Following the recent rally that has pushed Bitcoin (BTC) back above the psychologically important level at $70,000 and near the resistance that could catapult it further up, economist and Bitcoin skeptic Peter Schiff has retained his skepticism around the maiden cryptocurrency.

As it happens, Schiff said that the goal of Bitcoin’s recent “overnight” pump that has followed gold’s rally to new all-time highs (ATHs) was to “sucker [exchange-traded fund (ETF)] investors into buying the gap up,” telling his followers to “get ready for the dump,” in his X post on April 8.

Commenting on the American economist’s post, crypto journalist Willy Woo made a counter-argument, stating that it wasn’t a pump, but in fact, that the flagship decentralized finance (DeFi) asset was finalizing its consolidation process under the ATH.

Bitcoin ETF godsend for central banks?

More recently, Schiff also expressed his view that “Bitcoin ETFs have been a godsend for foreign central banks,” allowing them to “buy more gold cheaper” to “replace dollars and build real monetary reserves to back their currencies,” as Bitcoin ETFs “have siphoned investor demand away from gold.”

As a reminder, the economist has maintained that Bitcoin was likely to crash while dismissing products such as the Bitcoin spot ETFs as one of the factors that would contribute to its collapse due to more BTC entering spot BTC ETFs approved by the US Securities and Exchange Commission (SEC) this year.

More recently, he bashed the largest crypto, referring to it as a “fake asset,” stressing that the popular opinion of its risk being “in the eye of the HODLer” was “crazy,” and praising silver as “the new Bitcoin” and “Bitcoin 2.0,” as Finbold reported on April 3.

Bitcoin price prediction

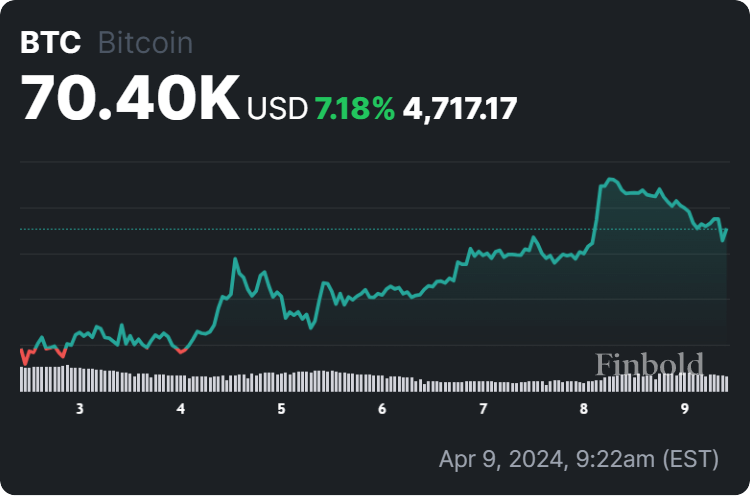

For now, Bitcoin is changing hands at $70,400, recording a decrease of 3.30% in the last 24 hours but gaining 7.18% across the previous seven days, advancing 0.43% over the month, as well as growing 69.52% since the year’s start, as per the information retrieved on April 9.

Furthermore, several crypto trading experts have offered their BTC price prediction between $100,000 this year and a bewildering $1,000,000 in 2025. However, doing one’s own research and weighing all the risks is critical before investing any significant amount of money.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.