The year 2025 has seen the sharpest rise in U.S.-led protectionism since the Great Depression. With President Donald Trump’s return to office in January, sweeping new tariffs have shaken global markets and reignited fears of a full-blown trade war.

President Trump’s new set of tariffs, announced after markets closed on April 2, has raised U.S. import taxes to levels not seen since the Great Depression—specifically, to about the same high levels as those set by the controversial Smoot-Hawley Tariff Act of the 1930s.

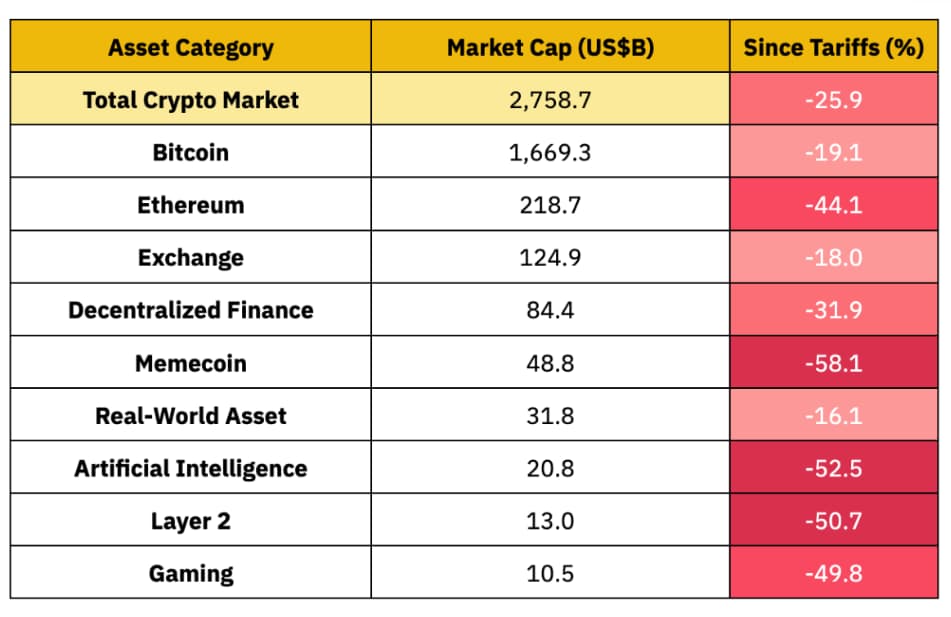

The latest insights shared with Finbold on April 7 from Binance Research reveal that crypto has lost $1 trillion in market value since the first round of U.S. tariff announcements, with total capitalization plunging 25.9% from its January highs.

As global trading partners respond with retaliatory measures and investors flee risk assets, the crypto sector has borne the brunt of the uncertainty, with sentiment slipping and capital rotating into traditional safe havens.

Capital flees crypto as risk-off sentiment intensifies

The tariff shock has sparked a broad risk-off reaction in financial markets. Both crypto and equities have slid into correction territory, while traditional safe havens like gold have rallied.

Since the first tariff shock, the S&P 500 is down 17.1%, while gold has surged 10.3%, breaking successive all-time highs as investors seek refuge from economic instability.

Crypto markets, however, have borne the brunt of investor flight. Bitcoin (BTC) is down 19.1%, but losses have been far more severe in the altcoin space.

Ethereum (ETH), the second-largest digital asset, has plummeted 44.1%. High-beta categories such as memecoins and artificial intelligence tokens have suffered steep declines of 58.1% and 52.5%, respectively. Gaming and Layer 2 tokens have dropped around 50%, while DeFi tokens are down 31.9%.

This widespread sell-off has erased early-year gains across much of the crypto market and pushed Bitcoin into negative territory for the year—despite a strong performance in 2024.

Institutional confidence weakens

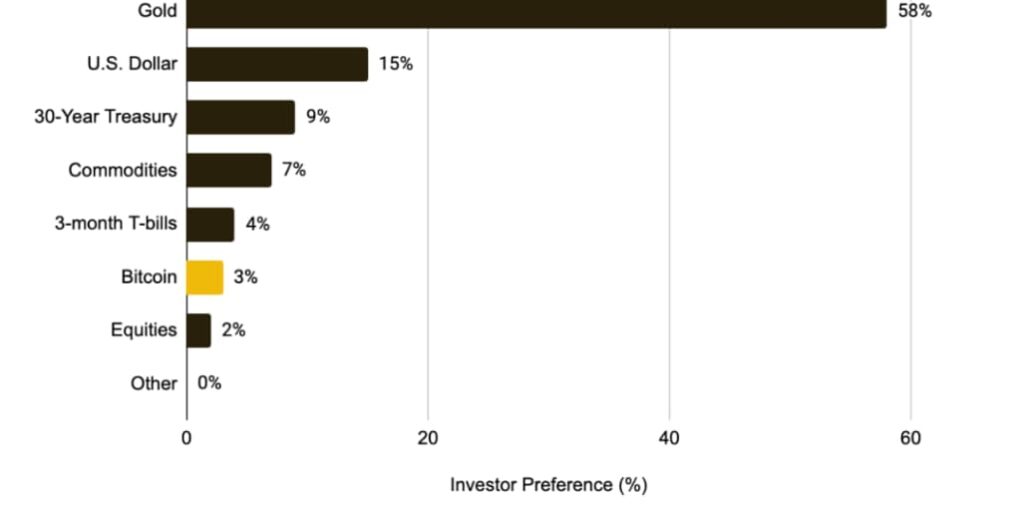

The downturn is also being reflected in institutional sentiment. A recent Bank of America Global Fund Manager Survey shows that only 3% of fund managers currently favor Bitcoin in the context of a trade war, compared to 58% who prefer gold.

Volatility has surged as well. Bitcoin’s one-month realized volatility rose above 70%, and Ethereum’s spiked past 100% in the wake of the tariff news.

As liquidity tightens and risk aversion grows, crypto’s narrative as a hedge against economic uncertainty is being called into question. For now, it appears that investors are prioritizing capital preservation—and crypto is no longer at the top of their list.

Featured image via Shutterstock