The cryptocurrency market continues to show resilience, with the global market cap reaching $3.68 trillion, marking a modest 0.6% increase in the past 24 hours. In this context, two cryptocurrencies are standing out, presenting potential entry points for traders and investors seeking opportunities.

Bitcoin (BTC) is currently trading around $100,067 after a 4% rally fueled by the latest US Consumer Price Index (CPI) data. Meanwhile, renowned analysts have their eyes on altcoins, forecasting an incoming altseason.

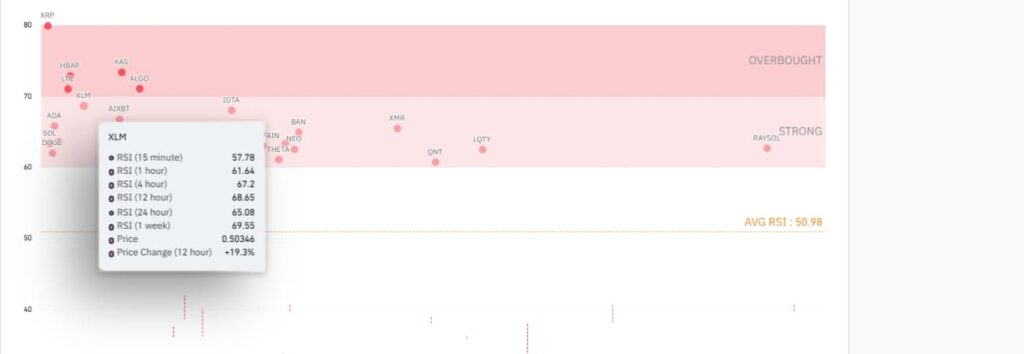

Amid this backdrop, Finbold analyzed CoinGlass’s Relative Strength Index (RSI) heatmap on January 16, identifying notable buy signals across the cryptocurrency market.

With the 12-hour RSI averaging 50.98, several assets are showing strong potential, offering promising opportunities for traders and investors navigating the sector’s persistent volatility.

Cardano (ADA)

Cardano (ADA) is positioning itself as a strong buy this week, backed by robust technical indicators and market momentum.

The 12-hour RSI stands at 65.82, well above the market average RSI of 50.98, signaling steady upward movement while staying below overbought territory.

Shorter time-frame RSIs, such as the 15-minute RSI at 72.29 and the one-hour RSI at 68.7, indicate consistent buying pressure, with values close to the overbought zone.

This sustained interest in ADA suggests a continuation of bullish momentum in the short term, as traders are actively entering positions, driving demand upward.

Complementing its RSI metrics, all 14 tracked moving averages, from short-term exponential to long-term simple averages, classify ADA as a strong buy.

With an 18.19% price increase over the past 12 hours, ADA’s strong technical setup reflects growing market interest, making it a solid choice for traders seeking to capitalize on its momentum and investors looking for near-term gains or strategic accumulation.

Stellar Lumens (XLM)

Stellar Lumens (XLM) is emerging as a strong buy, supported by robust RSI metrics and technical indicators that signal sustained bullish momentum.

The 12-hour RSI stands at 68.65, comfortably above the market average of 50.98, reflecting steady upward momentum while leaving room for further growth.

Shorter time-frame RSIs, including the one-hour RSI at 61.64 and the four-hour RSI at 67.2, highlight consistent buying pressure, showcasing active trader interest in driving demand.

Further supporting its bullish case, XLM has recorded a notable 19.3% price increase over the last 12 hours, indicating growing market interest and strong accumulation.

All tracked moving averages, from short-term exponential to long-term simple averages, position XLM as a buy.

These aligned technical indicators point to XLM’s potential for further upside, making it a compelling choice for traders seeking momentum and investors looking to position themselves for longer-term gains.

While RSI provides valuable insights into momentum and potential price movements, relying solely on this indicator can be risky.

A comprehensive approach that incorporates additional technical tools, market trends, and fundamental analysis is crucial for making well-informed investment decisions.

Featured image via Shutterstock