The stock market relies on public trust, as investors would be reluctant to participate in a system rigged against them, and insider trading is highly regulated. However, some elected officials have access to insider information, giving them an advantage over other investors. Still, they are allowed to trade stocks and often earn lucrative profits in the process. This guide will explore politician stock trading in detail, explain how to track it, and ultimately use it to benefit yourself.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

What is politician stock trading?

The Senate meeting is over, and you’re walking down the hallway, head wrapped in thoughts about the virus. No one is taking it seriously yet, but according to the information just presented, it’s spreading fast, and the authorities will implement measures. In fact, the whole economy might grind to a halt. Business is still as usual, but it is a matter of weeks before Wall Street gets the news. But now you know, and you’re not going down with the rest—time to sell. And quickly.

This is just an example of politician insider trading, but if it sounds familiar, you are not wrong. Something not unlike this actually happened in 2020 in one of the largest congressional insider trading scandals in recent history.

But let’s slow down and go through the basics first.

Politician stock trading definition

Although politician stock trading is legal, it can often be classified as insider trading, which is frequently illegal.

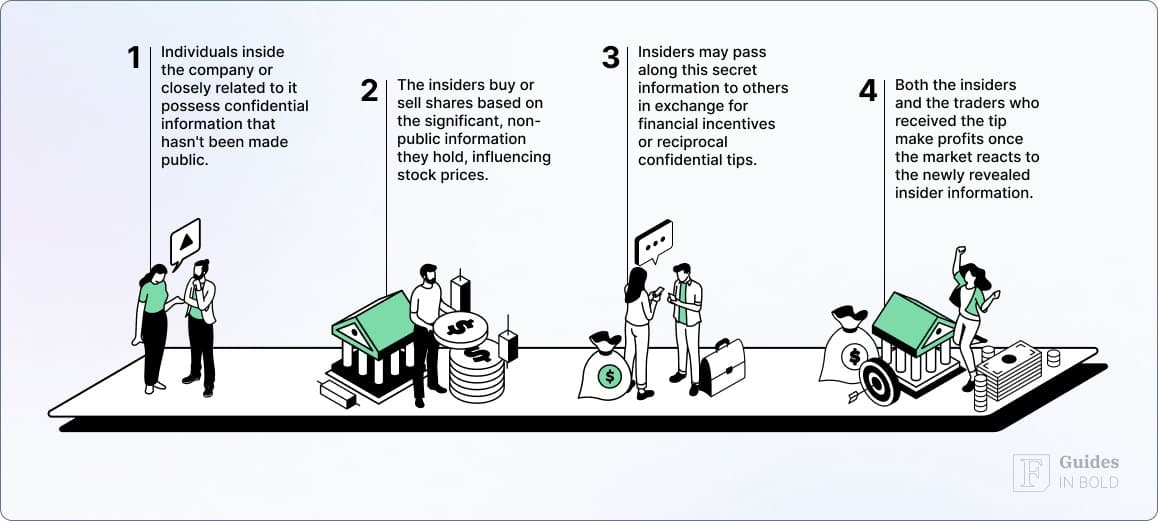

What is insider trading?

Material non-public information is information that can significantly affect the decision to buy or sell the security that is not legally public domain and remains known to a closed group, such as corporate executives or government officials.

Are politicians insiders?

Who are insiders?

That said, corporate insiders can attempt to pass the insider information as a “tip” to a friend, family, or associate. Therefore, the law mandates that any individual who trades securities based on MNPI is conducting illegal insider trading.

“It’s simple: members of Congress are supposed to serve the American people, not their stock portfolios. Elected officials have access to private information that can affect individual companies and entire industries. We need more accountability and transparency to prevent members from abusing their positions for personal gain.”

—Senator Sherrod Brown.

Furthermore, by the nature of their work, politicians are commonly exposed to insider information daily. Whether they sit on an intelligence committee, provide companies with federal contracts, or simply gain access to information through a closed-door meeting, they are at risk of becoming an insider on a daily basis.

In fact, the U.S. Securities and Exchange Commission (SEC), a U.S. federal agency dedicated to preventing market manipulation, designates government employees who trade securities based on a piece of insider information as one of the typical cases of illegal insider trading.

Is politician stock trading legal?

