For several months, various indicators have suggested a possible recession, with most analysts agreeing on the outlook but not the timing.

One of these indicators is job data, which paints a grim picture of the general economic outlook. Notably, the latest data released on September 6 indicated that the U.S. added 142,000 jobs in August, below the forecast of 164,000. At the same time, the unemployment rate fell to 4.2%.

This data will likely influence the next Federal Reserve interest rate decision, which could alter the course of the projected recession.

However, the job data regarding the economy’s health is less encouraging, especially since it is likely to be revised lower. Analysts maintain that the data is already disappointing and is likely to escalate the recession debate.

“Rarely has there been such a make-or-break number—unfortunately, today’s jobs report doesn’t entirely resolve the recession debate,” said Seema Shah, the chief global strategist for Principal Asset Management.

Indeed, the jobs revision showed that June was down by 88,000 jobs while July was down by 25,000. This suggests that the revisions could indicate whether a recession will set in, with the critical threshold being 100,000 jobs.

Can the recession be avoided?

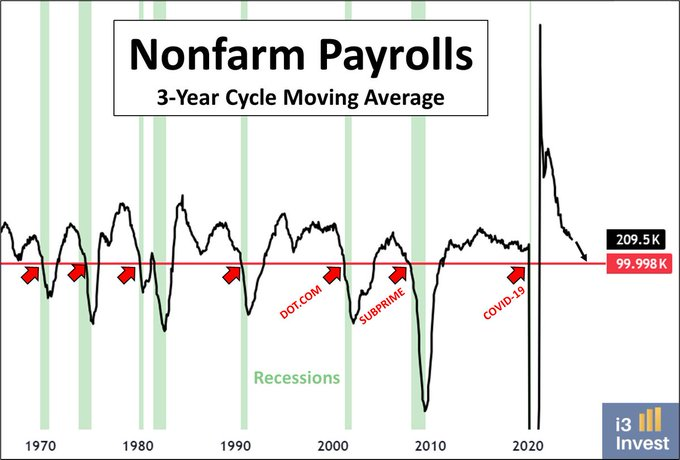

In this context, according to an analysis shared by market strategist Guilherme Tavares in an X post on September 6, there is cause for concern, as the three-year moving average of non-farm payrolls is almost hitting a critical juncture.

Based on analysis of past data, he noted that the movement of non-farm payrolls has been central in highlighting possible economic downturns, and the current value suggests that the recession might not be avoided.

Notably, the three-year moving average has dipped below the crucial 100,000 level, currently at 99,998. This metric has been instrumental in signaling the onset of the Dot-com Bubble in 2000, the financial crisis in 2008, and the pandemic-induced recession in 2020. Each time, the indicator was a leading sign of the following recessionary period.

“It will be hard to avoid a recession when the 3-year average of nonfarm payroll drops below 100k. It was a leading indicator for the dotcom and subprime recessions,” he said.

He noted that although the current value of 209,500 might seem robust, the trend observed in the past three years suggested that current strength might not last longer.

Additional economic headwinds

In this case, with the labor market softening, the economy could face additional headwinds, from reduced consumer spending to weakened business investment. Based on its historical accuracy, a drop below 100,000 may signal an impending recession.

In summary, there remains considerable uncertainty regarding whether the U.S. is posed for a recession, considering that the Fed is highly anticipated to cut rates in September. However, if the employment data is anything to go by, investors need to be on high alert in the coming months.