The block subsidy halving is expected to happen on April 20, fuelling Bitcoin’s (BTC) price as in the past. However, BTC could still crash from current prices before gaining enough strength for the expected post-halving surge.

In particular, CrypNuevo sees a short-term bull run to $47,000, followed by a crash to the $36,000 zone. The expert trader posted this analysis on X on January 26, following a validated previous insight from January 21. This account is known for its high accuracy rate with liquidity pool analyses.

Essentially, CrypNuevo explained how Bitcoin might consolidate in the range between $40,000 to $45,000 over February. During this time, the market may see a deviation run to the aforementioned $47,000.

After that, there is a potential support zone from $36,000 to $36,700, considering previous liquidity pools and price action.

BTC halving and historic price action

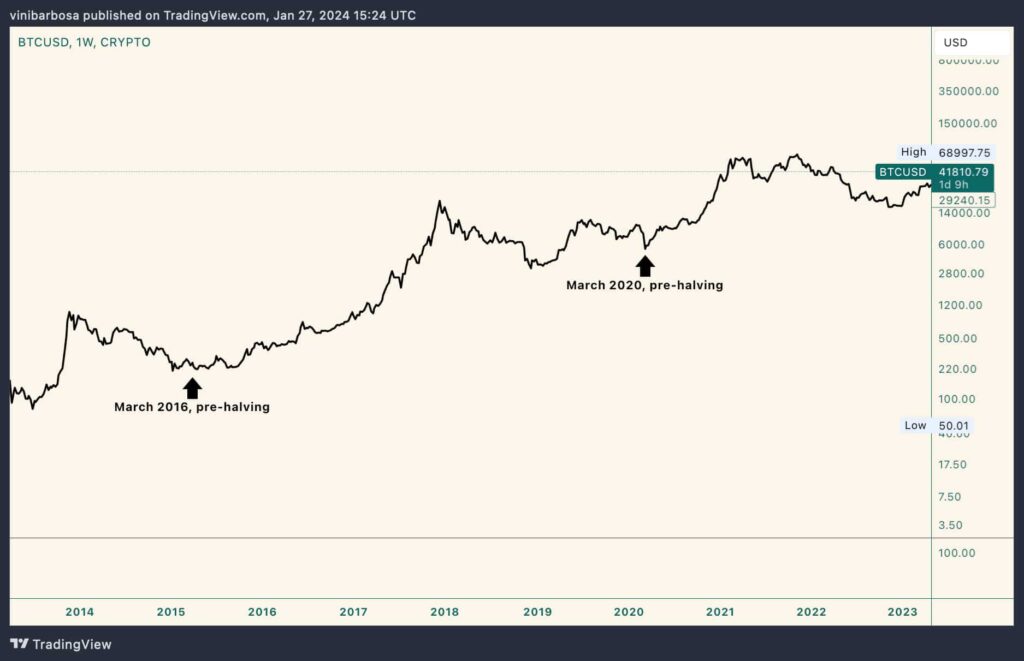

Historically, Bitcoin consolidated or retraced in the months that preceded each previous halving. This historical pattern validates CrypNuevo’s liquidity analysis, strengthening this year’s forecast of BTC at $36,000 in March.

A drop to the target would mean nearly 14% losses from BTC’s current price of $41,810. Notably, this percentage is also aligned with previous years. In 2020, Bitcoin lost over 40% from the local top to the local bottom during the COVID-19 world crisis.

Nevertheless, historic price action does not guarantee future occurrences. Similar to technical analyses that are based on odds and probabilities but can fail. The cryptocurrency market is highly volatile and unpredictable, which means everything could change given the proper conditions.

Cryptocurrency traders and investors must do their due diligence and understand the asset they are investing in. Macroeconomics, fundamentals, supply and demand, and whales’ movements could easily influence Bitcoin’s price. Thus, caution is required while speculating.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.