In a bid to bolster its competitiveness in the artificial intelligence (AI) arena, Advanced Micro Devices (NASDAQ: AMD) acquired ZT Systems for nearly $5 billion on August 19.

This acquisition aims to bolster AMD’s position in a fight with Nvidia (NASDAQ: NVDA). ZT Systems is tasked with providing hardware solutions for cloud systems to companies like Microsoft (NASDAQ: MSFT) and enhancing AMD’s GPU-producing capabilities.

Amid such a huge deal, Finbold decided to use AI, more precisely ChatGPT-4o from OpenAI, to determine how this development will impact AMD stock in the upcoming period.

ChatGPT-4o offers the most likely stock price range for AMD

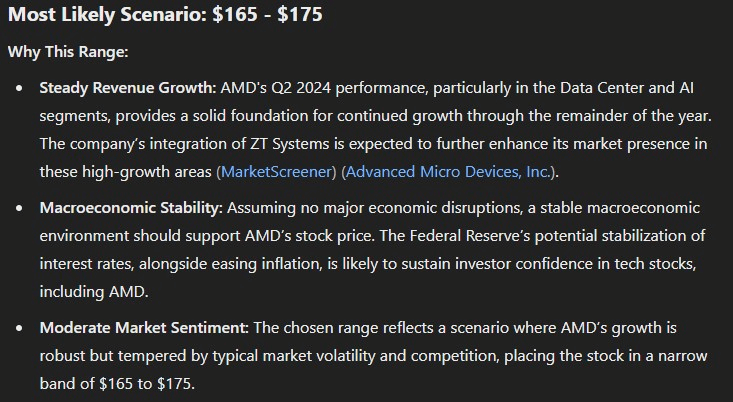

After the acquisition is complete and ZT Systems is fully integrated into the semiconductor’s production line, ChatGPT-4o expects this acquisition to bolster AMD’s market presence and drive its price toward the $165 to $175 range.

The overall scenario represents a period of lowered market volatility, during which AMD stock continues to grow without major disruptions, bolstered by the Federal Reserve’s interest rate cuts.

Bullish and bearish prediction for AMD stock

In a bullish scenario, AMD’s stock could reach $185 to $195 by the end of 2024. This rise would be fueled by the rapid adoption of AI technologies, increasing demand for AMD’s processors and GPUs, and strong revenue growth.

If AMD continues to leverage its acquisitions and innovate in AI, it could capture significant market share, boosting investor enthusiasm and pushing the stock towards $195.

A broader market rally due to improved economic conditions or positive tech trends could also enhance this growth.

Conversely, in a bearish scenario, AMD’s stock might drop to $135 by year-end. This decline could result from an economic slowdown, such as a recession or persistent inflation, which could reduce corporate spending and affect AMD’s revenue.

Increased competition from rivals like Nvidia and Intel (NASDAQ: INTC), particularly if they offer superior products or aggressive pricing, could also impact AMD’s market share.

Additionally, difficulties in integrating ZT Systems or a weakened tech sector due to higher interest rates or regulatory changes could contribute to the stock’s decline. This range suggests a decline that reflects faltering growth but is cushioned by the company’s underlying fundamentals.

What will the ZT Systems acquisition bring to AMD?

Aiming to bolster its infrastructure further, AMD has followed its previous acquisition of Silo AI–the largest private AI lab in Europe by $4.9 billion worth of purchase of ZT Systems.

ZT Systems will help AMD strengthen its microchip designs, enhance its customer support, and accelerate deployment of its AI rack-scale systems for cloud and enterprise customers, thus outpacing competition and presenting itself as an ideal solution for other potential clients.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.