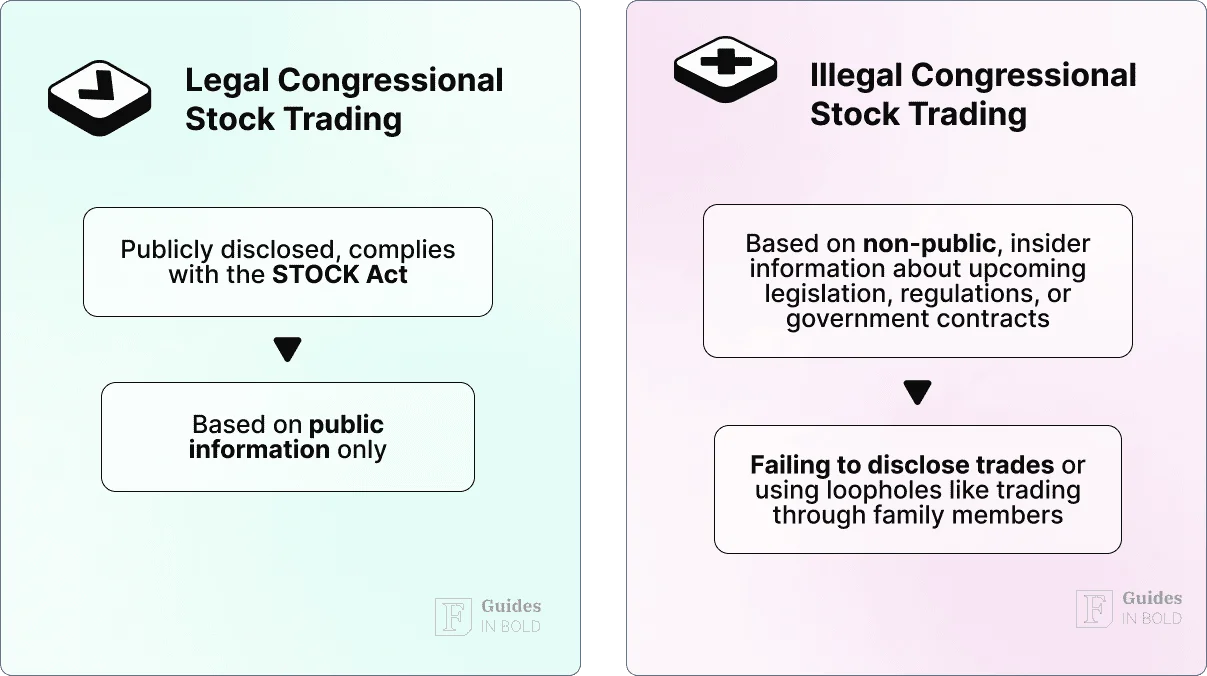

Politician stock trading based on confidential material information is unlawful, and the perpetrators caught in the act will be prosecuted by the SEC.

Albeit politician insider trading is illegal, elected officials and government employees are not barred from buying, selling, or owning a public company’s securities if it is done legally. That said, the practice remains controversial, with numerous members of Congress and the public expressing their disdain and calling for a total ban on politician stock trading.

This comes from the “gray zone” that politicians occupy when it comes to the legal classification of insider and insider information. A legislature has been enacted that governs how politicians must conduct legal stock trading, but catching perpetrators in the act is notoriously difficult.

The STOCK Act

To prevent congressional insider trading and make politician stock trading more transparent, the U.S. Congress enacted the Stop Trading on Congressional Knowledge (STOCK) Act in 2012.

We have already explored the details of the STOCK Act in this guide, so let us summarize what the bill means for politician stock trading.

What is the STOCK Act?

Prior to the Act, regulation on politician stock trading was much less strict, which allowed some members of Congress to take advantage of their position for massive financial gains. Since the passage of the bill, members of Congress are required to disclose their assets and liabilities, including the terms of mortgages on their homes. Furthermore, they are prohibited from receiving special access to initial public offerings (IPOs).

Limitations of the STOCK Act

Although the STOCK Act imposed stricter regulations on U.S. politicians, critics argue that it is not enough, and various media have reported egregious violations of the legislation, with dozens of Senate and House members failing to report or improperly reporting their transactions.

The Stock Act is also difficult to enforce due to the issue of separation of powers, as the executive branch may be reluctant to purse its legislative counterpart. Additionally, the Act has not definitively dissuaded politicians from insider trading, as investigations revealed that at least 78 members violated it between 2021 and 2022.

Should politicians be able to trade stocks?

“Members of Congress should not be able to trade individual stocks during their time of service, given the disproportionate access to market-moving information lawmakers enjoy and their unique ability to affect markets with their legislative activity.”

—Andrew Lautz, Director of Federal Policy, National Taxpayers Union.

