large amounts.

Notably, the report highlights six of these investors withdrawing 4,046 BTC and wBTC from centralized exchanges (CEXs). These withdrawals have an average price of $59,194, totaling $239.50 million worth of Bitcoin.

Bitcoin on-chain data: Price, Whales, and MVRV

Finbold gathered premium on-chain data from Santiment‘s SanBase Pro platform, looking for insights on investors’ behavior and finance indicators. As of August 16, this data validates the perceived bullish bias noted this week, tracing a positive Bitcoin price analysis.

First, whale addresses show a surging accumulation in the past two years, looking at wallets holding 100 or more BTC. Large investors currently have 11.81 million BTC, an amount of over 50% of Bitcoin’s circulation and max supply.

Additionally, the 365-day Market Value to Realized Value (MVRV) indicates low intent to sell, which can foreshadow a price surge. Right now, Bitcoin’s MVRV is slightly below 3%, a level where investors usually buy and accumulate.

Essentially, MVRV is one of the most popular on-chain indicators that measures the ratio between the network’s dollar-cost average in a period (365 days) in comparison to the current price, at $58,500.

It is notable, however, that Bitcoin’s price has been downtrending with lower highs and lows since the peak in March. The leading cryptocurrency must reverse this short-term trend to see the forecasted gains backed by these indicators.

Cryptocurrencies can experience high volatility, and predicting their behavior is a difficult task, even for the most experienced analysts.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.