The New York Stock Exchange (NYSE) is considering implementing cryptocurrency trading, although the current regulatory framework prevents moving forward. As the world’s largest exchange in volume, such development could positively impact the demand for cryptocurrencies—Bitcoin (BTC) included.

Looking for insights on the possible effects of an NYSE Bitcoin listing, Finbold asked OpenAI‘s most advanced artificial intelligence (AI) model, ChatGPT-4o, what the BTC price could be following this approval.

ChatGPT-4o Bitcoin price prediction in hypothetical NYSE listing

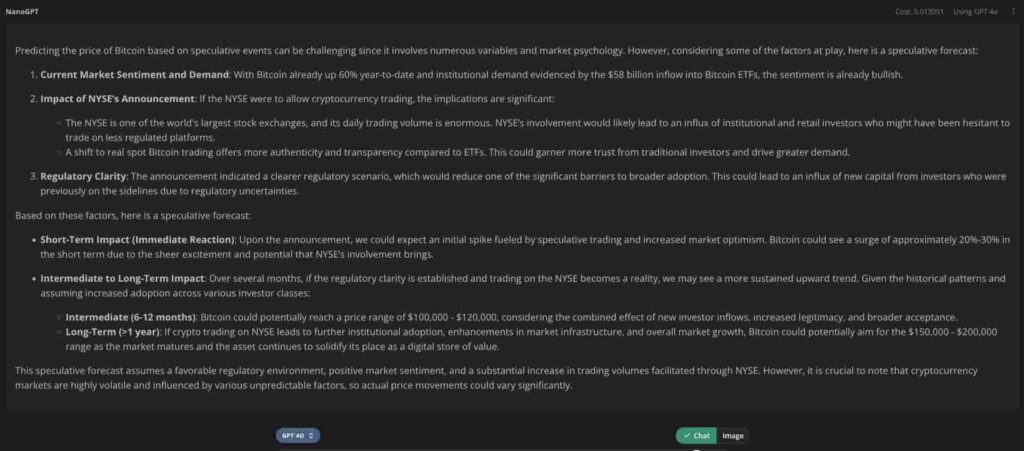

Notably, ChatGPT-4o has provided three price predictions for the short, mid, and long terms after receiving the proper context.

At first, the AI model believes the current short-term speculation regarding a possible NYSE listing is enough for a surge. In particular, ChatGPT-4o believes in a 20% to 30% price increase following the recent announcement as an immediate reaction. This would put Bitcoin at $82,000, which aligns with a reported analysis on Finbold from a veteran cryptocurrency trader.

Second, OpenAI’s flagship product is expected to be priced between $100,000 and $120,000 in the mid-term. This is considering the combined effect of new investor inflows, increased legitimacy, and broader acceptance within six to 12 months.

Finally, the long-term BTC price prediction puts the leading cryptocurrency in a price range between $150,000 to $200,000.

“If crypto trading on NYSE leads to further institutional adoption, enhancements in market infrastructure, and overall market growth, Bitcoin could potentially aim for the $150,000 – $200,000 range as the market matures and the asset continues to solidify its place as a digital store of value.”

NYSE open to crypto trading with clear regulations; CME plans spot trading

In the Consensus 2024 event, NYSE President Lynn Martin said the exchange would consider offering cryptocurrency trading if U.S. regulations were clearer. The success of U.S.-listed spot Bitcoin ETFs, amassing $58 billion, indicates demand for regulated crypto products. CME, NYSE’s rival, plans to launch spot crypto trading for clients, as also reported by CoinDesk.

Bullish CEO Tom Farley highlighted the rapid change in U.S. politics towards crypto, predicting regulatory progress in 2024-2025. Martin remains optimistic about using blockchain to improve financial processes, especially for less liquid assets.

However, Farley believes regulators’ distrust of public blockchains may push TradFi firms towards developing private blockchains for settlement. Clear regulatory guidance is crucial for the crypto industry’s growth and innovation in the U.S.

BTC price analysis

As of this writing, Bitcoin trades at $67,724, maintaining a price range between $60,000 and $72,000. Nevertheless, currently trading above the 30-day exponential moving average (30-EMA) suggests a bullish potential to challenge the range’s resistance and fight for the $82,000 as forecasted by ChatGPT-4o.

Additionally, Bitcoin’s daily relative strength index (RSI) also suggests a growing momentum that can propel this potential bull rally. BTC is up 60% year-to-date from the $42,284 exchange rate on January 1.

In closing, the above ChatGPT-4o’s price prediction for Bitcoin will depend on a number of factors and is not guaranteed. Further regulatory developments, investors’ interest, and traditional finance offerings could significantly impact the cryptocurrency in the following years.