Politician stock trading is controversial, least to say.

Let us take Senator Tommy Tuberville as an example.

According to Finbold’s report, between January and June 2024, Tuberville disclosed almost $5 million worth of stock sales. The timing seems practically perfect, as many of the sold stocks depreciated in price afterward. However, as a member of the Senate Subcommittee on Commodities and the Senate Committee on Health, he directly oversaw the stocks he traded. Did he rely on insider information? It cannot be conclusively said.

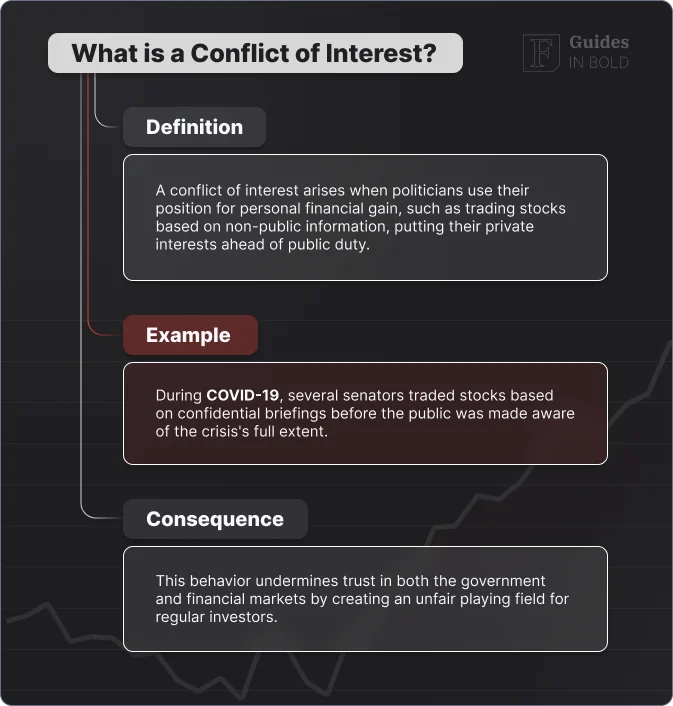

Examples such as this, as well as the widespread belief that trades made by government officials outperform the market, call into question the ethics of politician stock trading and the potential for conflict of interest.

In 2021, Nancy Pelosi, then-House Speaker and lucrative politician stock investor, defended her right to stock trading by saying, “This is a free market.” However, many of their peers disagree, with the most vocal opponents pushing for an outright ban on stock trading, including Alexandria Ocasio-Cortez, Josh Hawley, and Kirsten Gillibrand.

At least until the debate is resolved, politician stock trading will remain legal and regulated by the STOCK Act only.

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

Notorious examples of politician stock trading

While legislators and elected officials are expected to uphold the well-being of their constituents first, there are historical examples of politicians profiteering from a public crisis for their own benefit.

The previously mentioned 2020 congressional insider trading coincided with the COVID-19 global pandemic.

- Senator Richard Burr: Burr offloaded over $1.7 million in stock after receiving classified information on the pandemic’s potential effects. His trades were fiercely criticized, leading to an FBI investigation;

- Senator Kelly Loeffler: Loeffler, together with her husband, sold stocks after similar briefings while also buying shares in healthcare companies that would benefit from the crisis;

- Senator Dianne Feinstein: Feinstein’s husband sold stocks during the initial days of the pandemic, though Feinstein denied any involvement in the stock trading.

The scandal caused an uproar in the media, but whether due to lax legislation or the complications of sanctioning several Congresspeople, the investigations were closed, and not a single senator was prosecuted.

What can politician stock trading tell?

Owing to the STOCK Act, all politician stock trades worth over $1,000 must be publicly disclosed via appropriate forms. Therefore, legal congressional stock trades are available to the public. But what can these transactions tell us, and how can these forms help you inform your trading decisions?

Politician stock buying

When insiders and people with insider information (politicians included) buy stock, it almost always means one thing: they are confident the stock price will rise.

Nancy Pelosi, for example, made headlines when her Nvidia (NASDAQ: NVDA) stock call options bet worth between $1 million and $5 million earned her over $500,000 in just two months. The amount is more than double her annual salary, and Pelosi earned an estimated $5 million on her call options, approximately 20 times her annual salary.

Even Jordan Belfort, the famous American stockbroker and financial criminal who inspired the Wolf of Wall Street movie, opined that she must have traded using confidential information.

In any case, significant politician stock buying is usually a sign that you might want to follow in their footsteps.

