Bitcoin (BTC) retrieved a four-month price range above $60,000 after a two-week deviation, trading at $64,000. However, a network value indicator at an all-time high suggests Bitcoin could be overvalued in its current state.

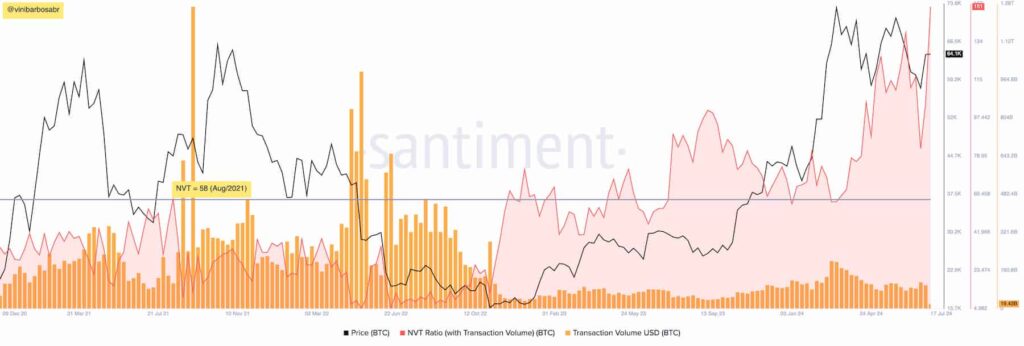

In particular, Finbold retrieved data from Santiment showing Bitcoin’s Network Value-to-Transaction (NVT) ratio reached an all-time high on July 19. The NVT indicator is often compared to the price-to-earnings (P/E) indicator for stocks, which is used for fundamental analysis.

As observed, Bitcoin’s seven-day NVT ratio is at 151 considering a $19.43 billion transaction volume at $64,100. In 2021, the Network Value-to-Transaction peaked at 58 with BTC trading at $44,800 and $106.92 billion transacted on-chain.

At that time, Bitcoin was heading to the top of the last bull cycle, preluding the inevitable correction that followed.

How does Network Value-to-Transaction (NVT) indicate an overvalued Bitcoin?

This is a direct result of an aggressive increase in the BTC price, which was not followed by network activity. In summary, the cryptocurrency price is rising while Bitcoin’s transaction volume is holding at historically low levels.

Therefore, this suggests a mostly speculative demand for an asset without a proportional organic demand and could hint at an impending correction if the network activity does not pick up.

Nevertheless, speculative demand remains strong, signaled by high open interest (OI) values and significant inflow to institutional products like the Bitcoin spot ETF. If new buyers continue to surge despite the low network usage, this could help BTC’s price sustain the current level.

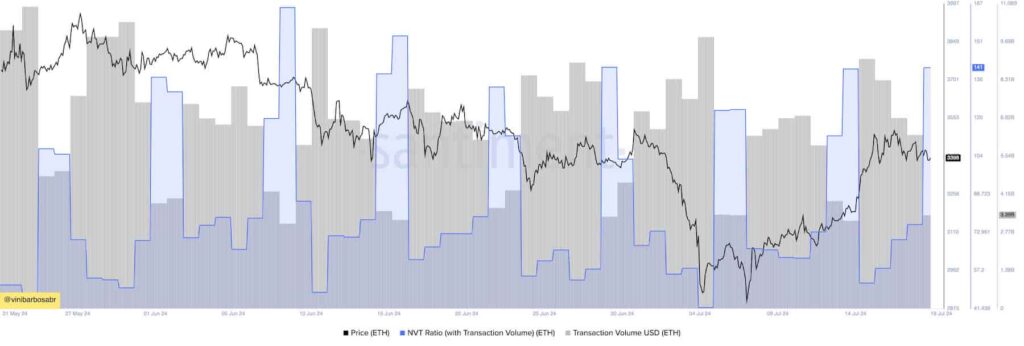

On June 16, Finbold sounded a similar alert for an overvalued Ethereum (ETH) above $3,500, with a 134 NVT. Notably, ETH reached a local bottom two weeks later at $3,090, losing over 11% of its value.

Finbold also recently reported a concern about the centralization of the Bitcoin network, bringing uncertainty to its security.

Conversely, most crypto analysts have shown a bullish bias toward Bitcoin and other cryptocurrencies. For example, different technical analyses place BTC at $180,000, according to a chart pattern, or trace a roadmap directly to $200,000.

As usual, investors should remain cautious and consider different analyses and indicators to improve decision-making in such a volatile market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.