Bitcoin (BTC) remains in a localized correction phase, as the market navigates regulatory uncertainty and macroeconomic pressures.

Despite multiple attempts to break higher, BTC has struggled to gain momentum, keeping price action range-bound. However, a breakout from this consolidation could reignite bullish sentiment, potentially pushing Bitcoin toward $107,000 in the coming weeks, as noted by analyst RLinda.

Technical outlook: Bitcoin key levels to watch

Bitcoin is consolidating within a tight range between $94,800 and $98,400, with a breakout from this zone likely to determine its next major move.

A decisive push above $98,400 could shift market sentiment, potentially driving BTC toward $100,200, $102,700, and ultimately $107,000.

However, the broader technical outlook suggests that Bitcoin could first test liquidity at $91,000 and $90,000 before resuming an upward trajectory.

On the downside, $94,800 remains a critical support level, with the analyst cautioning that a failure to hold this range could accelerate a decline toward $91,300 and further down to $90,000.

Should buyers step in at these lower levels, Bitcoin could stage a bullish reversal, setting the stage for a rally toward new highs.

More bullish projections

CryptoQuant CEO Ki Young Ju also remains optimistic about Bitcoin’s long-term trajectory, highlighting that the bull cycle remains intact despite short-term consolidation.

“I don’t think we’ll enter a bear market this year. We’re still in a bull cycle. The price would eventually go up, but the range seems broad. I personally think that the bull cycle could continue even with a -30% dip from ATH (e.g., 110K → 77K), as seen in past cycles.” — Ki Young Ju

According to Young Ju, Bitcoin’s price range is expected to remain broad, but its overall trend remains upward. He notes that even if Bitcoin experiences a 30% correction from an all-time high to $77,000, a scenario observed in past cycles would not mark the start of a bear market.

Instead, such a correction would represent a normal retracement within a larger bullish phase, keeping BTC well above its previous cycle’s all-time high.

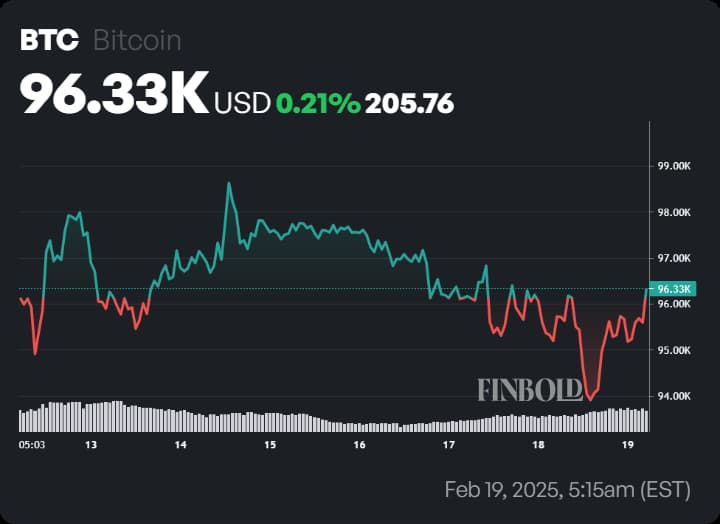

BTC price analysis

At press time, Bitcoin is trading at $96,339, posting a 0.7% gain in the past 24 hours and a modest 0.21% increase over the past week. While BTC has held steady, market conditions remain cautious, with no clear catalyst for a breakout.

A combination of Federal Reserve policy uncertainty and escalating trade tensions have added to economic concerns, weighing on investor sentiment and limiting risk appetite for speculative assets like Bitcoin.

Adding to the unease, Bitcoin investment products saw $430 million in outflows last week, marking the largest single-week decline of 2025, as noted in a CoinShares report. This shift ends a 19-week streak of institutional inflows, during which Bitcoin investment vehicles accumulated $29 billion since the 2024 U.S. election.

For now, investors remain cautious, watching for macro developments and institutional sentiment shifts that could determine Bitcoin’s trajectory in the coming weeks.

Featured image via Shutterstock