Politician stock selling

On the other hand, politicians selling their shares is not that clear-cut and can happen for many reasons. While it can indicate a bearish stance on the company’s stock price, it can also mean that the Congressperson wants the cash to buy a car, a house, or a plane.

For a more straightforward answer, you must compare the financial report with other politicians and corporate insiders from the company itself. Is the trade isolated, or are the other insiders also selling their positions? A single person leaving the ship does not tell you much, but when several officers start packing, you might want to start looking for the lifeboat yourself.

Politician stock trades indicating new sector trends

A single politician’s stock trade can mean many things. Several trades centered around a company can indicate a more clearly defined trend. However, when several politicians start trading in an industry in unison, you might spot an underlying change in whole sectors.

The best example is again the 2020 politician stock trading scandal. Forecasting the new sector trends, U.S. senators traded millions of dollars worth of stocks, buying healthcare stocks, particularly those involved in immunization and producing personal protective equipment, and selling everything the movement and trade restrictions could damage, primarily shares in hospitality and oil companies.

More recently, giants of politician stock trading like Senator Tommy Tuberville and Representative Nancy Pelosi anticipated the slowdown in the IT sector, selling Apple stocks (NASDAQ: AAPL), offloading Nvidia stocks (NASDAQ: NVDA), and forecasting Intel (NASDAQ: INTC) stock price tumbling.

It is often beneficial to track prolonged and clustered trading activity of Congress members, as large enough trading samples can be analyzed for potential insider information that can indicate a significant market movement and, therefore, inform your trading decisions.

Long-term vs. short-term: what strategies do politicians commonly use?

We have also explored the topic in depth in this guide, but let’s summarize the main points here as well.

So, due to the controversy surrounding politicians trading individual stocks and the legal requirement to disclose each transaction valued above $1,000, most politicians invest in “long-term” financial assets such as bonds, savings accounts, real estate, mutual funds, and ETFs.

However, the U.S. Congress has 100 senators and 435 representatives. While most of them invest in long-term assets, and a significant number do not invest at all, several prominent figures in American politics still partake in “short-term” investing, mainly trading individual stocks.

According to a report, only 38 politicians reported more than 20 transactions between September 2023 and September 2024. However, ten politicians have reported more than 100 transactions, while Representative Michael McCaul disclosed 2,025 transactions and Representative Ro Khanna filed over 3,810 transactions, which is more than ten daily transactions on average.

Where does Congress invest?

Like every investor, the U.S. politicians each have their individual preferences. However, when taken as a group, members of Congress do seem to follow a pattern and have their favorites among stocks.

The top ten stocks (by trading volume) bought by House representatives in 2023 are:

- ConocoPhillips (NYSE: COP) – $2.4 million;

- Apple (NASDAQ: AAPL) – $2.3 million;

- Tyson Foods (NYSE: TSN) – $2 million;

- Microsoft (NASDAQ: MSFT) – $1.9 million;

- Alphabet (NASDAQ: GOOGL) – $1.4 million;

- NGL Energy Partners (NYSE: NGL) – $1.4 million;

- Bayer AG (OTC: BAYRY) – $1.3 million;

- CVS Health (NYSE: CVS) – $1.2 million;

- Arista Networks (NYSE: ANET) – $1.2 million;

- Fidelity National Information Services (NYSE: FIS) – $1.2 million.

The top ten stocks (by trading volume) sold by House representatives in 2023 are:

- Microsoft (NASDAQ: MSFT) – $10.9 million;

- Pioneer Natural Resources (NYSE: PXD) – $5 million;

- Energy Transfer (NYSE: ET) – $3.4 million;

- Alphabet (NASDAQ: GOOGL) – $3.4 million;

- Meta Platforms (NASDAQ: META) – $2.6 million;

- Activision Blizzard (NASDAQ: ATVI) – $2.3 million;

- Citigroup (NYSE: C) – $2.1 million;

- UnitedHealth (NYSE: UNH) – $1.8 million;

- Nvidia (NASDAQ: NVDA) – $1.7 million;

- Netflix (NASDAQ: NFLX) – $1.7 million;

On the whole, senators traded much less in volume in 2023:

- Admiral Acquisition (LSE: ADMR) – $1.55 million, bought exclusively by Senator Richard Blumenthal;

- PayPal (NASDAQ: PYPL) – $1 million;

- Cleveland-Cliffs (NYSE: CLF) – $0.98 million;

- Qualcomm (NASDAQ: QCOM) – $0.88 million;

- Clorox Co (NYSE: CLX) – $500,000.

