Social media giant Reddit (NYSE: RDDT) made a notable debut on Wall Street, surging to highs of $57 before concluding nearly 48% higher on March 21, the day it went public.

Notably, this surge is particularly noteworthy considering the company had initially set its Initial Public Offering (IPO) share price at $34.

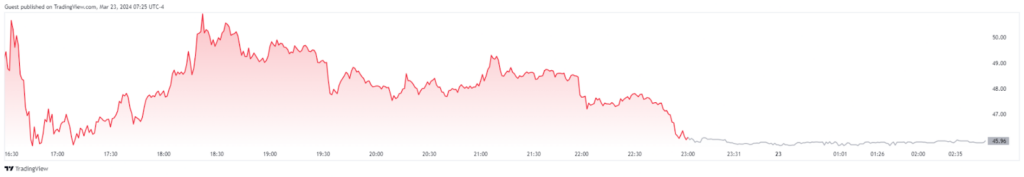

However, by the close of markets on March 22, RDD was down almost 9%, with the equity trading at $46.

Indeed, the stock’s impressive debut coincided with a period when the general market was trading in the green zone, following remarks by Federal Reserve Chair Jerome Powell, who indicated that the central bank would soon begin tapering its “quantitative tightening” program.

Reddit’s fundamentals to $100

As the new kid on the block, attention is focused on whether Reddit can sustain its impressive debut and potentially target the three-figure mark at $100. Currently, Reddit is plagued by several fundamentals likely to influence its price in various directions.

What stands out is that Reddit is trading at the higher end when factors such as its financials are considered. Notably, in 2023, the company recorded $804 million in revenue and remains unprofitable, with net losses of more than $90 million last year.

When considering the potential trajectory of RDD’s price, beyond relying solely on the overall stock market trends, the company faces several factors likely to influence its price. For instance, Reddit’s venture into artificial intelligence (AI) could serve as a significant catalyst. Notably, several Wall Street giants associated with AI have witnessed their stocks rally to new heights, and Reddit is likely to follow suit.

This anticipation follows Reddit’s sale of $203 million worth of contracts to AI companies for access to its data. The social media platform is regarded as a treasure trove of the precise training data that AI companies require, signaling the potential for growth in this segment of its business.

On the other hand, Reddit may benefit from the potential frenzy surrounding meme stocks, considering that a majority of retail investors already utilize the platform. Notably, the r/WallStreetBets forum played a pivotal role in driving the meme stock craze that affected stocks such as GameStop (NYSE: GME). However, this aspect could have both positive and negative impacts on Reddit’s stock.

Reddit’s bearish fundamentals

On the other hand, Reddit’s trajectory could face obstacles from regulatory challenges. In particular, the social media forum disclosed that the Federal Trade Commission (FTC) was conducting an inquiry regarding its data-licensing business related to AI system training.

In summary, despite potential regulatory hurdles, Reddit’s stock holds promise to reach the $100 mark in 2024. However, achieving this target will largely depend on the performance of the general stock market alongside the Federal Reserve’s decisions on interest rates.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.