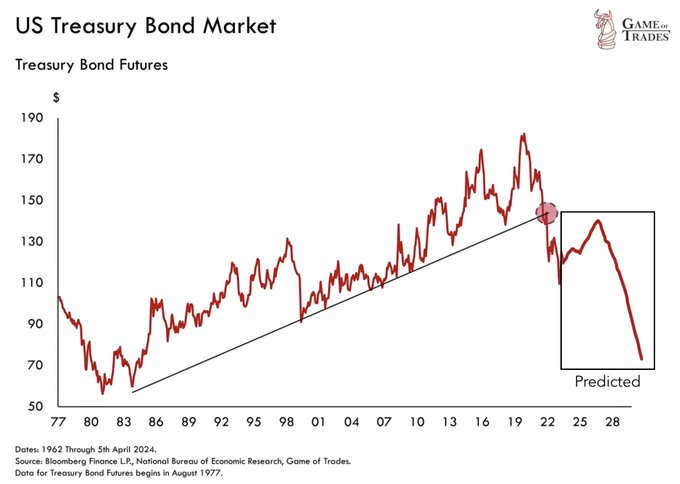

At a time when the United States economy is facing uncertainty, the performance of Treasury bonds is contributing to this underlying instability by breaking away from a multi-decade uptrend.

Particularly, according to data provided by research investment platform Game of Trades in a May 26 post on X, U.S. Treasury bonds have deviated from a 40-year upward trend, pointing to alarming times ahead.

The platform elaborated on the potential near-term dynamics, suggesting that while a bounce in bond prices might be anticipated due to technical factors and potential rate cuts, the overall outlook remains bleak.

“This is a very concerning development. Bonds have broken down from a +40-year uptrend,” the platform noted.

Worth noting is that high levels of debt and persistent inflation are the primary drivers of this downturn, which are expected to exert downward pressure on bonds throughout the coming decade.

Meanwhile, the data coincide with a previous Finbold report that indicated that U.S. bonds are on track to record the worst performance in over a century.

U.S. economy uncertainty

Notably, the U.S. has been grappling with rising debt, with some market players warning that it may not be sustainable in the long run. At the same time, the Federal Reserve has failed to initiate interest rate cuts as the country faces stubbornly high inflation. Typically, bond prices tend to rise as interest rates fall.

Overall, the shift marks a stark departure from the stability and growth that Treasury bonds have typically represented over the past four decades.

The deviation from the long-standing trend raises questions about the future performance of Treasury bonds and signals broader economic implications.

Historically, Treasury bonds have been considered a safe haven for investors, providing consistent returns and serving as a barometer for economic health. The breakdown from this uptrend could indicate underlying economic vulnerabilities and a shift in investor sentiment.

Notably, recent reports indicate that investors are anticipating an inflow of U.S. government debt issuance, which has the potential to negatively impact a bond rally. This is due to growing speculation that there is no end in sight to tackling the increasing debt burden.