The top five stocks sold by volume in 2023 are, interestingly enough, almost exclusively traded by individual senators:

- Wireless Telecom Group (now acquired by Maury Microwave) – $7 million, sold by Senator Rick Scott;

- Radius Global Infrastructure (now acquired by EQT Active Core Infrastructure) – $1.25 million, sold by Senator Richard Blumenthal;

- U.S. Steel Corporation (NYSE: X) – $1.14 million, sold by Senator Tommy Tuberville;

- Liberty Media Corp Series C (NASDAQ: FWONK) – $1.1 million, sold by Senator Blumenthal;

- Microsoft (NASDAQ: MSFT) – $700,000 (sold by several senators);

Top five stocks favored by members of Congress

While no stock is below politician stock trading and Congresspeople invest in companies of all sorts, there are stocks that they trade more than others. We did a deep dive into the stocks beloved by the U.S. politicians here, but we’ll include an overview of the findings here.

So, when measuring by the total volume, the top stocks bought by Congress include:

- ConocoPhillips (COP) – $2.4 million;

- Apple (AAPL) – $2.3 million;

- Tyson Foods (TSN) – $2 million;

- Microsoft (MSFT) – $1.9 million;

- Alphabet (GOOGL) – $1.4 million.

The top stocks sold by Congress, however, yield interesting results:

- Microsoft (MSFT) – $11.6 million;

- Wireless Telecom (no longer listed) – $7 million;

- Pioneer Natural Resources (TSN) – $5 million;

- Energy Transfer (ET) – $3.4 million;

- Alphabet (GOOGL) – $3.4 million.

We can see here that Microsoft and Alphabet (Google) are both among the most sold and bought stocks, indicating a lack of consensus among politicians about these companies’ future. However, it is possible that some of the investing decisions were based on different insider information, and some were not supported by any information.

The effects of politician stock trading on stock price and trading volume

Ever since the STOCK Act was introduced and the public became more aware of the success of politicians’ stock trading, many investors have been keeping track of and copying trades made by members of Congress, especially high-profile ones like Nancy Pelosi, Richard Blumenthal, and Tommy Tuberville.

More and more traders believe politicians invest based on insider information they obtained due to their unique professional and legal position. Ironically, the STOCK Act, the very mechanism designed to regain trust in Congress, has provided the investing public with means to measure the success of politician investors and copy them, as it requires Congresspeople to disclose transactions valued above $1,000 publicly.

Are members of Congress beating the stock market?

So, the question poses itself: are politicians really performing better than the stock market?

Some academic studies, including this study covering the period between 2012 and 2020, argue that there is no evidence to support that U.S. politicians are trading based on insider information.

On the other hand, some groups focused on raising awareness of congressional insider trading have covered the period after 2020 and the big congressional insider trading scandal. They showed that politicians, on average, are consistently overperforming.

