Bitcoin (BTC) gained $1,500 in seconds as the May print of the Consumer Price Index (CPI) showed inflation cooling faster than expected.

The most awaited U.S. Consumer Price Index (CPI) data today revealed that inflation remained unchanged at 0.3% in May, surpassing market estimates.

Notably, market watchers were eagerly anticipating this crucial inflation data for insights into the current economic health and the potential stance of the U.S. Federal Reserve with their policy rate plans.

The cooling inflation figures have significantly boosted market sentiment, causing Bitcoin and other altcoins to surge. Following the CPI data release, Bitcoin surged 3.60%, reaching $69,411.30.

Altcoins like Ethereum (ETH) and Solana (SOL) also saw substantial gains, rising nearly 3% and 4%, respectively. This positive market reaction underscores the critical role of inflation data in shaping investor expectations and market dynamics.

ChatGPT-4o Bitcoin price prediction

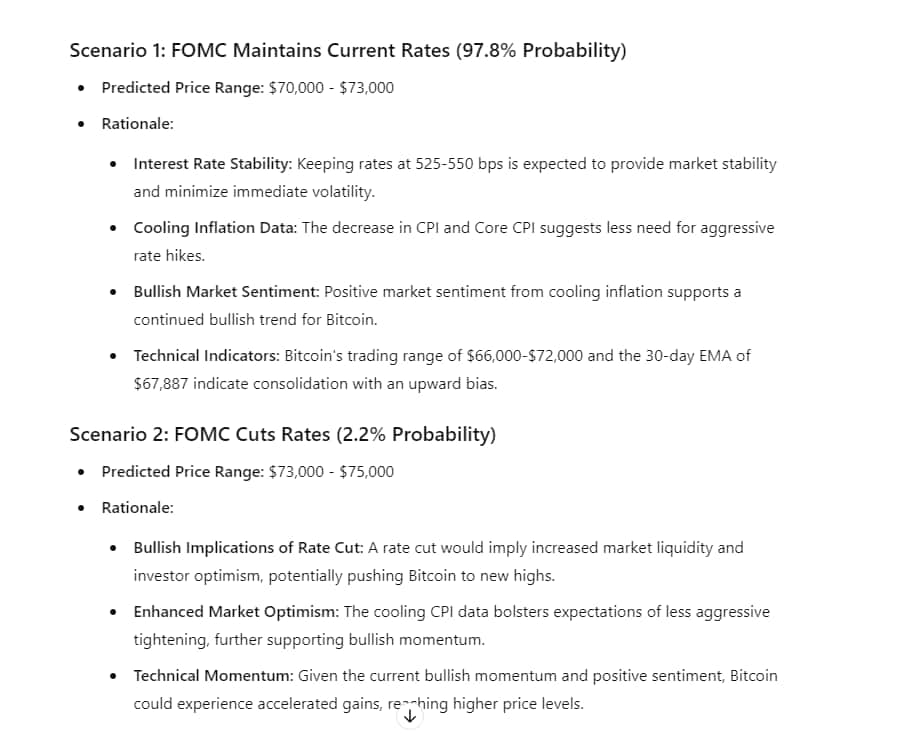

With the upcoming Federal Open Market Committee (FOMC) meeting, traders and investors are keenly focused on potential interest rate decisions. In this context, Finbold provided technical analysis and market projections to ChatGPT-4o for a one-month BTC price prediction.

This period is chosen to capture the immediate aftermath of the FOMC meeting and the typical short-term market response to significant economic events.

Considering the cooling CPI data and its impact on market sentiment, ChatGPT-4o forecasts a favorable environment for Bitcoin.

If the FOMC maintains the current rates, Bitcoin is likely to trade between $70,000 and $73,000. However, in the less likely scenario of a rate cut, Bitcoin could see more pronounced gains, trading between $73,000 and $75,000

BTC price analysis

After a sluggish performance earlier this week, Bitcoin experienced a notable rally of 3.60% today, spurred by the latest inflation data, reaching a price slightly above $69,000.

Within the past 24 hours, Bitcoin’s price dipped to a low of $66,123.60. Additionally, Bitcoin Futures Open Interest increased by 2.29% over the last four hours, according to CoinGlass data.

Considering the cooling CPI data and its impact on market sentiment, ChatGPT-4o forecasts a favorable environment for Bitcoin. Investors and traders must be cautious this week, as analysts expect high volatility.

The cooling CPI data has sparked optimism in the cryptocurrency market, but the upcoming FOMC meeting and PPI data release will play critical roles in determining Bitcoin’s near-term trajectory

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.