The world’s largest asset manager, BlackRock (NYSE: BLK) holds stock in more than 5,000 businesses. The sheer scale of the investment giant’s dealings is tough to comprehend — but honing in on how the company treats specific businesses can serve as a worthwhile barometer.

As one of the players at the forefront of ESG (environmental, social, and governance) investing, Blackrock’s focus on renewables has led it to invest in numerous ventures that are tackling the issue of climate change.

One such company is Lucid Motors (NASDAQ: LCID), which has faced numerous setbacks throughout the course of 2024. LCID stock was trading at just $2.11 at press time, having shed 17.18% in value over the course of the preceding 30 days to bring year-to-date (YTD) losses up to 49.04%.

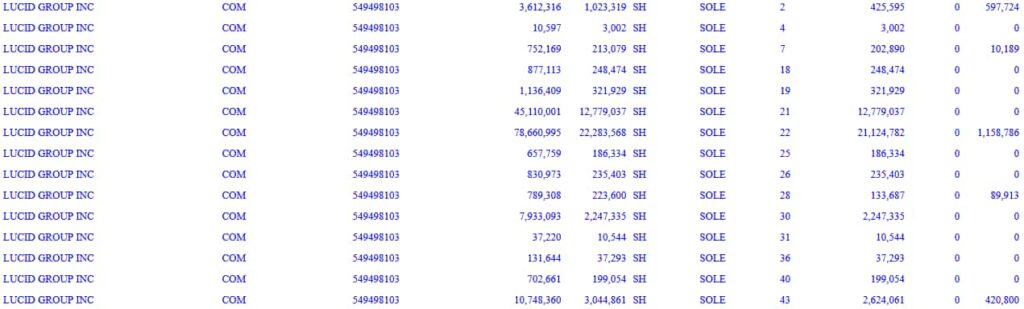

Now, BlackRock’s stake in Lucid has been reduced, as revealed by the massive 13-F filing made public on November 13, potentially signaling more issues to come with the electric vehicle maker.

BlackRock cuts stake as LCID stock price keeps dropping

In the preceding quarter, BlackRock owned 45,228,798 LCID shares — per the latest report, the asset manager now holds 43,056,832 Lucid stocks. This represents a 4.8% reduction — which, while significant, is far from a total divestment.

BlackRock owns roughly 1.43% of the automaker and is its third-largest shareholder, behind Vanguard, which owns 2.79%, and the Saudi Public Investment Fund, which owns 45.65%.

This latest development comes at a critical juncture — although buoyed by seemingly endless funding from its largest stakeholder, Lucid has done little to warrant investor trust.

The company missed its original delivery targets for the first two quarters of 2024 by approximately 90% — and more recently, the business, which was once hailed as a ‘Tesla-killer’ has seen a ‘death cross’ chart pattern play out — raising fears that it could once again become a penny stock.

Although the carmaker’s Q3 production and delivery numbers show promise, it’s looking like a case of ‘too little, too late’ — last quarter, the company posted a net loss of $992.5 million, up from $630.9 million in the same quarter last year.

Lucid’s only hope amidst share dilution

While endless funding sounds like a dream come true, it’s proven to be more of a double-edged sword.

The company’s CEO, Peter Rawlinson, has previously cautioned against overreliance on the Public Investment Fund — in October, the fund purchased an additional 375 million LCID shares after 262 million new shares were issued, but the dilution was poorly received, as the stock crashed by 15%.

Elsewhere, the upcoming release of Lucid’s luxury Gravity SUV, which is slated to begin being delivered in early 2025 is the only glimmer of hope remaining — but with plenty of competition and a market that is forecast to slow down, at least for the time being, staying in business long enough to weather storm could prove to be too tall an order for Lucid Motors.

Featured image via Shutterstock