Thanks to its increasing presence, everyday utility, and damage it has already caused, the artificial intelligence (AI) boom appears to be in full swing. However, some potential issues have been plaguing the technology for years.

One of the biggest is AI’s immense energy and processing power requirement—an issue the world’s biggest asset manager, BlackRock (NYSE: BLK), now appears poised to tackle.

BlackRock, in partnership with Microsoft (NASDAQ: MSFT), Abu Dhabi’s MGX, Global Infrastructure Partners (GIP), and with help from Nvidia (NASDAQ: NVDA), now plans to invest at least $30 billion in developing new infrastructure, per an official announcement published on September 17.

Additionally, the project falls under the umbrella of the Global AI Infrastructure Investment Partnership (GAIIP) and hopes to eventually mobilize as much as $100 billion to help boost logistics necessary for the smooth continuation of the artificial intelligence boom.

How BlackRock and GAIIP plan to resolve AI bottlenecks

The program is designed to address various needs of AI technology, such as energy sourcing and supply chains. Nvidia, the world’s prime semiconductor giant, will support the initiative with its expertise in designing and running data centers and manufacturing plants.

Larry Fink, the Chairman and CEO of BlackRock, emphasized the potential for the initiative to ‘unlock a multi-trillion-dollar long-term investment opportunity,’ which will eventually ‘help power economic growth, create jobs, and drive AI technology innovation.’

Microsoft Satya Nadella raised a similar point, highlighting his firm’s vision for AI that helps ‘advance innovation and drives growth across every sector of the economy.’ Jensen Huang of Nvidia, for his part, emphasized the technology’s potential to usher in a new industrial revolution.

An echo of Sam Altman’s $7 trillion AI infrastructure drive

The multi-company partnership harkens back to an alleged goal of OpenAI’s Sam Altman, initially revealed in late 2023, to try and raise as much as $7 trillion for AI infrastructure.

At the time, it was reported that such a massive investment would be primarily aimed at tackling existing bottlenecks, particularly in terms of semiconductor production.

Considering the involvement of Abu Dhabi’s MGX in the GAIIP, it would appear that Altman’s decision to reach out to the government of the United Arab Emirates for backing was the right call.

AI boom is great for investors, but is it great in general?

Considering the stock market performance of various firms involved with the artificial intelligence boom – Nvidia and Super Micro Computer (NASDAQ: SMCI), even after its September issues, being prime examples – GAIIP’s project to enhance infrastructure is likely to be lucrative for investors.

Still, it may not be an investment to be made lightly or one to be uncritically welcomed given the damage misuse of AI is already doing, for example, through the rise of computer-generated papers in science.

Additionally, recent months have enabled multiple uncomfortable facts about the levels of societal control enabled by AI to emerge. Alex Carp, the CEO of Palantir (NYSE: PLTR) has, in particular, been vocal about the potential impact on war, diplomacy, and politics. Given the current impact of some artificial intelligence-driven targeting software, not all the insights have been comforting.

Microsoft stock outlook in wake of AI infrastructure plan

Whatever the wider impact, the stocks of firms involved with the AI infrastructure investment are likely to benefit from the plan moving forward.

Microsoft, for example, is likely to retain and expand on the positive momentum it has been gaining, with a 3.57% 30-day rise to MSFT price today of $436.58. There have, however, been no benefits from the announcements as of the pre-market on Wednesday, September 18.

So far, Microsoft stock is up only a marginal, 0.35% up in the extended session.

However, the positive outlook is only reinforced by the fact that, even before the GAIIP announcement, experts and analysts considered it a ‘strong buy.’

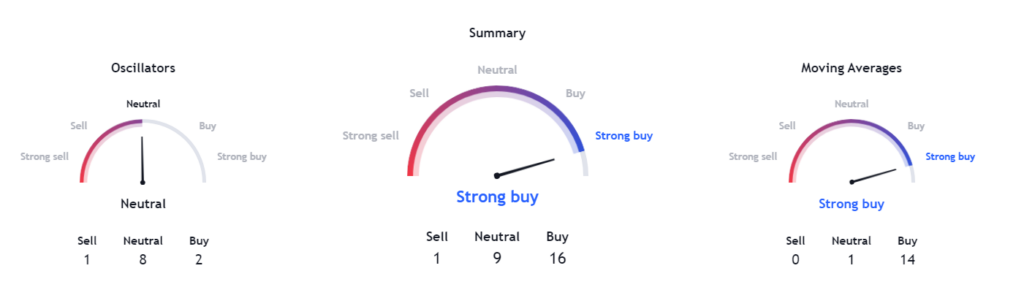

MSFT shares have already been on a strong recovery since the early September market-wide downturn with their upcoming performance, as exemplified by the technical analysis gauges available through TradingView ranking it as either a ‘buy’ or ‘strong buy’ based on recent performance.

The TradingView rating considers the readings from multiple indicators, including oscillators and moving averages.

Though not as prominently featured within the GAIIP program, Nvidia stock is also likely to be a major beneficiary as its input on making new and improved data centers and manufacturing facilities could further bolster its position as an industry leader.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.