Members of Congress tend to secure above-average returns from their stock market investments. The root of this phenomenon is easy to identify — lawmakers possess a general informational edge, as well as a more specific one due to their committee assignments.

At the same time, the rules and regulations governing the practice are rather lax, while the penalties for non-compliance are trivial. It comes as little surprise that congressional stock trading has become both a popular and a controversial subject.

Many investors have taken to copy-trading their representatives or senators — but recent findings suggest that certain shifts, such as the latest market downturn, blindside even the most gifted traders on Capitol Hill.

Market intelligence platform Quiver Quantitative has been one of the vanguards of making political trades more public, trackable, and ultimately, actionable from the perspective of retail investors. According to their data, February was a very red month for congressional stock traders.

Is it time to hit pause on congressional copy trading?

In February, members of Congress lost a total of $71 million in the stock market, per a March 18 post made by Quiver on social media platform X.

However, placing things in the proper context is crucial. That figure — $70 million, is imposing — but you might be shocked when we look at it from another perspective.

As can be seen in the image above, losses amounting to hundreds of thousands, if not millions of dollars, usually equate to about half a percentage point when it comes to a loss in portfolio value. If anything, this only serves as a reminder of the oft-forgotten extent of congressional stock trading.

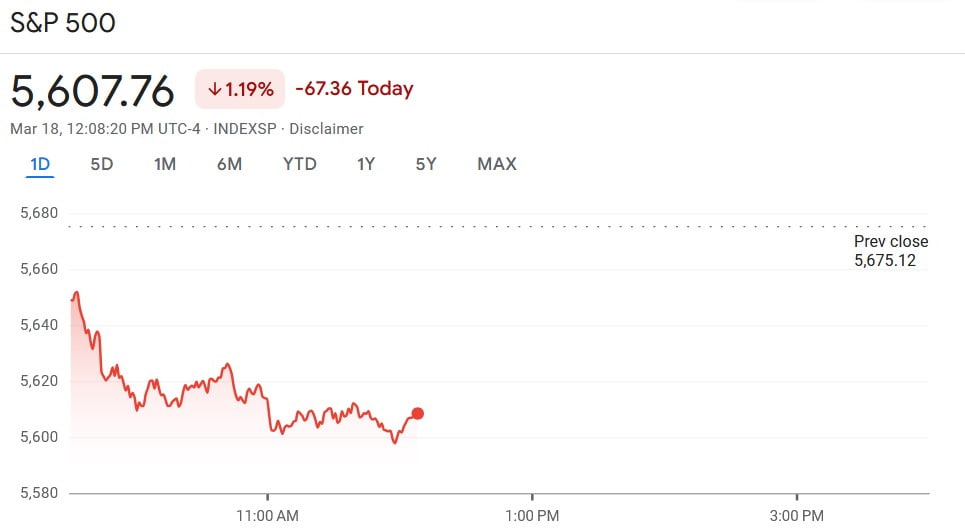

The figures above indicate congresspeople’s daily losses — at the time of writing, the S&P 500 had marked a 1.19% decline on the daily chart, suggesting that a wide variety of politicians suffered smaller losses compared to your average retail trader.

So, are we dealing with a ‘the only winning move is not to play’ situation? Not at all — for one, anyone who has been investing for an appreciable amount of time will tell you that drawdowns are an unfortunate fact of life. Secondly, U.S. politicians continue to make a significant number of suspicious trades — some of which are quite profitable even in the midst of the current downturn.

While these recent developments might make straightforward copy-trading a less appealing strategy, keeping close track of congressional trades (but exercising a greater degree of due diligence) remains a wise course of action.

Featured image via Shutterstock