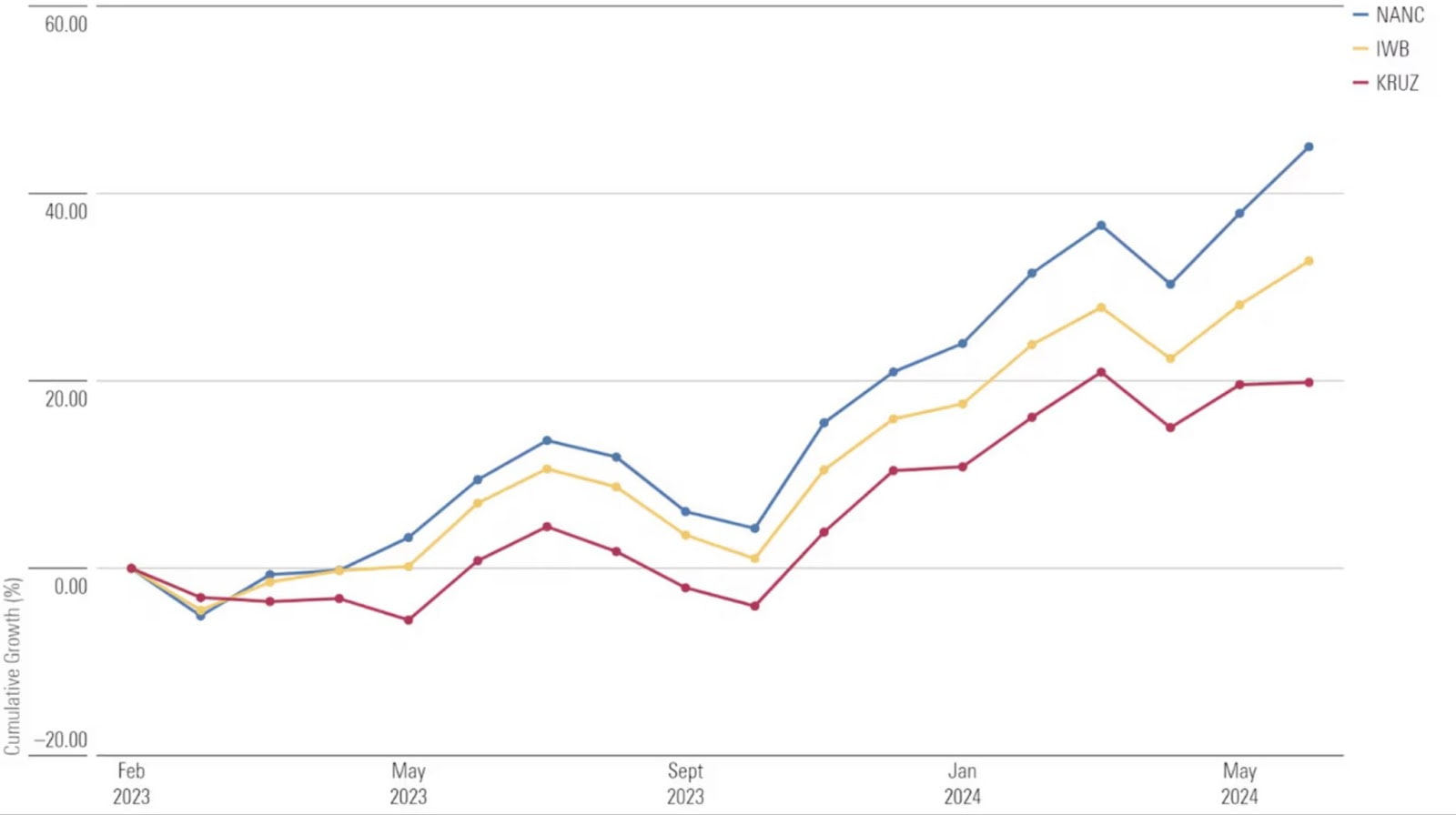

For example, in 2023, the S&P 500 was up 24.23%, which means that year was pretty good for the economy. However, assets held by members of Congress were up 24.585% on average, with Democrats being up by 31.18% and Republicans being up 17.99% (arguably still good).

They have reached similar conclusions in 2022 and 2021. While the stock market fell by 18% in 2022, Republicans were up 0.4%, and Democrats lost just 1.8%. Likewise, in 2021, the S&P rose 26.89%, and politicians beat even that with 1.2% more growth than the economy benchmark.

How to track politician stock trading?

Based on what we have so far, monitoring politician stock trading and using the data to inform your investments is definitely worthwhile. But how do you do that? Fortunately, the STOCK Act provides the means.

What is a periodic transaction report?

According to the STOCK Act, annual financial disclosure reports and periodic transaction reports are required to be publicly available online. As such, reports disclosed by senators can be found at efdsearch.senate.gov and reports made by representatives are available at disclosures-clerk.house.gov/FinancialDisclosure.

Online tracking services

Both archives are exhaustive and definitive repositories for publicly disclosed financial information. That said, these archives are enormous, and new reports are added daily. Therefore, various online services and trackers exist to give you a filtered selection of the most relevant and informative congressional stock trading and potential insider information.

Be the first in line for information!

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

ETFs dedicated to tracking congressional stock trades

Have you heard of NANC and KRUZ?

Their full names are Subversive Unusual Whales Democratic ETF (NANC) and Subversive Unusual Whales Republican (KRUZ), and they might appear as memes. However, they do tell a story, and, believe it or not, since they were launched in February 2023, NANC has returned 45% and KRUZ yielded 20%.

NANC and KRUZ use the database from Unusual Whales to build a portfolio of stocks in which Congresspeople and their families invest their money.

Note: It is important to note that these ETFs, as well as all other trackers, rely on the STOCK Act and the strictness of its enforcement for the reliability of data. Failures to properly disclose trades or inaccuracies in reports are bound to contaminate the validity of all research, tracking, and reporting on congressional stock trading.

How to identify politicians’ investment strategies using congress stock tracker?

Analyzing a series of stock trades and identifying underlying investment strategies is complex, so check out our guide on the topic for the full story.

