Amid growing scrutiny over financial trades by members of Congress, Representative Barry Moore has disclosed a Bitcoin (BTC) purchase made a month before the cryptocurrency‘s halving event, sparking discussions about the timing and insights behind such investments.

While some lawmakers have faced criticism for poorly timed trades, Moore’s move—positioned just days before a major reduction in Bitcoin’s supply—contrasts sharply with recent trading losses by other officials, showcasing a potentially savvy understanding of cryptocurrency trends.

Barry Moore’s strategic Bitcoin purchase

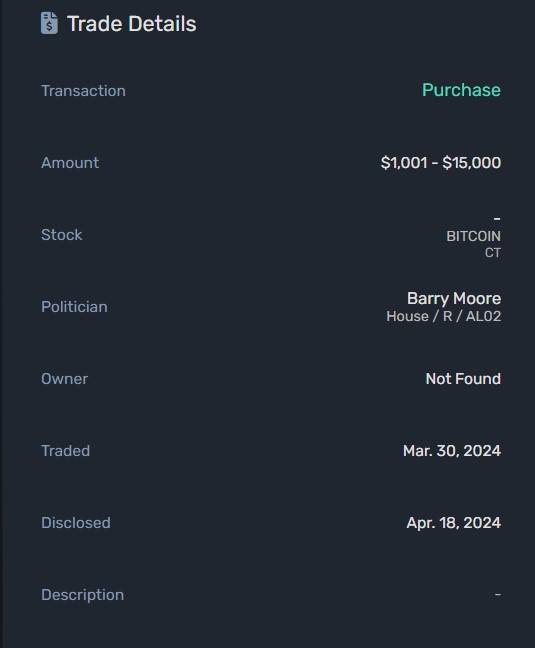

Moore disclosed a Bitcoin purchase made on March 30, 2024, just before the Bitcoin halving event, an occasion known for influencing significant price movements due to the reduced pace of new Bitcoin availability. The purchase, valued between $1,001 and $15,000, was revealed on April 18 amid volatile market conditions.

Analyzing the timing of Moore’s investment

The timing of Moore’s Bitcoin investment is pivotal, positioned right before the halving that many investors watch closely. Historically, such events have led to bullish market behavior. When Moore made his Bitcoin purchase, the price was hovering around $69,000. By the time of disclosure, Bitcoin showed some fluctuation, settling near $64,562

Further scrutiny of Moore’s trading history reveals that this is not his first step into cryptocurrencies. In mid-2021, Moore diversified his portfolio with investments in other major cryptocurrencies: Cardano (ADA), Dogecoin (DOGE), and Ethereum (ETH). Each of these purchases was also valued between $1,001 and $15,000.

By the time of the late disclosures, the prices for ADA, DOGE, and ETH had all declined from their purchase points, reflecting the high volatility and risk associated with cryptocurrency investments.

Representative Barry Moore’s latest move—buying Bitcoin before a major market event—suggests a more calculated approach, possibly drawing lessons from past experiences with volatile crypto assets.

Platforms monitoring congressional trades, such as the bot created by Quiver Quantitative, can significantly influence public and investor perceptions, particularly concerning market fairness and the implications of potential insider information.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.