With the second half of 2024 on the horizon, investors are keen to align their portfolios with the most promising sectors and stocks.

This period comes at a time when the stock market is roaring, with several indices hitting new records. In such a situation, deciding which prospective sectors and stocks investors should invest in can sometimes be challenging.

In this case, Finbold consulted ChatGPT-4o, the latest iteration of OpenAI’s artificial intelligence (AI) platform, which laid out a comprehensive plan for constructing a diversified and potentially high-performing portfolio.

Elements to asses before selecting a portfolio

To begin with, ChatGPT-4o emphasized the importance of assessing economic and market trends. Considering the global economic outlook, investors should monitor growth forecasts for major economies such as the United States, China, and the Eurozone.

The platform also highlighted key indicators to monitor, such as GDP growth, unemployment rates, and inflation, as these factors will shape market conditions. Additionally, central banks’ policies, particularly the Federal Reserve’s stance on interest rates, will significantly influence stock market performance.

At the same time, the AI tool pointed out that identifying sectors expected to perform well is crucial for making informed investment decisions. Additionally, ChatGPT-4o advised investors to focus on diversification to spread risk and capture growth in different market areas.

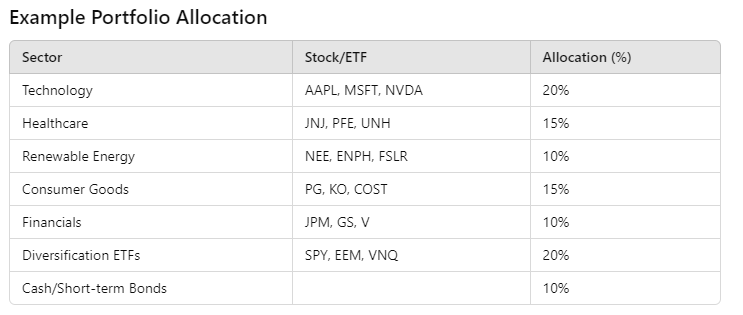

In terms of stock selection, ChatGPT-4o identified specific stocks and ETFs within each sector, as highlighted below.

1. Technology

The tool selected tech giant Apple (NASDAQ: AAPL) due to its strong financials, innovative products, and loyal customer base. It also recommended Microsoft Corp. (NASDAQ: MSFT), recognized as a leader in cloud computing and enterprise software, and Nvidia Corp. (NASDAQ: NVDA), which dominates GPU manufacturing and AI technology.

2. Healthcare

Johnson & Johnson (NYSE: JNJ) is noted for its diversified healthcare products and strong financial stability in the healthcare sector. Pfizer Inc. (NYSE: PFE) is recommended for its pharmaceutical innovations and robust R&D pipeline, while UnitedHealth Group Inc. (NYSE: UNH) is included for its leadership in health insurance and healthcare services.

3. Renewable energy

In the renewable energy sector, NextEra Energy Inc. (NYSE: NEE) is a major player in renewable energy generation. Enphase Energy Inc. (NASDAQ: ENPH), which focuses on solar energy and energy management technology, and First Solar Inc. (NASDAQ: FSLR), a manufacturer of solar panels emphasizing sustainable energy, are also recommended.

4. Consumer goods

Procter & Gamble Co. (NYSE: PG) is recognized in the consumer goods sector for its diverse range of consumer products and strong brand recognition. Coca-Cola Co. (NYSE: KO), noted for its strong global presence and leadership in the beverage industry, and Costco Wholesale Corp. (NASDAQ: COST), a retailer known for its robust membership model and consistent growth, are also suggested.

5. Financial services

Banking giant JPMorgan Chase (NYSE: JPM) is highlighted as a leading global financial services firm with diverse revenue streams in the financial sector. Goldman Sachs (NYSE: GS), known for its investment banking and asset management, and Visa Inc. (NYSE: V), which dominates the payments technology sector, are also recommended.

For diversification through exchange-traded funds (ETFs), ChatGPT-4o suggested the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index and provides broad market exposure. The iShares MSCI Emerging Markets ETF (EEM) offers exposure to emerging market equities, and the Vanguard Real Estate ETF (VNQ) invests in real estate investment trusts (REITs).

Additionally, the tool noted that regularly monitoring and rebalancing the portfolio is essential to maintain the desired risk levels and take advantage of new opportunities.

Overall, the portfolio aims for growth while maintaining a balanced risk profile through diversification.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.