The gist of it, however, is that much can be learned from the patterns in which politician stock trading is conducted. The database required for that pattern could hardly be built without the help of a politician stock trading tracker.

Let us pick Rep. Ro Khanna as an example. He made a total of 3818 trades between September 2023 and September 2024, which is approximately 10.46 transactions per day. The stock tracker reveals that, out of all transactions, 1,602 were sales and 2,210 were purchases. According to the data, Khanna’s rapid, opportunistic trading pattern points to a short-term or active investing strategy.

Judging by such “active” trades realized in 2023 (e.g., bought in February and sold in July), Khanna received returns of 98.5% on realized NVDA stock trades, 65.9% on TSLA, and 45.2% on West Pharmaceutical Services (NYSE: WST) stock trades.

On the other side of the spectrum, we have Rep. Mark Green, who made only 14 trades in the same period, with 13 transactions selling NGL stock. Despite this, his stock portfolio returned a whopping 122.2%.

Green started buying NGL in 2022, when its stock price was approximately $2.30. Between January 2024 and June 2024, he sold $2,450,000 worth of NGL, with its stock price hitting $5.50 in mid-June. With few but intelligent (or informed) trades, the representative has achieved significant returns, indicating a strategy called value investing, which is a more long-term approach.

Informing your investments with politician stock trading

As we can see, aligning your investments with congressional stock trades might be quite profitable, right?

Well, it is more complicated than that. Consider the following:

- Time delay. Even if some studies show that politicians statistically outperform the market, the public is informed about the trades with a delay of up to 45 days. In the stock market, a few days can drastically change the financial environment, let alone a month and a half. Knowing whether the trade was made recently is a vital piece of context;

- Consider the broader portfolio. Politicians trade within a given context. At times, they could rebalance within the same sector, e.g., IT. Sometimes, they sell to retreat from a controversial stock, perhaps to return later, or buy to reinforce their commitment or belief in an industry, sector, or the wider economy;

- Analyze the strategic approach. Consider the strategy behind a congressional stock trade. Rep. Mark Green’s only trades were selling an energy stock. Does that mean that the stock failed? No, it actually more than doubled in value: Green is simply reaping the profits he made earlier;

- Pick your politicians. Choosing whom to follow is not that different from choosing a legislator: you will want to know their history and how well they perform before casting your vote. While Congress beats the market on average, some individuals mark stellar returns while others plunge deep into the red.

Which politicians’ stock trading to track?

Speaking of choosing politicians, who gained better returns does matter, but it is not the only factor. Also, consider the following:

- Compatibility: Congresspeople do not trade the same. Some have embraced long-term strategies while others partake in what can be considered as day-trading. Make sure to copy a strategy that is similar to your investing style;

- Industry bias: Certain politicians have bias for and against certain stocks, with, e.g., conservatives favoring energy stocks and progressives drifting closer to the technology sector. Compare their strategies with the broader market trends.

- Performance history: A senator may have excelled in 2023 but had catastrophic losses for three consecutive years prior to that. Always take into account the success of the previous stock trading the politician had made before placing your bet.

Politician stock trading differences between the parties

Needless to say, rival parties also have differences in trading patterns, preferences, and strategies.

Which party prefers which stock?

Favorite stock buys for the Democrats in 2023 included Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOGL), while most purchased stocks for the Republicans in the same year are ConocoPhillips (CON), Tyson Foods (TSN), and Energy Partners (NGL).

On the other hand, Republicans’ top sells were Microsoft (MSFT), Pioneer Natural Resources (PXD), and Energy Transfer (ET), while Democrats sold mostly Microsoft (MSFT), Activision Blizzard (NASDAQ: ATVI), and Liberty Media (FWONK).

In other words, Democrats focused on the big players in the technology sector, while Republicans mostly opted to stick to energy companies and traditional industries.

How do trading patterns differ between the Democrats and Republicans?

Furthermore, the representatives from the Democratic Party sold more than their Republican counterparts ($96 million compared to $78 million) and also bought more ($59 million to $42 million). That said, Republican senators outbought ($18 million vs. $7.4 million) and outsold ($10 million vs. $3.2 million) their peers from the Democrats.

Who profits more, Democrats or Republicans?

There’s no way around it: in 2023, Democrats beat Republicans by a wide margin.

As we said, Republicans measured an average of about 17.99% in returns. This is below the SPY index, which was up 24.81% in 2023. However, Democrats measured an astonishing 31.18% in returns.

Which party did better in politican stock trading in 2023?

