With recent economic indicators, such as inflation slowing down and a projected Federal Reserve interest rate cut, macroeconomist Henrik Zeberg is warning that the situation might be dire while painting a grim outlook.

Through a series of X (formerly Twitter) posts on January 12, Zeberg cautioned that a major recession and the largest market crash since 1929 are on the way, citing several alarming indicators.

In his detailed analysis, Zeberg addressed common counterpoints to his warnings of an impending economic crisis. He debunked claims that the recession had already occurred in 2022 or that the Fed’s interventions would stave it off, asserting that these arguments stemmed from a fundamental misunderstanding of business cycles.

“Major Recession will set in. The Titanic has already hit the iceberg – and it will sink. There is nothing that can be done from the Fed or any administration,” he said.

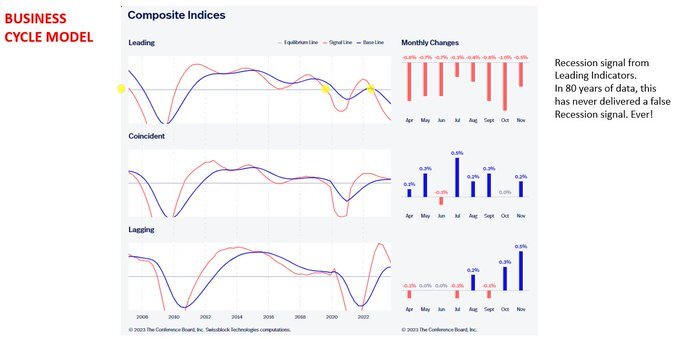

Zeberg’s initial argument is based on the Business Cycle Model. According to him, this model, with a track record of accurately predicting recessions over 80 years, showed leading indicators crashing beneath their equilibrium line, pointing to a recession.

recessions. Zeberg contended that analysts had prematurely dismissed this signal, emphasizing a typical lag of 12-15 months before a recession follows the bottom of the yield Inversion, which occurred in June 2023.

Examining industrial production, the expert drew parallels between the current situation and the period preceding the 2007-2008 financial crisis. He highlighted a divergence in the move’s strength, signaling an imminent significant drop in industrial production.

Possible parabolic surge in unemployment

Shifting the focus to the housing market and personal interest payments, Zeberg noted a substantial decline in housing, historically leading to increased unemployment. He underscored the potential for a parabolic rise in unemployment due to the recent spike in personal interest payments resulting from escalating market rates.

He warned that rising interest payments would cause a plummet in housing affordability, potentially leading to increased default rates on homes as unemployment surges.

For his final alarming indicator, the economist turned to retailer inventory levels, which currently exceed the trend line. Zeberg cautioned that companies and retailers, anticipating a demand return, had overstocked their inventories, setting the stage for impending economic challenges.

It’s worth noting that, in addition to Zeberg, other influential figures in the financial world share the view that an impending market crash is on the horizon. Robert Kiyosaki, the author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ issued a similar warning. Kiyosaki cautions that market participants should not anticipate a soft landing and emphasizes the gravity of the potential market downturn.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.