As Bitcoin (BTC) aims to reclaim and hold gains above $55,000, with a long-term target of $60,000, analysts have pointed out that chart patterns suggest it’s time to accumulate.

Specifically, according to analyst Captain Faibiki, through an X post on August 6, Bitcoin is indicating what might be the last buying opportunity before a significant bull run.

The expert noted that the current Bitcoin chart formations are reminiscent of the 2020-2021 surge following the COVID-19 crash.

The analysis includes a detailed comparison highlighting two critical phases in Bitcoin’s recent history. Both phases showed substantial price movements following periods of consolidation and market uncertainty.

Notably, from late 2018 to early 2020, Bitcoin experienced a prolonged consolidation with a descending triangle pattern, signaling the “risk of recession.” The breakout from this pattern marked the beginning of a substantial upward trend, culminating in Bitcoin reaching $15,000.

On the other hand, during the 2020-2021 period, Bitcoin experienced the infamous “COVID Crash.” The sharp decline was followed by another consolidation phase within a descending triangle. The subsequent breakout led to an unprecedented bull run, propelling Bitcoin to new all-time highs above $60,000.

According to Captain Faibiki, the current market conditions echo these historical patterns. Bitcoin appears to be in a similar descending triangle formation, suggesting a strong potential for a breakout. The pattern indicates that Bitcoin might be at a pivotal point, presenting investors with a crucial buying opportunity before the next significant bull run.

“Bitcoin Seems like Last Buying Opportunity before Mega Bullrun like 2020-21 (after Covid Crash),” the expert noted.

Bitcoin’s key support zone

The analysis shows that just as substantial price surges followed the previous consolidations, the present conditions could lead to a similar outcome.

Bitcoin’s price action has shown resilience, bouncing back from recent lows below $50,000 and maintaining support levels that hint at a robust upward momentum.

In the meantime, as Bitcoin attempts to build on recent gains, another analyst, using the pseudonym The Moon, stated in an X post on August 6 that Bitcoin can rally to new heights if it successfully maintains its price above the $53,000 support zone.

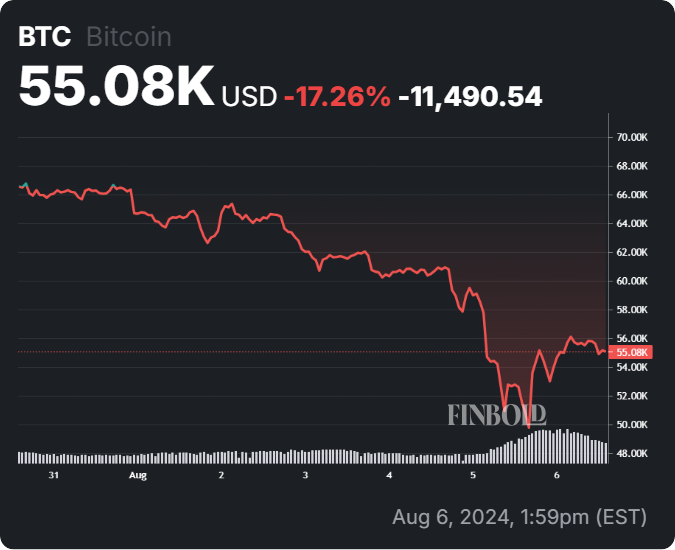

Bitcoin has experienced significant volatility in recent trading sessions, dipping to a critical support level of around $53,000. The cryptocurrency’s price sharply declined from recent highs above $73,000, testing investor confidence.

In this light, if Bitcoin holds this crucial support, it may pave the way for an upward move, potentially restoring some of its lost value.

Bitcoin price analysis

By press time, Bitcoin was trading at $54,080, having rallied over 8% in the last 24 hours. Over the past week, the maiden crypto remains red, having corrected by over 17%.

Overall, if Bitcoin maintains the short-term recovery, the asset will be in line to target the $60,000 resistance, especially if recession fears in the US decline.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.