The reason behind this discrepancy is relatively simple: Democrats focused on technology stocks, which had a pretty good year overall, while Republicans had significant positions in energy stocks, financial stocks, and commodities, which were struck hard by the banking crises and volatile inflation rates.

That said, the top ten performers in the congressional stock trading game have a mix of both parties, such as:

- Brian Higgins (D) – 238.9%;

- Mark Green (R) – 122.2%;

- Garret Graves (R) – 107.6%;

- David Rouzer (R) – 105.6%;

- Seth Moulton (D) – 80%;

- Ron Wyden (D) – 78.5%;

- John Rutherford (R) – 69.1%;

- Richard Blumenthal – 68.1%;

- Nancy Pelosi (D) – 65.5%;

- Pete Sessions (R) – 63.3%.

Tips and tricks for politician stock trading

All the information in this article might be too much to handle at once. If that is the case for you, let’s just boil it down to serviceable information, shall we? Here’s the list of tips and tricks that you can rely on if you decide to get yourself involved with the practice:

Tips and tricks – the list

- Politician stock buying tells more than politican stock selling. A buying signal is much more potent than selling, as people tend to buy for one main reason: they expect the price to rise. While corporate insiders can buy their own stock to raise confidence in their company, politicians do not. If they buy–and buy much and often–consider that as a very green flag;

- Group transactions. A single purchase may not mean much, especially if the total dollar value is not great. However, serial transactions of the same type and with the same stock warrant attention. Finally, if several members of Congress jump at the same thing, the chances are bigger that they are acting on insider information;

- Go with the historical winners. Not all politicians are good at stock trading: if you decide to track their portfolios, go with the historical winners. A single good year tells less than a five-year record of success;

- Consider the broader context. You should always check the trading record before coming to a conclusion: a representative selling a stock might seem like a sign of lost confidence, but it could mean that he is racking in profits from a previous bet that turned out to be successful;

- Act fast. The sooner you act on a congressional insider trade, the higher the potential winnings. Remember, there are many investors carefully observing elected officials’ portfolios, and the word goes around quickly. If you are confident in the integrity of your signal, act as soon as possible;

- Do your research. It is never ideal to mindlessly follow your favorite politician stock trader. You should always double-check the strategy and do your own research to confirm or dispute the chances of the trade. Control your emotional urges, carefully manage risk, and make sure not to put all eggs in one basket.

Common mistakes when relying on politician stock trading

When it comes to wrong decisions, it is always best to learn from mistakes made by others. Bad choices are bound to happen in investing, but if you want to minimize them, consider avoiding the following:

- Taking all politicians’ stock buying as positive and stock selling as negative. When politicians decide to buy, it strongly implies confidence in the stock, but not always. Similarly, a senator could have sold that stock to pay a mortgage. Look for patterns rather than individual transactions;

- Ignoring previous performance. Make sure to separate luck from success or access to insider information. A lucky politician could have earned a lot from a single bet. However, a truly successful congressional insider trader is an outperformer in the long run;

- Overlooking the size and frequency of trades. Ten consecutive trades tell you more than a single transaction. Similarly, a $10,000 purchase yields less information than one worth $500,000;

- Neglecting the position of influence. When, e.g., Tommy Tuberville invests in an agricultural commodity sitting in the Committee on Agriculture, Nutrition, and Forestry, it carries much more weight than a trade outside that circle. Always consider the political role a member of Congress fulfils.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about politican stock trading

What is politician stock trading?

Politician stock trading is the practice of government officials buying or selling a public company’s securities. The term is often conflated with congressional stock trading, although the U.S. Congress comprises only senators and representatives.

Is politician stock trading legal?

Politician stock trading is legal if it is not based on insider information and if it complies with the STOCK Act and other relevant legislation.

What is insider trading?

Insider trading is the practice of buying or selling securities of a public company while possessing material information about the company that is not known to the investing public.

What is an example of insider trading?

An example of insider trading is when a politician discovers that a company will be awarded federal grants or contracts and buys stock in the company based on the information. In most countries, this type of insider trading is illegal, even if done through a proxy (e.g., a friend or an associate).

How to track Congress stock trades?

Although financial disclosure repositories are available online, due to their size and sheer volume of reports, it is best to use Finbold Signals to quickly gain access to the best information with maximum utility.

Where can I find politician stock trading information?

All politician securities trading must be reported to the Clerk of the House and the Secretary of the Senate websites and remain available online. However, due to the size and volume of financial disclosures reported, it is often more convenient to use a congressional trading tracker such as Finbold Signals.