While Nvidia (NASDAQ: NVDA) excelled in the stock market last year and carried its success into 2024, the recent period has seen a slowdown, with NVDA stock struggling to surpass the $900 mark and Nvidia shares down -$26.06 (-2.88%) in the past month at $877.57.

Given this situation and its high current price, investors might consider turning to another AI-focused stock—Amazon (NASDAQ: AMZN)—which is priced much lower and offers various avenues to success.

Diversification as a key argument

While Nvidia holds a strong position in the AI market and boasts impressive performance, its business model is primarily centered around this aspect. On the other hand, Amazon is involved in various industries, notably e-commerce, digital advertising, and cloud computing.

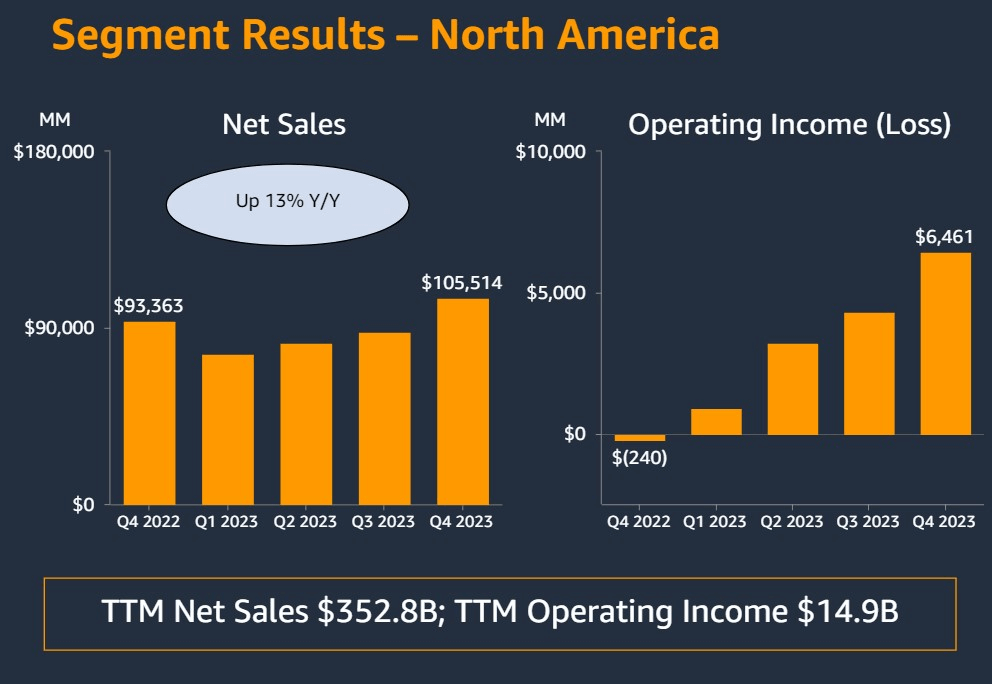

Amazon operates the largest online marketplace in North America and Western Europe, continually gaining market share. Its strength in retail has propelled it to dominate the retail advertising market, ranking as the third-largest AdTech company globally, behind Alphabet (NASDAQ: GOOG) and Meta Platforms (NASDAQ: META).

Amazon Web Services (AWS) also remains the leader in the cloud infrastructure and platform services market despite a slight market share loss to Microsoft Azure in the fourth quarter.

Artificial intelligence is Amazon’s strong suit

Amazon leverages artificial intelligence across its primary business segments to enhance its competitive edge. In e-commerce, Rufus, a generative AI shopping assistant, has been introduced. It provides personalized recommendations and answers customer queries based on extensive product data and reviews.

Additionally, machine learning models optimize warehouse inventory and streamline last-mile delivery, enhancing logistical efficiency. In digital advertising, Amazon’s AI tools enable brands to create engaging lifestyle images, addressing a common challenge for media buyers in generating effective content.

Lastly, in cloud computing, Amazon Web Services (AWS) is advancing in the generative AI market with innovations at various layers of the AI stack, including infrastructure, platform, and application layers.

These developments, such as custom chips for AI training and inference and AI automation tools like Amazon Q, position AWS to compete effectively in the evolving AI landscape.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.