Bitcoin (BTC) has consistently been a focal point in the cryptocurrency market, with its price movements closely analyzed by investors and market watchers.

As Bitcoin establishes its price above the $67,000 mark, a crypto analyst has noted that recent trends and historical data suggest Bitcoin’s peak is yet to be reached, forecasting a substantial price surge in late Q3 or early Q4 this year.

In a post on July 20, Stockmoney Lizards highlighted three key factors, halving events, short-squeeze zones, and institutional accumulation, that provide projected targets and crucial support and resistance zones, justifying the anticipated massive run for Bitcoin

Post-halving correction and redistribution

Bitcoin’s halving events, which reduce the supply of new Bitcoins, typically act as a “sell-the-news” event. Retail investors often buy into the hype expecting a big run, while large holders, or whales, start to distribute their accumulated assets.

Following the halving, the market usually experiences a correction as retail addresses that bought at the top begin to sell at a loss.

According to the analyst, smart money or whales, recognizing these selling pressures, steps in to rebuy at these lower levels.

This pattern was evident in the past cycles post-2016 and 2020 halvings, where Bitcoin corrected and then consolidated around significant support levels before starting a massive rally.

The current support zone, identified between $53,000 and $56,000, shows a similar pattern of correction and redistribution, indicating that smart money is accumulating in anticipation of the next big move.

Short-squeeze zones: Catalysts for bullish reversals

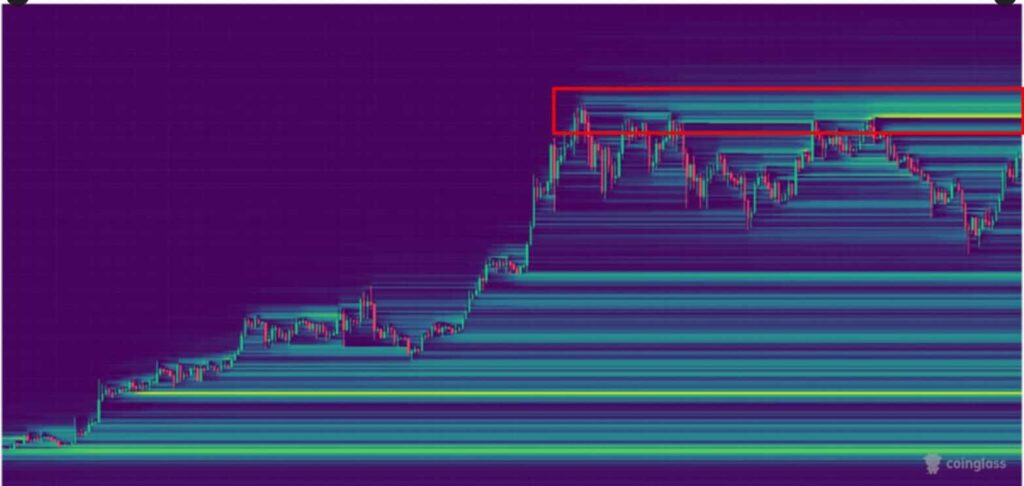

Short-squeeze zones are critical areas where high volumes of liquidations occur, forcing bearish traders to close their positions and triggering a bullish breakout.

In both the 2016 and 2020 cycles, these zones were followed by fakeouts and subsequent drops, which provided strategic entry points for traders. The current short-squeeze zone, identified around $67,687, is expected to see significant liquidations, leading to a reversal in market sentiment.

This pattern suggests that a potential fakeout and drop could precede the actual rally, offering traders an optimal entry point.

Monitoring this zone closely is crucial, as it is likely to precede a significant price movement. Historically, these zones have been pivotal in reversing bearish trends and igniting bullish momentum.

Institutional accumulation

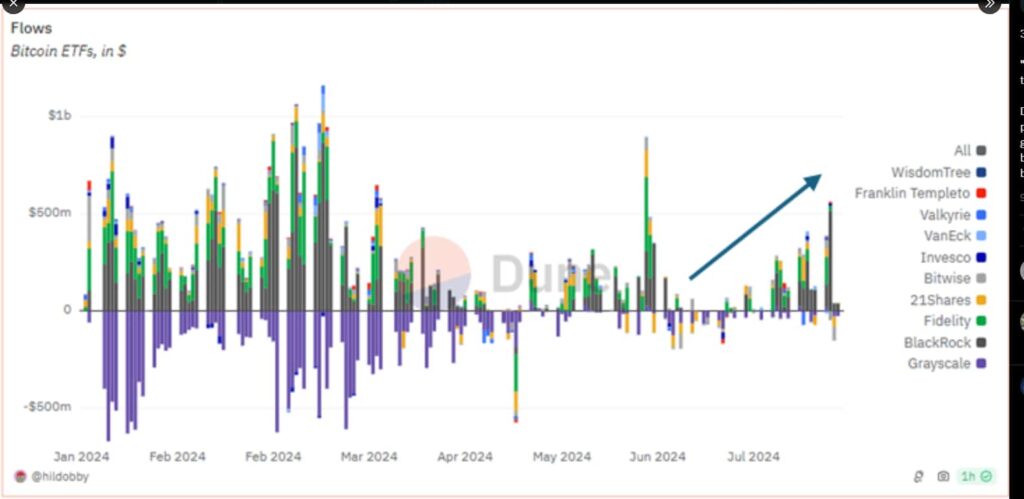

Recent data on Bitcoin exchange-traded funds (ETFs) flows reveal substantial investments by major institutional players such as WisdomTree, Franklin Templeton, Valkyrie, VanEck, Invesco, Bitwise, 21Shares, Fidelity, BlackRock, and Grayscale.

Despite recent price declines, these institutions have been steadily accumulating Bitcoin, indicating strong confidence in a future price surge.

The increased ETF flows over the past two months, even as prices remained range-bound, suggest a strategic positioning for a forthcoming breakout.

This trend aligns with historical patterns where institutional accumulation precedes significant bullish movements, further supporting the prediction of a massive run for Bitcoin. Institutional confidence is a strong indicator of market sentiment and often precedes major price rallies as smart money positions itself for substantial gains.

Projected targets and key levels

The convergence of these factors suggests that Bitcoin is poised for a significant bullish trend. The critical support level of around $67,687 is likely to act as the base for the next rally.

Below this, the support zone between $53,000 and $56,000 will be crucial to watch for potential accumulation and consolidation.

On the upside, key resistance levels include $150,000 and $200,000, with an ultimate target of $300,000.

Analysts forecast the peak to occur in late Q3 or early Q4, aligning with historical post-halving price surges and current accumulation trends.

Bitcoin price analysis

At the time of reporting, Bitcoin was trading at $68,448, with daily gains of over 1.8%. Over the past seven days, it has been up nearly 4%.

The combined impact of halving events, short-squeeze zones, and institutional accumulation provides a robust framework for predicting a substantial bullish trend for Bitcoin.

With these factors in play, the top for Bitcoin is indeed yet to come, and a massive run is anticipated later this year. Investors and traders should monitor these key zones and trends closely, as they offer significant opportunities for strategic entries and potential gains.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.