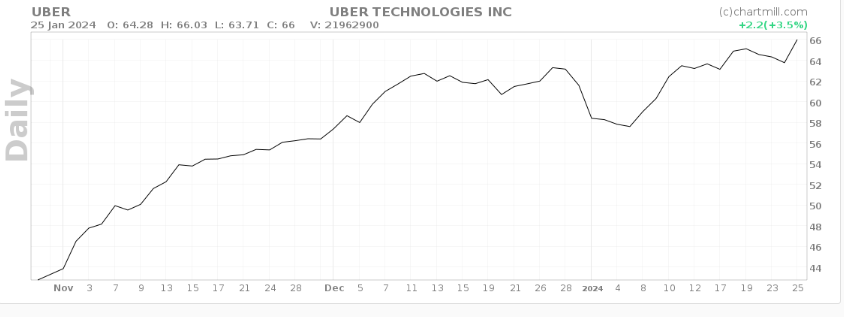

In 2023, ride-hailing platform Uber (NYSE: UBER) experienced a significant milestone as its stock price more than doubled. This surge was propelled by various factors during the post-pandemic recovery, driven by increased investor confidence.

The company’s strategic expansion into new markets and introducing new product lines also played a pivotal role in solidifying its position in the ride-hailing sector.

The stock has reached a new record high, and investors are closely monitoring whether it can reach the coveted $100 mark. Starting 2024 on a robust note with year-to-date gains of 13%, the focus is on whether the stock can reach the $100 milestone.

Uber needs its stock price to increase by more than 50% from its current valuation of $66 to reach the $100 target.

Uber’s key fundamentals

After years of navigating mobility sector challenges, Uber is relishing profitability—a long-sought dream for investors. For instance, during Q3 2023, the company reported revenue of $9.3 billion, marking an 11% year-over-year increase. Uber also disclosed a net income of $221 million in the third quarter, a significant turnaround from the $1.2 billion net loss reported in the same quarter the previous year.

Additionally, the company’s optimism is rooted in its network effect. Uber’s two-sided marketplace thrives on a virtuous cycle, where increasing riders and drivers enhances the platform’s value for both parties. This network effect creates a self-reinforcing loop, potentially attracting more users and solidifying Uber’s dominance in the ride-hailing space.

While ride-hailing remains Uber’s core business, its strategic expansion into food delivery through Uber Eats has proven to be a masterstroke. This diversification acts as a crucial safety net, mitigating potential downturns in one segment with the sustained growth of the other.

However, Uber is not without challenges. Macroeconomic concerns, such as the possibility of a recession impacting consumer spending, threaten Uber’s growth. Additionally, regulatory uncertainties in the autonomous vehicle sector may hinder the company’s long-term plans and affect its stock value.

Uber’s road to $100

To reach $100, Uber’s stock requires an impressive 51% gain, a milestone that would be well-received by investors. The target seems achievable, given Uber’s recent performance, with the stock rallying nearly 40% in the last six months, and the company aims to sustain this momentum.

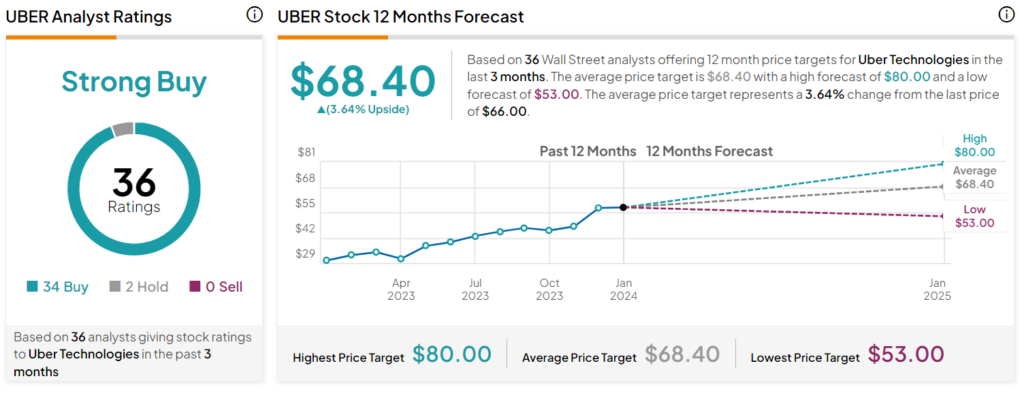

Several analysts project an upside for Uber in 2024. For instance, Wells Fargo’s analyst Ken Gawrelski has an “overweight” rating and a price target of $64.

Additionally, insights from 36 Wall Street analysts at TipRanks, considering Uber’s performance over the last three months, forecast an average price target of $68.40 for the upcoming 12 months. This range varies from a high forecast of $80 to a low estimate of $53, suggesting a 3.64% change from the closing price of $66.

Finbold also utilized a machine learning algorithm at CoinCodex, predicting Uber will reach $80.80 by the end of 2024, with a potential yearly high of $90. By January 26, 2025, the tool projected that Uber would likely trade at $103.58.

Considering Uber’s recent strong performance, there’s a likelihood that the stock will reach the $100 mark in 2024, supported by its robust business. However, it’s essential to note that the stock is not immune to market challenges, including macroeconomic factors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.