Despite a slowdown in 2023 that saw hybrid cars rise to new heights of popularity and significantly reduced demand for pure electric vehicles (EVs), Elon Musk’s Tesla (NASDAQ: TSLA), unlike several of its competitors such as Lucid (NASDAQ: LCID) navigated the year with notable success.

The most recent weeks, however, have been more challenging for the company with battery production issues, online ridicule of some of the odder maintenance requirements for the Cybertuck, and a massive, nearly pan-Scandinavian strike against the company.

The recent string of setbacks – further exacerbated by diminishing hopes that the interest rates will start coming down early in 2024 – caused Tesla to suffer its longest stock market losing streak since 2021.

In fact, while TSLA’s performance in the last 52 weeks remains strong with a 45.35% rise, its more recent price movements have taken a significantly different trajectory. In the last 6 months, for example, the company is actually down 22.27%.

Zooming in, the last month is also red – TSLA fell 18.50% in 30 days – just like the first weeks of 2024 – Elon Musk’s company is down 15.81%.

The last full trading day – Tuesday, January 23 – ended slightly positively for the firm as it rose 0.18% to $209.14 per share.

While the company is certainly still at risk of extending the downward momentum into its sixth week, the latest earning report – scheduled for market close on Wednesday, January 24 – might revitalize the EV maker’s shares.

Experts cautious despite strong Q4 deliveries

Despite the fact that Tesla set a new record in 2023 when it comes to deliveries, its stock market performance – and analyst forecast for Q4 earnings – remained tame due to multiple factors, such as a string of price cuts and discounts implemented in various markets.

For example, the estimated earnings per share (EPS) for the quarter stand at either $0.73 or $0.74 – depending on the source – which would constitute an increase compared to Q3 when the EPS came in at $0.66.

It is, however, worth remembering that experts were forecasting $0.73 for the third quarter as well and that the company achieved $1.19 in Q4 2022.

The expectations for revenue in the fourth quarter perhaps reflect the impressive production and delivery figures as the forecast ranges from $25.640 billion to $25.598 billion – meaning Tesla is expected to set a new record.

Ultimately, judging by TSLA’s January 23 rise and its extended hours trading – which has seen it rise 1.40% by the time of publication – investors appear confident when it comes to the EV maker’s performance.

Still, the fact that 2023 was a challenging year means that it isn’t impossible that the firm will prove to have underperformed – which would likely guarantee that the losing streak extends into its sixth week.

TSLA long-term prospects

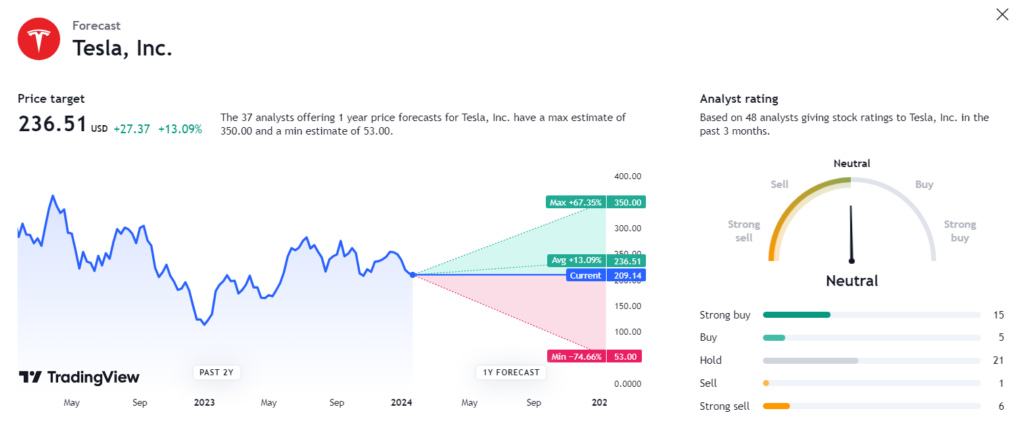

In line with the challenges and setbacks, experts remain divided on Tesla’s 12-month prospects. The 48 analysts represented on TradingView are sharply divided with 15 ranking it as a “strong buy,” 5 as a “buy”, 1 as a “sell,” and 6 going as far as saying it is a “strong sell.”

Nearly half – 21 – are firmly neutral on the stock.

The differences in opinion are also evident in the 12-month price target, as the average constitutes a 13.09% upside – $236.51.

The high estimate stands at $350 – a notable reduction to previous estimates as Dan Ives, who once forecast TSLA will reach $1 trillion in market cap this year, lowered his estimate to $345.

Finally, the low target for Tesla at press time stands at $53 – meaning some experts see a 74.66% downside as plausible.

Ultimately, Tesla’s performance in 2024 is hard to gauge as the company is facing major challenges – though it has always been facing different challenges – but also has several promising developments in store, such as a likely new production plant in India and a new affordable model reportedly in production in Germany.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.