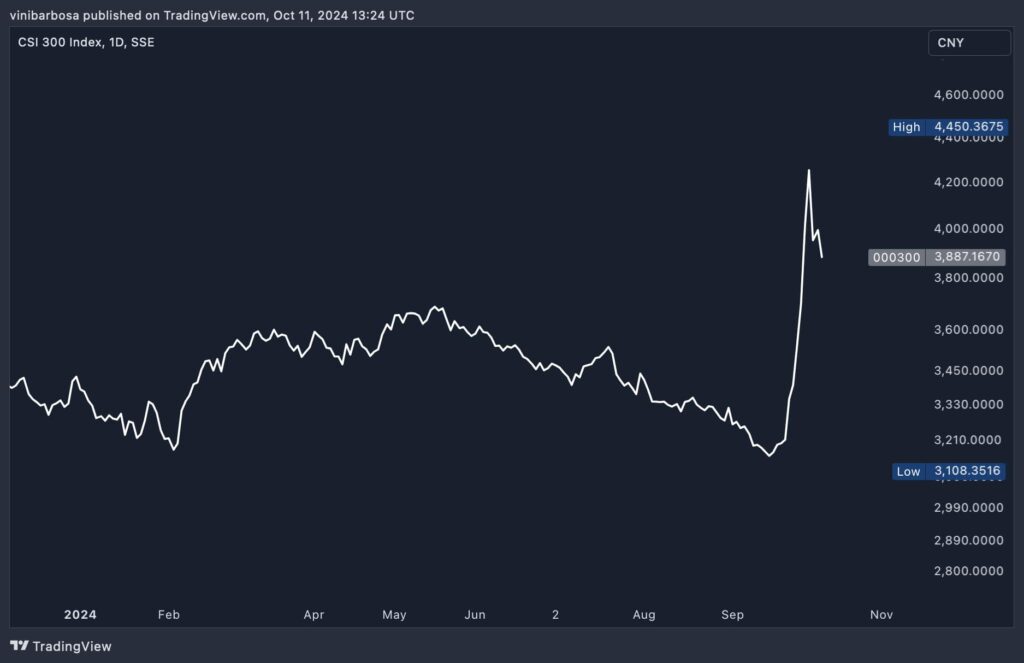

Chinese stocks, represented by the Shanghai Stock Exchange (SSE) CSI 300 index, registered big losses after a recent massive surge. China’s stock market reached a two-year high on October 9, a few days after the government provided significant financial stimulus.

This recent corrective movement happens as the stimulus packages cool down and investors begin to offload their now profitable positions.

As Finbold reported, the Chinese government announced a $140 billion stimulus package on September 24, igniting an unprecedented bull rally. During this surge, China’s short sellers lost $7 billion in liquidations while foreign investors mistakenly missed a $15 billion positioning.

Interestingly, these events brought an overall sentiment dominated by the “Fear of Missing Out” (FOMO) over Chinese stocks. Even Goldman Sachs analysts joined the crowd and forecasted an additional 15% to 20% upward potential for China’s stock market.

This, however, was close to a local top for the CSI 300 index, reached on October 8, one day after Goldman Sachs’s prediction.

CSI 300 index: Chinese stocks analysis amid stimulus expectations

Essentially, SSE’s CSI 300 index peaked at 4,450 points on Tuesday, consolidating a 41% surge since September 18’s bottom. As of this writing, the top-300 Chinese stocks index marks 3,887 points, following Friday’s closing on October 11.

This marks a 12.65% correction move from the local top, which is aggressive for the stock market, but expected after the previous surge. The question that remains is whether the corrective move will find support and bounce back up or retrace all the way down.

Notably, hedge funds proceeded to sell a record amount of Chinese stocks on Tuesday’s peak, offloading their profitable positions. This information is from a Global Market Investor post on X, highlighting the historically high volatility of China’s stock market.

Now, worldwide investors await to see if the Chinese government will release another finance stimulus package or cool down. Next week’s development will significantly impact China’s stock market, while US economics weakened with rising inflation data this week.

The Ministry of Finance has a scheduled briefing for Saturday, likely to address some of these rising concerns and expectations.